Analyzing China s Mutual Fund Industry Research and Markets

Post on: 11 Апрель, 2015 No Comment

FEATURED COMPANIES

A mutual fund is a type of Investment Company that gathers assets from investors and collectively invests those assets in stocks, bonds, or money market instruments. China’s mutual funds have been performing well over the past year, with over 20 percent yield achieved in 2006, which encouraged investors to buy into funds in the first few months of 2007.

Overall, China’s mutual fund industry has boomed during the past two years, and has become the main driver of share prices in the domestic market. The industry is currently managing assets worth nearly 250 billion Yuan (US$30.2 billion).

China’s booming mutual fund market is attracting more foreign companies to take part in local business. Though eight fund management joint ventures have been established in China already, with two more in preparation, the market has sufficient room for further expansion.

With China’s entry into the World Trade Organization, its financial system faces enormous changes and increasing pressure from foreign competition in the coming years.

The mutual fund market in China is expected to experience increasing growth rates. China will also step up the development of its mutual fund market, and help cultivate institutional investors in the securities market. The continuing stock market correction and tightening of money supplies may cast a cloud over new mutual fund IPOs in the short term, but fund managers are still optimistic about the future and will proceed with their expansion plans.

Aruvian’s R’searchs report Analyzing Chinas Mutual Fund Industry starts off with an in depth analysis of the Chinese economic scenario, without which the understanding of Chinas Mutual Funds Market would be incomplete. The report delves in the basics of the industry, describing market patterns, growth drivers, issues and challenges facing the industry, a historical perspective of the industry, and an overall market profile

The Chinese Mutual Fund Industry is further examined through two very important frameworks the PEST Framework Analysis and the Porters Five Forces Strategy Analysis giving an idea about market entry, competition, and buyer/supplier scenario in the industry.

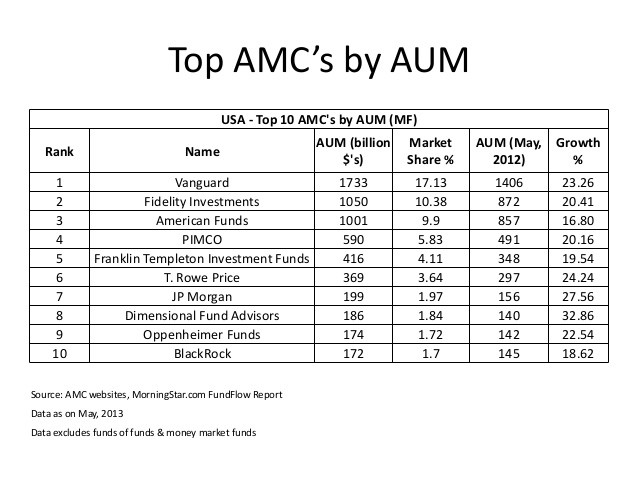

A section on understanding the herding behavior of Chinese mutual funds adds value to the report as it undertakes a thorough analysis not only on the herding trends in Chinas mutual fund industry, but also gives a complete comparison between the US and Chinese mutual funds industry. The uniqueness of portfolio stocks in the Chinese mutual funds industry is also described in details.

The report further explores the leading players in Chinas mutual fund industry such as Fidelity Investments and US Global Investments Inc. and ends with a future outlook for the Chinese mutual funds industry. SHOW LESS READ MORE >

Note: Product cover images may vary from those shown