Are QE3 and Mortgage REIT ETFs a Winning Combo ETF News And Commentary

Post on: 13 Август, 2015 No Comment

Share | Subscribe

With the economy still sputtering, the Federal Reserve recently revealed another round of quantitative easing, QE3, in order to hopefully jumpstart growth once again. This program looks to buy up roughly $40 billion in MBS each month, a technique that looks to keep rates low on mortgage debt and utilize the housing industry as a jumping off point for higher growth levels.

In addition to the bond buying, the central bank also announced that it would continue to ‘twist’ its T-bill holdings profile in order to go into longer duration securities. If that wasn’t enough, the low rate language was extended to 2015, suggesting that the zero interest rate policy will be the name of the game for another few years, at least.

In this kind of environment, Treasury bonds and other bonds represent lukewarm (at best) choices for investors seeking more current income. As a result, a greater focus has been on the equity market and traditional high yielders like MLPs, telecoms, and consumer staples for stable and robust payouts.

Beyond these choices, securities focused in on the real estate market, and especially those structured as REITs are also popular picks in this type of market. That is because REITs, in order to avoid corporate level taxation, must pay out at least 90% of their income to investors, making them prime securities for high yield investing (see The Introductory Guide to Real Estate ETF Investing ).

Yet while REITs have become more in focus, many investors have likely overlooked a segment of the market that could potentially benefit from the current low yield environment, should it remain stable for the next few years. This corner of the REIT world is the mortgage REIT segment, which can potentially offer up a better risk reward play at this time.

That is because mortgage REITs borrow capital and these ultra low short term rates, and then turn around and invest it into potentially higher yielding real estate portfolios. Basically, securities in this segment often use leverage to make money off of the spread differential in rates while still paying out high yields to investors on a regular basis (see Three Overlooked High Yield ETFs ).

Mortgage REITs are an attractive play on high yields assuming the Federal Reserve keeps rates low for an extended period of time said Brandon Rakszawski. Product Manager at Van Eck Securities. Borrowing costs are likely to remain at a low level, giving these firms easy access to cheap capital.

If that wasn’t enough, trends in the overall mortgage market also could favor mortgage REITs and some margin expansion in the near future. GSEs have been tasked with winding down their mortgage portfolios, so there is a large demand for private players in the space continued Brandon of Van Eck. This suggests that vertical integration could also be a trend in the market, a situation that could help to boost profitability in the sector as well.

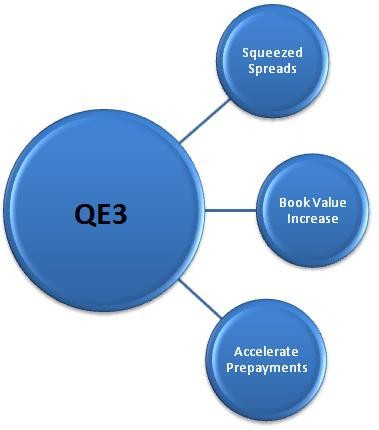

Still, there are some risks in the space, notably in the compression of returns in longer dated securities. Should the Fed’s plan to buy up MBS in bulk go according to plan, it could pull down rates of return in the REIT market, reducing profits for those in the mREIT sector.

However, Brandon of Van Eck notes that while this will probably hurt mortgage REIT payouts, this trend will be felt across the board, suggesting that mREIT yields should remain attractive when compared to their peers in the market (also read 4 International ETFs Yielding more than 5% ).

For these reasons, now could be the time to take a closer look at the mortgage REIT market. The borrowing costs look to remain stable for at least the next couple of years and there are few segments of the investing world that can even come close to matching the yield payouts seen in the mortgage REIT market.

While buying up individual mortgage REITs is always an option, less risky (more diversified) options can be found in the ETF market with the two products that occupy this space. While both could be decent options for exposure to this market segment, there are some key differences between the two which we have highlighted below:

Market Vectors Mortgage REIT Income ETF ( MORT )

For investors searching for the cheapest option in the mREIT space, look no further than MORT. This product tracks the Market Vectors Global Mortgage REITs Index, which looks to give investors exposure to the overall performance of publically traded mortgage REITs (also see Time for a Commercial Real Estate ETF? ).

In total, the ETF holds about 25 securities in its basket, with a heavy focus on Annaly Capital ( NLY ) which makes up nearly 20% of assets and then American Capital Agency Corp ( AGNC ) which accounts for roughly 15% of the fund. Still, the fund offers a nice mix of capitalization levels, as large caps make up roughly one-third of the portfolio while small and micro caps comprise just over 60% of the assets as well.

As we alluded to earlier, MORT is the cheaper of the two on this list, charging just 0.40% after waivers, while volume is at a reasonable 35,000 shares a day. Meanwhile, from a yield perspective, the product is hard to beat coming in at 11% in 30 Day SEC Yield terms.

iShares FTSE NAREIT Mortgage REIT ETF ( REM )

The original ETF in the mREIT market comes to us from iShares in its REM which tracks the FTSE NAREIT All Mortgage Capped Index. This benchmark follows the residential and commercial mortgage real estate sector of the U.S. market, holding about 30 securities in total.

Despite holdings more securities in its basket, REM is arguably more concentrated as it puts 22.6% in NLY and then 16.85% in AGNC. Much like its Market Vectors counterpart, REM is skewed towards pint sized securities as large caps account for roughly 40% of assets with mid caps making up another 5% as well (read Is ROOF A Better Real Estate ETF? ).

While REM might not be as cheap as its MORT cousin-charging eight basis points more a year-it does have a much higher volume suggesting tighter bid ask spreads for this product. Additionally, it does slightly beat out the other fund on yield, paying out just over 12.4% in 30 Day SEC terms, although it is more focused on its top few holdings.

Key Data Point