Asset Allocation Guide Why to Invest in International Index Funds Asset Allocation International

Post on: 16 Март, 2015 No Comment

If you followed the market from 2000-2009, youll know that US stocks got hammered. Investing in international stocks wouldnt have saved you from a period like that, but it could have helped. International stocks provide some much needed diversification and tend to reduce your portfolios overall volatility. In fact, since international funds make up 60% of every asset in the world market, a market weighted portfolio would hold 40% US Stocks and 60% International Stocks. A portfolio without international stock is too US-biased to provide adequate diversification.

If youre in a lifecycle fund like 2040 Target Date ETF(TDV) then youre already invested in international funds, 24% to be exact. But if youve decided to cut down on expense ratios and manage your portfolio yourself, you need to understand why and how much to invest in international stocks. I started working on my annual rebalance and it got me thinking about my international allocation. Currently, Im 90% stocks, 10% bonds and within my equities, Im at 60% domestic, 40% international. I had the number 40% written down and highlighted but I could not remember why. In my quest to find out, I found some great information on the bogleheads forum and a very helpful Vanguard paper.

Vanguard Conclusions

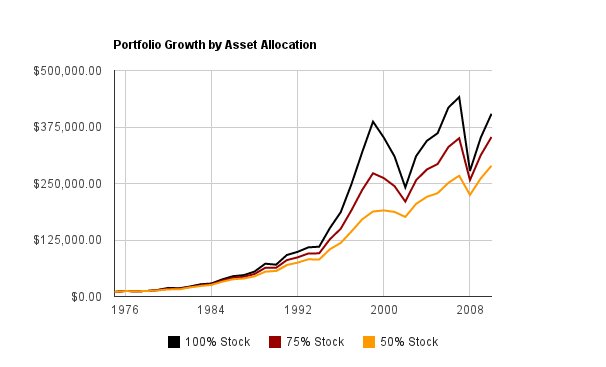

Luckily for everyone, I did read through that boring paper so let me give you the summary so you wont have to read it and halfway through youll feel like gouging your eyes out. Vanguard found that although finance theory dictates that an upper asset allocation limit should be based on the global market capitalization for international equities (currently approximately 58%), we have demonstrated that international allocations exceeding 40% have not historically added significant additional diversification benefits, particularly accounting for costs and that a 20% limit is a reasonable starting point. Now what the hell does that mean? Basically based on past performance, Vanguard found that a 20-40% allocation(as part of your equities) towards international stocks would give the highest returns while minimizing volatility. Allocations over 40% did not provide a diversification benefit nor a greater return.

Since 60% of the worlds stock investment opportunities are outside of the United States, it makes sense to include them as a part of your portfolio. If you fail to include international stocks, youre missing out on a lot of potential. Youll find the following companies in international markets:

- 8 of the 10 largest automobile companies

- 8 of the 10 largest diversified telecommunications companies

- 7 of the 10 largest metals and mining companies

- 7 of the 10 largest electronic equipment and instruments companies

- 6 of the 10 largest household durables companies

Income Dependent

So whats the allocation we want? I think 20% is much too low because the market cap is closer to 60%. In addition, since we live in the United States, we are very dependent on our economy already. It seems to me that holding US bonds and US stocks and getting paid by US companies is not diversified. A move closer to market cap makes sense because your salary is so dependent on the US economy. Although, if youre closer to retirement, then you are less dependent on the US economy since you have less working years left. In this scenario it might make sense to shift back towards US stocks to stay diversified.

Dont Go International Crazy

There is a tendency you should avoid though, over-weighting emerging markets. Just because you know India and China are growing faster than the rest of the world doesnt mean you should go crazy and invest a ton of money there. Believe it or not, other people have realized this too, and a long time ago. Even though its obvious that the growth of these two countries will far outpace the US growth in the next 100 years, that growth should already be reflected in the price of their stocks. So in my opinion, theres no need to tilt too heavily towards emerging markets unless you think they will exceed their projected growth pace.

Personally, I decided to keep my international allocation at 40% and US allocation at 60%. I think that the US economy is on the decline, but that doesnt mean that all US large cap companies are in trouble. As the population of China and India grows, so does their demand for American products, services, etc. Take Apple or any other US large cap company for example, lets say that 30% of their 2011 revenue came from outside of the US. That would mean that 70% of their revenue came from the US, so Apple/US large caps domestic allocation is actually 70% x 60% = 42%. Instead of a 60% US allocation, Im actually at 42% in this scenario since many large cap companies do business abroad.

Its hard to say what the right number is for the future but we know that in the past it was somewhere between 20 and 40%. But as the world becomes a global economy and countries start sharing resources and trading more frequently, the lines between domestic and international equities start to get blurry. For now Im happy with 40% because I think it takes into account enough of the world market where I can receive diversification benefits and the capital return of US companies.

Readers, have you looked at your asset allocation lately? How much do you have invested in international equities?