Analyzing Mutual Funds

Post on: 11 Апрель, 2015 No Comment

Mutual fund investing can be overwhelming. There are hundreds of mutual fund companies and thousands of funds spread across hundreds of different market sectors. Our method of analyzing mutual funds is rather simplified but should yield as good of results as many financial advisors can give. To find the right mutual fund, research using the following methods:

Determine the Mutual Fund Sector(s) to Invest In — Should you invest in large cap, small cap, growth, value, bonds, international, health care, technology or other sector funds? The answer depends mainly on how much money you have to invest. If you have several hundred thousand dollars to invest, you should diversify your mutual funds over a dozen funds or more, with as little overlap as possible between the mutual funds. In this case you could choose many specific sector funds if you prefer. If you are just starting out and want to invest a few hundred or few thousand dollars, then you should stick to one fund that is general in nature. In other words, the more money you have, the more variety of mutual funds you should purchase.

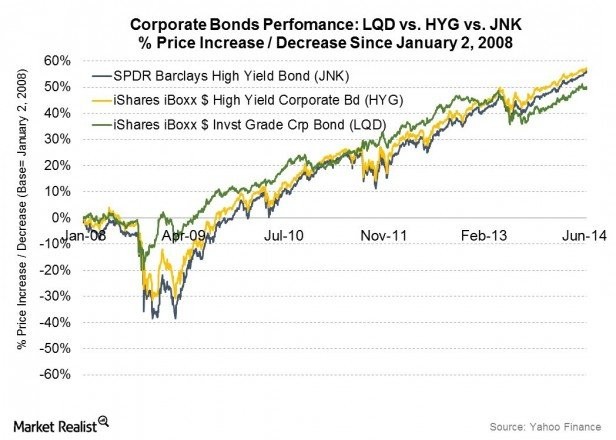

Also, you should pick your mutual funds based on your age and your investment goals. If you are simply speculating, you’ll want to stick with pretty specific sector funds. This increases your risk and chance of higher return. Also, the younger you are, the more risk you can withstand in your portfolio. Regarding age, the older you are, the more diversification you should take. For example, if you are nearing retirement, you’ll want a large portion of your portfolio invested in bond mutual funds. Take this information into account with the information from the previous paragraph and use them together. For example, if you are young and don’t have a lot of money to invest, you should pick one or two general funds that replicate the overall stock market. If you are older and have lots of money to invest, you should own several funds including both foreign and domestic stock and bond funds.

If you know what sectors of the market you want to invest in, you can determine your fund sector based on personal preference. For example, you may believe that technology, oil, or healthcare stocks are poised to rise faster than the rest of the market. If this is the case, and you are okay taking the extra risk, then you could invest in specific sector funds that match your beliefs. Often, it is a good idea to invest your money by the book (generally accepted investment philosophies, i.e. diversify, diversify, diversify), but it also makes sense to invest most of your money by the book and invest the rest in sectors that you find particularly appealing.

With an idea of what type of funds you want to invest in, it is time to narrow down the list to a group of fund families that you find acceptable.

Find Acceptable Mutual Fund Families — You’ll want to pick mutual fund companies that have a wide variety of options, low fees, no loads and most importantly, a great reputation. I usually choose the large mutual fund companies that have avoided any scandals, but small fund companies can be just as good if not better. By selecting large companies you can choose between many different mutual funds under one family. Also, large mutual fund companies often charge lower fees and have better insider trading and fraud protection programs. Most importantly, a larger mutual fund company doesn’t rely on one single portfolio manager for all of its funds. That means that just in case the manager leaves the firm, there will still be several other capable managers to take over. Our favorite mutual fund companies (at the time of this article) are Vanguard and T. Rowe Price — they both have no loads, low fees, good reputations and a large variety of funds. Once you’ve done your research and have formed a list of several fund families, it’s time to pick your specific funds.

