Asset Allocation Tactics and Strategies for 2014

Post on: 15 Июль, 2015 No Comment

Best Moves Now for Your Mutual Funds Portfolio

You can opt-out at any time.

The first thing for investors to keep in mind when planning asset allocation, investment changes or portfolio structure is their own investment objectives. For example, if you are a short-term investor with less than 3 years’ time horizon, it may not be appropriate to look for stock funds now. Conversely, if you are a long-term investor, with more than 10 years to invest, moving all of your portfolio assets to cash because you fear a new bear market in the coming year is not the best move either.

Stocks, Bonds and Cash: Tactical Asset Allocation Strategy Basics in 2014

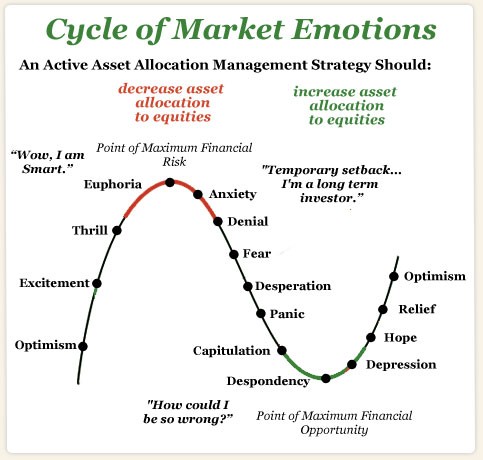

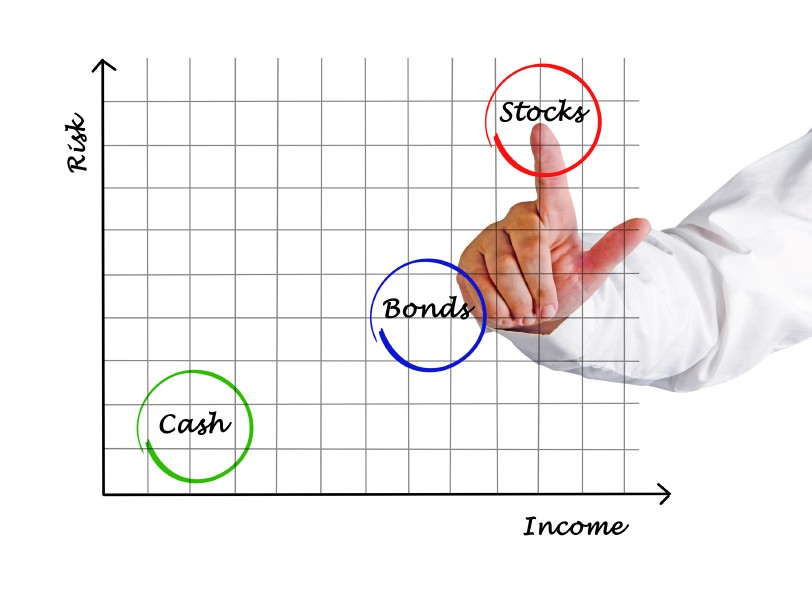

Tactical asset allocation is a portfolio strategy where the investor will change their allocation of assets, such as stocks, bonds and cash, in their portfolio to meet a planned objective while taking advantage of current and near-term market and economic trends. The investor will normally begin with a target allocation that is appropriate for their investment objectives. such as time horizon and risk tolerance.

For example, let’s say your target allocation, which can also be referred to as your neutral-weighted allocation, is 70% stocks and 30% bonds. Using 2014 as an example, you can also assume that the market and economic outlook is that stock prices are getting high in relative terms, the bull market is older than average, and the the economy is in the latter stages of its cycle. This means that we are probably much closer to the end of this bull market than we are to the beginning.

Therefore, a tactical asset allocation move at this point would be to under-weight stocks (to below the neutral weight %). Also, interest rates are rising, which places downward pressure on bond prices. So under-weighting bonds can also be a good move. These assumptions or expectations may then lead you to over-weight cash. Now your 2014 target allocation may look like this: 60% stocks, 20% bonds and 30% cash.

However, cash is yielding close to zero right now. This can be perfectly acceptable and appropriate for most investors, especially because earning near nothing is preferable to losing. Some investors may also consider adding an alternative asset type.

Commodities as an Alternative Asset Consideration in 2014

Most investors are wise to stay away from exotic investment types that they don’t understand. Commodities. such as gold, oil, sugar and corn, may be easy enough to understand but investing in them is a different story. However, there are broad-basket commodities mutual funds and Exchange Traded Funds (ETFs) that can add diversity to a portfolio. One such fund is the Powershares DB Commodity Index Tracking ETF (DBC ).

Investing in commodities in 2014 would be primarily a diversification play and secondarily a contrarian investing move, which is to say that commodities, especially gold, had one of the worst years in history in 2013 and may be due for a correction in the positive direction.

If you decided to include commodities in your asset mix in 2014, your new asset allocation might look like this: 60% stocks, 20% bonds, 10% Commodities, 10% cash.

For more information and ideas on asset allocation and investment direction, look for more articles as they are published here on Where to Invest Now .

Disclaimer: The information on this site is provided for discussion purposes only, and should not be misconstrued as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities.