Asset Allocation by Age What Investments Should You Hold and When

Post on: 20 Июнь, 2015 No Comment

When it comes to your portfolio, you want to have an asset allocation plan and to stay on target. Photo: Flickr user Erika .

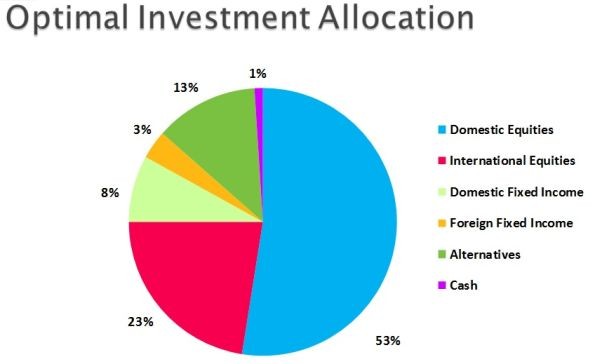

It’s most important that we save consistently and aggressively for retirement. However, we also need to be at least a little smart about how we invest that money. The proportion of your money that you invest in categories such as stocks, bonds, and cash (represented by savings accounts, money market accounts, and CDs) is your asset allocation, and you’ll often run across different formulas for asset allocation by age. After all, a 25-year-old should invest a little differently than a 70-year-old.

The 100 rule

One rule of thumb that some people follow is this: Subtract your age from the number 100, and that’s the proportion of your assets you should hold in stocks. The rest can be invested in bonds and other safe investments such as CDs. Thus a 35-year-old should shoot for 65% in stocks, while a 60-year-old should have 40% in stocks.

It’s simple, which is nice, given that the world of financial management can seem complicated. And it makes some sense, too, because as you approach and enter retirement, you don’t want to be overly reliant on the stock market; over the long run, the stock market is arguably the best place to grow your wealth, but over periods of a few years, it can plunge. You don’t want that to happen right before you need to withdraw a chunk of change to live on.

An old rule of thumb has you subtracting your age from 100 to see how much you should have in stocks. (Image: Pixabay)

The rule is problematic, though. For one, there’s no true one-size-fits-all formula for investing. And for another, this rule is becoming a bit outdated because we’re living longer, and thus it’s often best if we leave our money in stocks longer so our savings will grow enough to last us through a long retirement. Therefore some experts have tweaked the rule and said our stock allocation should be closer to 110 minus our age, or even 120 if we’re willing to take on a bit more risk in hope of higher returns.

The Warren Buffett model

Warren Buffett has another, equally simple method to consider. Here’s what he said with regard to the money he will leave his wife when he passes away:

I’ve told the trustee to put 90% of it in an S&P 500 index fund and 10% in short-term governments. And the reason for the 10% in short-term governments is that if there’s a terrible period in the market and she’s withdrawing 3% or 4% a year you take it out of that instead of selling stocks at the wrong time. She’ll do fine with that. And anybody will do fine with that. It’s low-cost, it’s in a bunch of wonderful businesses, and it takes care of itself.

Crunch the numbers with the size of your particular nest egg and see if this model will work for you. If your nest egg is very small, you might want to keep a bigger portion in safer investments — though that portion won’t be growing quickly.

Asset allocation considerations

When you think about what your best asset allocation is, you need to take into account many factors besides your age. For example, your gender makes a difference, as women tend to live longer than men and thus need their nest eggs to support them for more years. The Social Security Administration notes that a man who has reached age 65 this year can expect to live, on average, to age 84.3, while the average 65-year-old woman can expect to reach 86.6. And those are just averages, which mean you shouldn’t put too much stock in them. Some of us, after all, will reach our 100th birthday, meaning our nest eggs might need to last 35 years!

Women live longer than men, in general, but many of us might reach age 100 and beyond. (Photo: Flickr user Mike Baird .)

Think, too, about your health, as it will affect your healthcare costs in retirement. If you’ve always been healthy and expect that to continue, you’ll likely face lower overall costs, though that’s not guaranteed. Your lifestyle also matters. If you live in a big house, travel a lot, golf a lot, and like to buy a new car every few years, you’ll clearly need more than someone living more modestly. Then there’s the interest rate environment. Rates have been near historic lows for many years now, and if that continues, then retirees and near-retirees won’t be earning much on their safe investments.

Automate your asset allocation by age