Are we in a Stock Market Bubble

Post on: 18 Август, 2015 No Comment

Theres been a lot of bubble talk in recent weeks. Actually, theres been a lot of bubble talk in recent years. The word bubble gets tossed around an awful lot ever since the Nasdaq bubble and the housing bubble. I guess its not that surprising.

But first, what is a bubble? I define a bubble as follows:

A bubble is an environment in which the market price of an asset has deviated from the underlying asset’s fundamentals to an extent that renders the current market price unstable relative to the underlying asset’s ability to deliver the expected result.

So, does the current environment qualify? Russ Koesterich of BlackRock provides his four reasons why this market is not a bubble:

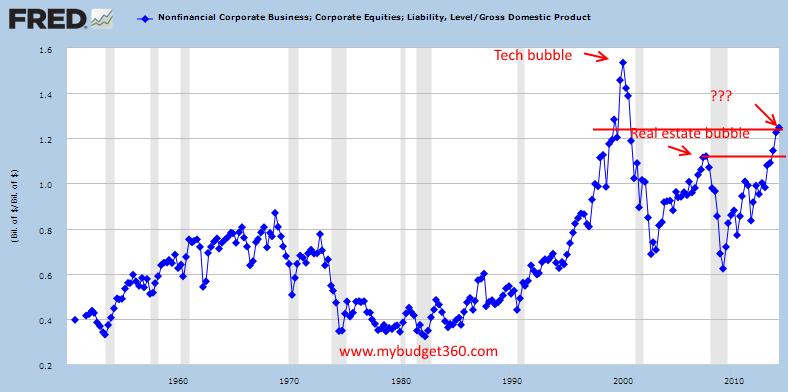

- Valuations are no longer cheap, but they are still a long way from the peaks seen in previous cycles. U.S. stocks trade for around 2.5x book value and for 16.5x trailing earnings. Looking at the last three major market peaks – 1987, 2000 and 2007 – price-to-earnings (P/E) ratios were respectively 23, 30 and 17.5. The price-to-book ratio, meanwhile, peaked at close to 5 in 2000 and 3 in 2007.

- As I discussed in August, valuations look more reasonable outside of the United States. Based on price-to-book measures. international stocks are 30% to 40% cheaper than U.S. stocks.

- On a relative basis, the earnings yield on stocks still compares favorably with the fixed income alternative. Compared to bonds, which have been bid up through central bank intervention, stocks still look cheap.

- Despite strong in-flows year to date, many investors are still underweight equities.

Im not a big valuation guy and I dont really buy the notion that money flows into outstanding assets. but I will say that I generally think Russ is right. When I try to decipher whether a market is in a bubble I dont like to rely on valuation metrics because I think bubbles are often the result of irrational behavior that makes valuation metrics unreliable for long periods of time. Instead, I prefer to look at underlying fundamentals relative to behavior. When I look at the current equity market I see corporate profits growing modestly, an economy that is expanding modestly and an equity market that is increasingly enthusiastic, but not showing the types of pure exuberance, greed and delusion that are typical in a bubble environment. Theres still a huge amount of skepticism about the equity market rally. This remains an extremely hated rally.

So, I would say theres growing risk as were seeing increasing signs of euphoria, but I wouldnt yet describe this as a bubble. I think that implies much more downside risk than is currently present in the economic and corporate fundamentals. And perhaps more importantly, were just not seeing the kind of all out delusion that usually accompanies a bubble. When people at dinner parties start telling me that stocks cant go down then Ill start getting scared.

Got a comment or question? Feel free to contact Cullen via email here or on Twitter here.