Asset Allocation_3

Post on: 20 Июнь, 2015 No Comment

Some investment portfolios do better over time than others. That obvious fact may seem to have an equally obvious cause — differences in market timing (buying and selling securities at advantageous times) or in the selection of individual securities. But, if you look at historical records, the reason some portfolios have better returns than others looks very different.

Analysts who examined the performance of 82 large pension funds over a ten-year period found this surprising reason for superior returns: The funds asset allocation policies accounted for 91.5% of their results. Neither securities selection nor market timing was the key factor.

Portfolio Proportion

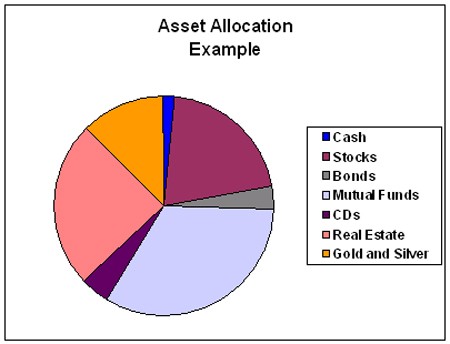

Asset allocation simply applies the basic risk-limiting investment principle of diversification to the proportion (distribution) of a portfolios investments among different investment classes, for example, stocks, bonds and cash equivalents. Also, asset allocation can determine the proportion of investment styles within each asset type.

The Risk/Return Tradeoff

Any investment portfolio has a range of possible returns along with a corresponding amount of risk (the variability of returns). Usually, there is a tradeoff of return vs. risk. The types of investments that offer low returns are the types that also have low risk. The investments that offer the possibility of higher returns also involve higher risk.

Asset allocation can favorably alter this risk vs. return tradeoff. With an efficient asset allocation, potentially higher returns become possible with little or no increase in risk. Or, if risk control is more important, efficient asset allocation can preserve a portfolios returns, yet reduce its risk.

Correlations in Performance

Asset allocation can alter a portfolios risk because, under certain economic conditions, some types of investments have a historical tendency to gain or lose value together. Other types of investments have a tendency to move in opposite directions. Statisticians call these tendencies correlation.

The types of investments that have tended to move together, such as bonds and high-dividend paying stocks, are positively correlated. The types of investments that have tended to move oppositely, for example, bonds and growth stocks, are negatively correlated. So, a portfolio manager can lower overall portfolio risk (variability of returns) with out lowering the possible return by using a mix of positively and negatively correlated investments.

Time Lowers Risk

A manager can use asset allocation to structure a portfolio that has the ability to perform well in different economic climates. The risk reduction and potentially higher returns that asset allocation provides are long-term benefits. So, an asset allocation plan requires time to succeed. For example, over one or two years one style of equity investing such as large company stocks, may strongly affect overall portfolio performance. Yet, over ten years or more of changing economic climates, equity styles have tended to have much narrower performance differences.

The investment professionals at Great Plains Trust Company can develop and manage an individually tailored portfolio. Contact us by email , or call us at 1-888-529-2776.