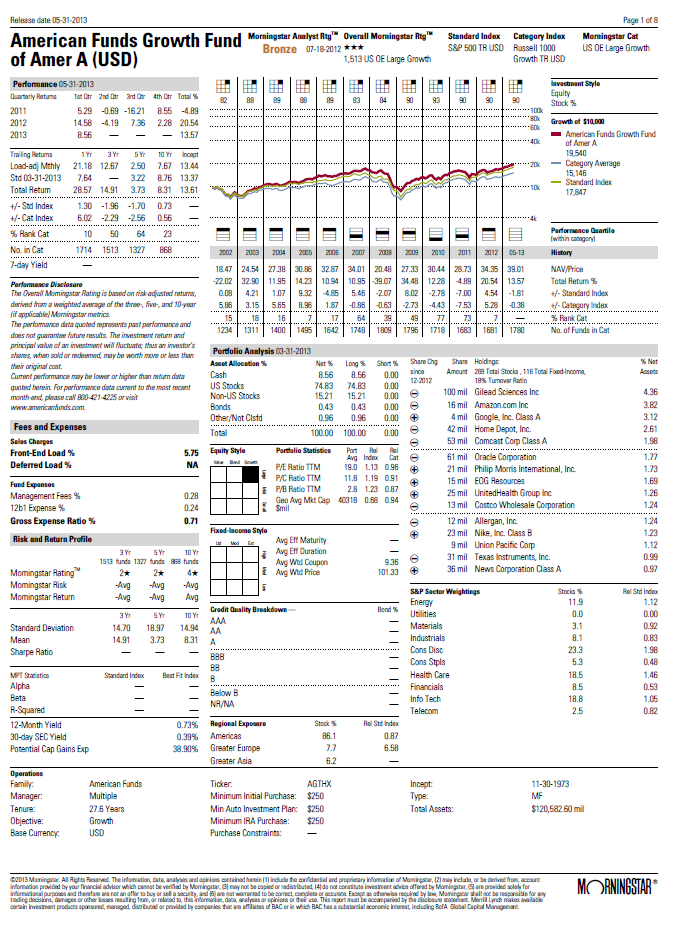

Compare Mutual Funds — The best way to judge a mutual fund is to compare it to its peers. Select the funds in the sectors you desire from the families you’ve chosen and compare them to each other. You can get fund information from prospectuses (available online at the fund families sites) or through screening tools like Yahoo Finance or E*Trade. Look closely at the following aspects of each fund:

Management — Look at the background of the portfolio managers. Do they have a lot of experience? Do they have experience in the industry that they are analyzing? How is their past performance? How is their past performance on other funds and at other companies? Look for backgrounds that have business experience as well as finance experience, and look for someone with a solid track record and that thinks independently of investment bankers and institutional research analysts.

Investment Strategy — What type of strategy does the fund follow? This is clearly stated in the prospectus and is easy to find online. Do you want someone that speculates? Uses leverage? Holds too much cash? Tries to time the market? You’ll find that strategies vary dramatically from fund to fund, even in the same sectors. For example, one growth fund may look for stocks growing 5% or more, while another looks for stocks that grow 15% or more. One growth fund may invest mostly in international, large cap stocks and another similar looking fund may invest in domestic small cap stocks.

Look closely at how the fund describes it’s goals. Make sure that they match the type of fund you are looking for.

Fund Size — Look at the total size of the funds’ assets. If it is small (in the $100s of millions) then the company may be able to get in and out of stock positions quickly. For larger funds (in the $billions), it is much more difficult to get in and out of stock positions. In fact, the largest mutual funds often have trouble finding enough stock to make their positions, which often leaves them no option to invest in some of the smaller cap companies. With that said, this is just one more tool to use when evaluating different funds.

Turnover — Do you want a mutual fund that is constantly buying and selling stocks or do you want an investment that buys and holds its stocks for a long period of time? Many funds say that they are long term investors but still have high turnover rates. Check the prospectus or information site you are using to compare turnovers. High turnover means higher commissions and expenses.

Holdings — This is one of the best ways to see what types of stocks your fund buys. Each fund is required to report its top 10 holdings each quarter, along with the percent held of each. Look at the list of top stocks. Are they too concentrated? Not concentrated enough? Are they all in the same sector? Are they chasing currently popular stocks? Are they international, domestic, large cap, etc? Compare the top holdings of each similar fund you are contemplating. Make sure that the same stocks aren’t in each of the funds. For example, a stock like Microsoft could be found in growth, value, large cap, technology and many index tracking funds. Overall, the top holdings should give you one of the best answers as to whether or not you want to buy it.

Past Performance — This information can be found in any prospectus, charting service (like BigCharts.com) or mutual fund screening tool (like Yahoo or E*Trade). Look at the past performance compared to it’s benchmark and compared to other funds you are looking at. If the performance is much better or worse than its peers, figure out why. And remember, past performance is not an indicator of future performance. There are many reasons why a fund has performed better or worse than its peers. For example, many funds that have done well over the past have often been invested heavily in certain sectors that have done well. Although these funds have performed well, they may have also taken more risk and could be currently exposed to downside risk if that sector goes through a down cycle.

With that said, past performance shouldn’t be used as the main reason to select a mutual fund. However, by studying the past performance, you should be able to gauge what kind of returns are likely in the future. For example, two growth funds that appear identical could have vastly different returns over time. One might vary between -10% and 15% returns per year while another varies between -25% and 30% returns. Difference like this are probably a good indicator of the type of inherent risk and return that you can expect from those funds.

Fees — Once you’ve narrowed the funds you like down to a short list, start comparing the fees. Look at the load and the management fees. We recommend that you never buy any fund with a load (a load is a fee charged to buy the fund that is in addition to an annual management fee), unless you really, really like the fund. Loads are typically used to pay salespeople and financial advisors and you shouldn’t have to pay these if you are buying on your own account. Regarding management fees, they vary from about 0.5% to upwards of 5%. We recommend that you find a fund that charges 1.5% or less. Remember, the management fee comes out of the fund each year, so if the total return on the fund is 8% and the fee is 3%, they’ve taken away 38% of your profit.

Minimum Investment — Finally, look at the minimum investments for a fund. Some minimum investments are $10,000 or more, so before you decide on a fund, make sure that you can meet the minimum investment criteria. For IRAs, this amount is often lowered so if you really want a high minimum fund, you could invest in it through an IRA.