An Overlooked Way To Play This Market Convertible Bonds

Post on: 16 Сентябрь, 2015 No Comment

Convertible bonds combine the income and stability of a bond with the appreciation potential of a stock.

Equity envy: A syndrome experienced by fixed income investors watching the stock market rise while interest rates and yields stay at near-record lows. Enter convertible bonds.

Investors seeking income and equity market exposure might want to consider this overlooked asset class, which combines the income and stability of a bond with the appreciation potential of a stock.

More technically, convertible bonds are hybrid fixed income securities which investors can convert into equity if the issuer’s shares price rises above a preset amount, or if investors redeem the bonds at par, usually $1,000 per bond, at maturity.

When the bond is acting like one, the yield is generally lower than a comparable bond that isn’t convertible – which makes them a good deal for issuers, including growing companies such as recently issued Tesla Motors, NetSuite and Salesforce.com.

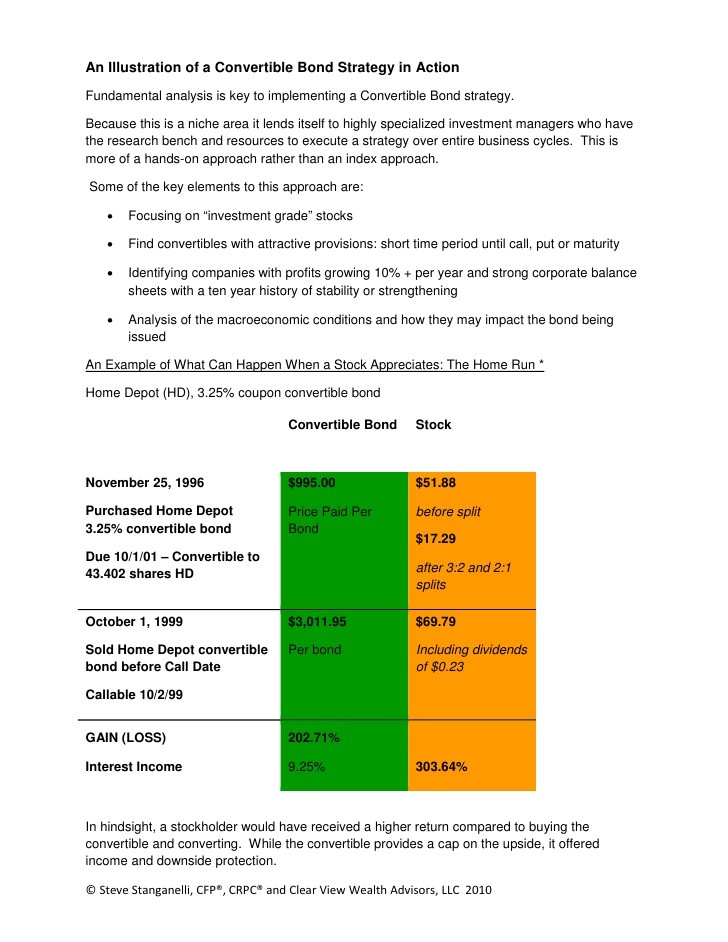

If the stock shares rise, the investor participates handsomely in the upside –since most convertible bonds are structured so that the investor can capture the majority of the upside movement in the issuer’s stock.

Consider this: The $200 billion universe of U.S. convertible bonds offers a current yield of 3% and sports an average rating of BB-, just three notches below investment grade. But through the conversion feature, the average convertible bond has risen more than 13% this year due to the stock market’s advance. This compares to the low single digit to outright negative returns year-to-date for many similar quality non-convertible bonds.

Meanwhile, the fixed income features of convertible bonds – namely, maturity at par and semiannual interest payments – offer downside protection and ultimate repayment of principal.

A point that Edward Silverstein, MacKay Shields’ Head of Convertibles recently reminded me is that because rising rates are often linked to strong equity markets, convertible bonds generally become more attractive, not less. The old adage “interest rates go up and bond prices go down” isn’t always true for convertible bonds, Ed said.

With yields low and the stock market on the rise, convertible bonds are getting a first or second look from many investors in multi-sector and dedicated convertible portfolios. In our opinion, most individual investors gain exposure to convertible bonds through a mutual fund. With various moving parts, it pays to shop around and look at a fund’s management team, process, and performance before investing.

If you would like to read up on recent convertible market commentary from Ed and his team click here .

________

This material is distributed for informational purposes only. The views expressed herein do not constitute research, investment advice, or trade recommendations and do not necessarily represent the views of all MacKay Shields Portfolio Management.