AsianBondsOnline Securities Issuance and Trading

Post on: 18 Июль, 2015 No Comment

Securities Issuance and Trading

This section discusses rules and procedures relating to: (i) licensing of dealers; (ii) accounting treatment of investments in securities (with particular regard to valuation); (iii) tax treatment of securities income; and (iv) securities trading, clearing, and settlement.

Registration and Licensing

Bond Issuing Procedures

Government bonds are exempt from verification and approval for listing on the Shanghai and Shenzhen stock exchanges. Rules and regulations for the issuance and transfer of bonds as well as conditions for listing corporate and convertible bonds on the Shanghai Stock Exchange can be found by following the links provided below.

In 2005, the People’s Bank of China (PBC) allowed qualified legal entities to issue yuan bonds and commercial paper by submitting required documents to the PBC. The PCB regulations are included on its website, which is linked below.

Under the Securities Law, the China Securities Regulatory Commission (CSRC) licenses stock exchanges, securities companies (comprehensive securities companies and brokerage securities companies have different licenses), securities registration and clearing institutions, and securities trading service organizations (e.g. professional securities investment consulting organizations and credit rating institutions).

CSRC also issues qualified foreign institutional investor (QFII) licenses with exchange quotas approved by the State Administration of Foreign Exchanges (SAFE). The China Banking Regulatory Commission issues licenses to financial institutions.

Related Resources:

The People’s Republic of China (PRC) is moving towards converging PRC’s Generally Accepted Accounting Principles (GAAP) to International Accounting Standards (IAS). The PRC’s GAAP do not require mark-to-market accounting for investments, but they specify that short- and long-term investments are to be valued at the lower of either cost or market value, plus or minus the amortization of premium or discount, depending on the type of investment. A detailed comparison between the PRC’s GAAP and International Financial Reporting Standard (IFRS) is linked below.

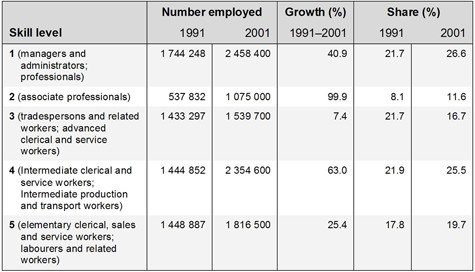

Interest income from government and most financial bonds is tax exempt. There is no stamp duty tax applied to government bond transactions. Interest income from investment in corporate bonds is subject to a tax at rates that vary between individual and institutional investors. The table below provides a summary of investor tax rates.