Asset classes diversification How to diversify your portfolio

Post on: 30 Апрель, 2015 No Comment

Diversify your portfolio

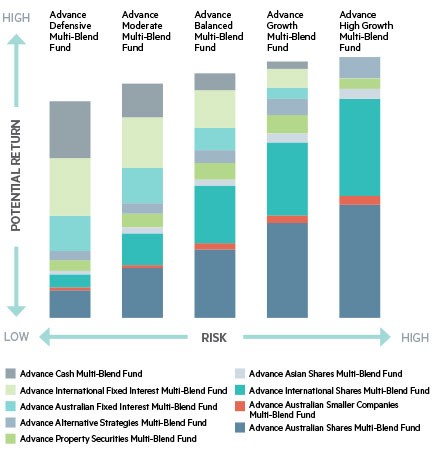

Each asset class is made up of subclasses, or categories, which expose you to different levels of investment risk and provide their strongest returns at different times in an economic cycle.

Overview

Some stocks, such as blue chipsissued by large, stable, well-regarded companiesare considered less vulnerable to market fluctuations than aggressive growth stocks issued by new companies in emerging industries. Sometimes blue chips provide higher returns, and other times aggressive growth stocks do.

The point is that no single asset subclass consistently produces the best return year after year. And theres no way to predict the pattern of performance. But you can be confident that asset subclasses will have their ups and downs just as the asset classes do.

Create a mix

While investment risk cant be eliminated, it can be managed. One way to approach some of the risks you face by not knowing which subclasses will be strong or weak at any specific time is to diversify your portfolio.

To diversify means to choose investments within each asset class that represent several different sectors, or parts of the economy, that are issued by companies of different sizes and, in the case of bonds, that have different terms and issuers. What you want to avoid is concentrating your money in just one or two sectors, sizes or issuers.

Diversification is the investment equivalent of the old saying: Dont put all your eggs in one basket. It enables you to:

- Take maximum advantage of market conditions and changes in the economy without the risk of trying to time the market, which means aggressively trying to sell investments at the market peak and buy investments at the lowest price

- Help manage your portfolio to withstand economic and industry downturns

How Do You Diversify?

When diversifying your portfolio, its important to consider the investments you already have as well as those youre considering buying.

Using a simplified example, say the stock portion of your investment portfolio consisted entirely of stock in Company Aperhaps the company you work for. If this were the case, your portfolio wouldnt be diversified, and if Company A were to fail, your losses could be major.

But if you were to buy shares in companies B, C and D, in addition to A, your portfolio would be more diversifiedprovided that B, C and D were all in different sectors of the economy and had different market capitalizations, or sizes. While that may mean you limit your gains because you dont happen to own the stock with the best return in any given year, it also means you position yourself to limit your losses, since different types of stocks are not as likely to lose value at the same rate or at the same time.

One way to diversify your portfolio is to invest in mutual funds or ETFs. When you buy shares in a fund, youre invested indirectly in the different stocks or bonds the fund owns. So, as long as the fund is diversified, so is your investment.