Annuity Calculator for Lifetime Annuities

Post on: 25 Июнь, 2015 No Comment

Annuity Definitions – Terms Related to Annuity Calculator

Annuity: An annuity is a financial product sold by insurance companies that provides a stream of payments over time to the purchaser (annuitant). There are a lot of different flavors of annuity contracts and they can be complex, however they can provide a number of benefits to the user including lifetime income and annual adjustments to your cost of living expense.

Lifetime Annuity: A lifetime annuity is a financial product you can purchase with a lump sum of money for which you will receive income for the rest of your lifetime. A lifetime annuity guarantees payment of a predetermined amount of money for the rest of your life. This is different from a term annuity which only pays you for a fixed amount of time.

Immediate Lifetime Annuity: An immediate annuity provides income to the purchaser that starts as soon as they deposit a lump sum and the payments last for the lifetime of the purchaser or for the lifetime of the purchaser and his or her spouse (or joint annuitant) or for some set amount of time (5, 10, 20 years). This can also be called a Single Premium Immediate Annuity (SPIA). Many people roll over tax qualified funds into a tax-deferred immediate annuity, because in many cases the user only pays taxes when they receive the monthly payment (so taxes are spread over time) and they only pay taxes on the portion of their payment attributable to tax qualified deferred income.

This is different from a Deferred Annuity where you the purchaser pays in over time (or one lump sum) and the money is invested by the insurance company until the stream of payments starts at some point in the future.

Deferred Lifetime Annuity: A Deferred Lifetime Annuity is an annuity in which the payments start at a predetermined future date. With a Deferred Annuity the purchaser pays in over time (or one lump sum) and the money is invested by the insurance company until the stream of payments starts at some point in the future.

A Deferred Annuity is most often used when you think there will be an income need in the future, but not immediately — if you have a job now, but forsee stopping work and still needing the income at a later date. Or, if you think medical or long term care costs will require additional income as you age.

Fixed Annuity: A fixed annuity pays a fixed rate of return and is typically invested in lower risk fixed income products such as government securities and corporate bonds. This is different from Variable annuities which typically invest in riskier assets such as mutual funds that hold equities. Variable annuities can provide a higher rate of return, but they have more risk and your monthly payment may fall as well.

Term Annuity: A term annuity is a financial product that guarantees payment for a specific period of time such as 5, 10 or 20 years.

Joint Annuitant: A joint annuitant is typically the spouse of the purchaser of an annuity (the annuitant) – very often retirees who want to secure lifetime income will purchase an annuity which provides payments for as long as either the annuitant or joint annuitant is alive.

Survivor Benefit: When people buy Joint & Survivor annuities that make payments for as long as either annuitant is alive they can elect to change the size of the payment to the surviving annuitant when one of them passes away. The survivor benefit is typically 100%, 75%, 66% or 50% of the original payment amount – it depends on what income amount the purchasers think will be necessary at that point in their lives.

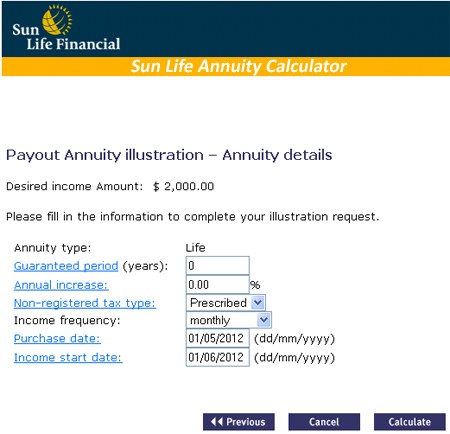

Monthly Income: Enter the monthly amount you think you will need from an annuity to cover a gap in your retirement income and the Annuity Calculator will retrieve quotes for what it would cost to buy this level of monthly income.

Lump Sum: Enter the savings you have available that you could convert to an annuity and the Annuity Calculator will tell you how much monthly income it would produce for the rest of your life.

NewRetirement prescreens Annuity Experts and will refer you to providers. These experts will contact you to answer questions and provide guidance.