Asset allocation strategy and rules of thumb

Post on: 6 Апрель, 2015 No Comment

I am a big fan of rules of thumb when it comes to asset allocation strategy. I initially spent a long time agonising over what my ‘optimal’ asset allocation should be. I knew there had to be one, because so many learned sources talked about the ‘efficient frontier ’. A fabled place, where, if I could only reach it, my blend of equities, bonds and other asset classes would function with perfect potency to give me the highest risk-adjusted return possible.

I spent a long time wandering the desert trying to find that place, seemingly getting nowhere.

Meanwhile, all around me were these little rules of thumb. Handy guidance tools that seemed to point away from asset allocation paradise and towards the quick departure lounge to ‘that will do’.

It took me a while to realise Id actually reached my destination – the understanding that there is no right answer when it comes to asset allocation. A standpoint summed up by passive investing sensei Rick Ferri as follows:

All of this nonsense about finding the ideal allocation is nonsense. The ideal portfolio can only be known in retrospect. We can only know what we should have done, not what will happen. So, choose a few low cost index funds in different asset classes, rebalance occasionally, and forgetaboutit.

The big decision

How much of my portfolio, then, do I fill with the rocket fuel of equities versus the parachute braking capabilities of bonds?

That’s the main question that your asset allocation strategy will settle.

The answer resides in the nature of your financial goals. your needs, and your ability to take risk – a bunch of difficult questions that can only be answered with a personal examination so intimate that it’s probably best to wear rubber gloves.

However, rules of thumb can be used to set the guidelines you’ll probably be working within once you pass the exam.

No idea what your risk tolerance is? Not sure what difference a long time horizon should make to your plan? Then the following rules of thumb can grease your understanding…

(By the way, none of the authors of the rules of thumb that follow have actually named them. I’ve made the names up to hopefully make the guidance a bit more memorable.)

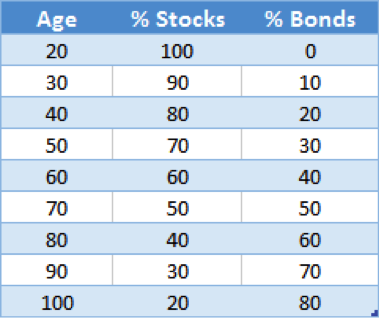

The 100 minus your age rule of thumb

This rule of thumb is so old it belongs in a rest home. But it’s still got legs because it helps you to work out how your age affects your pension portfolio decisions:

Subtract your age from 100. The answer is the portion of your portfolio that resides in equities.

For example, a 40-year-old would have 60% of their portfolio in equities and 40% in bonds. Next year they would have 59% in equities and 41% in bonds.

A popular spin-off of this rule is:

Subtract your age from 110 or even 120 to calculate your equity holding.

The more aggressive versions of the rule account for the fact that as lifespans increase we will need our portfolios to stick around longer, too, and that often means a stronger dose of equities is required.

Following this rule of thumb enables you to defuse your reliance on risky assets as retirement age approaches.

As time ticks away, you are less likely to be able to recover from a big stock market crash that wipes out a large chunk of your portfolio. Retuning your asset allocation strategy away from equities and into bonds is a simple and practicable response.

The Tim Hale ‘target date’ rule of thumb

What if you’re not saving for retirement? What if you’re going to need all the money on some very definite date, perhaps for a college fund or a mortgage pay-off?

We’re looking for a rule that gives us the courage to be relatively aggressive early on and then manage down our exposure to risky equities as the happy day approaches.

Tim Hale’s suggestion, in his superb UK-focused investment book Smarter Investing :

Own 4% in equities for each year you will be investing. The rest of your portfolio will be in bonds.

If your investment horizon is 10 years then you’ll hold 40% equities. When you’re T minus nine years then you’ll rebalance to 36% equities and so on.

I like this rule because it is a reminder to rein in adventurism if you want to use investing to achieve a short-term goal (say five years or less) but it takes the shackles off if your horizon is 20 years or more.

The Larry Swedroe ‘come out punching’ rule of thumb

US-based passive investing champion Larry Swedroe has come up with a similar guideline in his book The Only Guide Youll Ever Need for the Right Financial Plan , except his recipe is far more aggressive in the early years: