An Introduction To OIS Discounting

Post on: 6 Июнь, 2015 No Comment

The valuation of financial instruments is the foundation of all investing activity. Valuations are necessary to determine the fair market value of an investment, as well as for financial reporting and risk management purposes. By far, the most common method of valuation is the discounted cash flow (DCF) method which involves the estimation of future cash flows and the discount rate applicable to those cash flows. While cash flows are often easy to estimate, the discount rate can be tricky to ascertain. However, it is helpful to keep in mind that in order for the market value of an investment to be fair the discount rate must be the same as the rate of return on that investment. (To learn more about the DCF method, see: Introduction to Discounted Cash Flow Valuation .)

Derivative Valuation: Before and After 2007

Financial derivatives are useful for altering portfolio risks and diversifying risk by gaining exposure to different markets. Derivatives are valued under the assumption that the return on all underlying assets is the risk-free rate. and thus that same risk-free rate is the appropriate discount rate for derivative cash flows. This is known as risk-neutral valuation and relies on the presumption that it is not possible to make risk-free profits in the markets due to investors having access to similar information. An implicit assumption of risk-neutral valuation is that there is no counterparty risk. only market risk. (For related reading, see: How Risk Free Is The Risk-Free Rate Of Return ?)

Prior to the 2007 financial crisis, the yields on government bonds were assumed to be risk-free since it is near impossible for a government to default on its own debt denominated in its own currency. The reason for this is that the government treasury has the ability to print money in order to meet its debt obligations. In addition, it was thought that swap rates based on interbank lending rates (e.g. LIBOR, EURIBOR etc.) were essentially risk-free. Swap rates were considered more appropriate for risk-neutral valuation than bond yields because proceeds from derivative transactions are generally invested in the interbank market and not the bond market.

After the 2007 financial crisis, the failure of some banks proved that interbank lending rates were not risk-free. In fact, it also emerged that there was significant counterparty risk in derivative transactions that were not subject to collateral or margin calls. This was most evident when Lehman Brothers failed at a time when (according to Summe, K. (2011)) it was counterparty to 930,000 derivative transactions representing approximately 5% of global derivative transactions. (To learn more about the failure of Lehman Brothers, see: Case Study: The Collapse of Lehman Brothers .)

Collateralized vs. Uncollateralized Derivatives

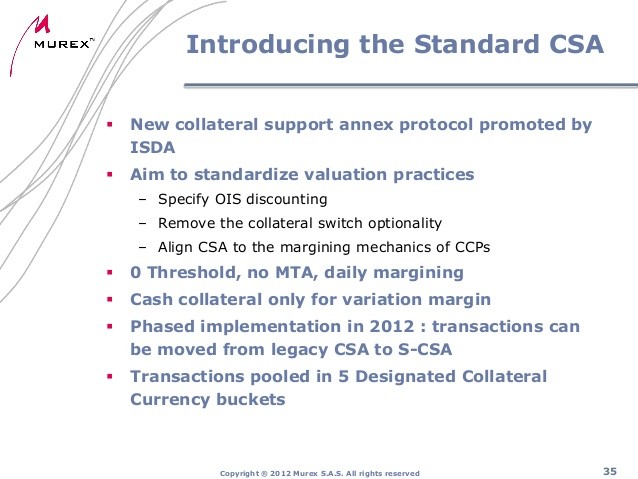

Derivatives that trade over-the-counter make use of a standard ISDA agreement. Many ISDA agreements include a credit support annex (CSA) which is an agreement that outlines permissible credit mitigants for a transaction, such as netting and collateralization. Collateralized transactions pose less counterparty risk because the collateral can be used to recoup any losses. When the collateral falls below a certain threshold, additional collateral can be called for.

Due to the difference in risk between collateralized and uncollateralized transactions, the discount rates for valuation must differ. There are various, well-understood discount rate choices for risky uncollateralized derivatives. Less risky collateralized derivatives, however, must be valued using a risk-free rate. The choice of risk-free rate presents a challenge since it is now known that swap rates are not risk-free.

Choice of Risk-Free Rate for Collateralized Derivatives

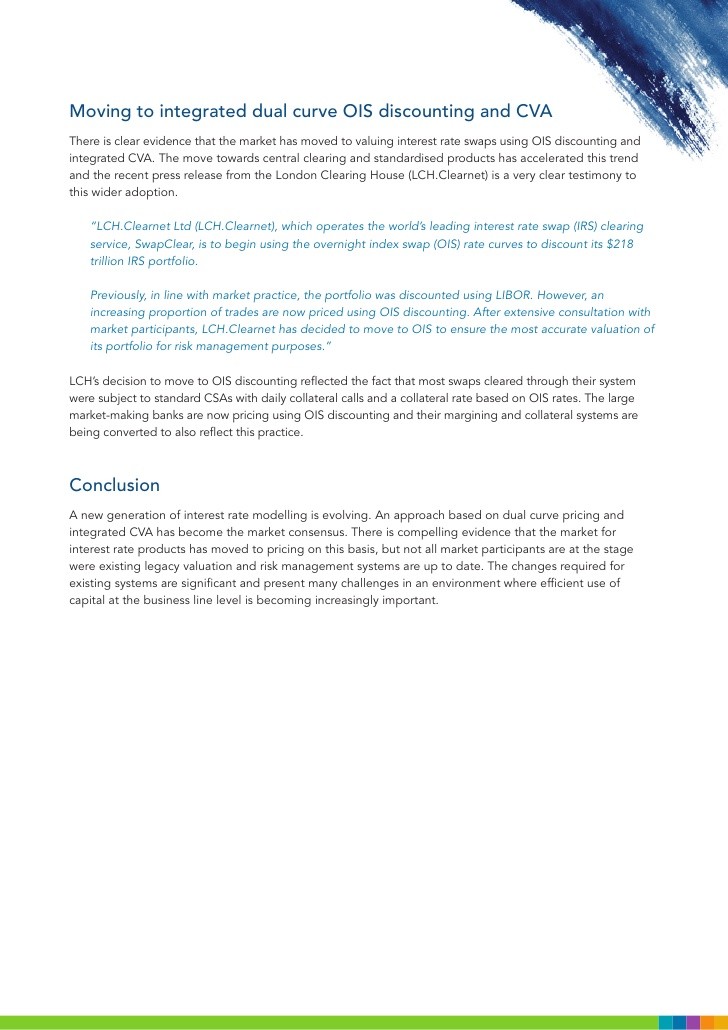

Standard CSA agreements stipulate daily collateral calls, failing which the transaction with that counterparty would be closed out, thereby limiting further losses. Given daily collateral calls, the natural choice for the risk-free discount rate is some kind of overnight rate. This is referred to as OIS discounting or CSA discounting. An overnight yield curve can be derived from overnight index swaps (OIS’). Prior to the 2007 financial crisis, there was little difference between the overnight yield curve and the yield curve derived from swap rates. During the crisis the spreads between the two yield curves widened, and persist to this day. Although overnight index swaps (OIS) were introduced fairly recently, some developed markets now have highly liquid OIS trading activity (most notably in the United States, the EU, the United Kingdom, Japan and Switzerland) which enable reliable valuations.

Historical Spread between 3-month USD LIBOR and the Fed Funds Effective overnight rate

In countries with an insufficiently liquid OIS market or no OIS market at all, valuation has become a tremendous challenge. One possible workaround is to create synthetic cross-currency OIS’ utilizing a liquid OIS curve as base and applying a cross-currency basis spread to derive a local currency OIS curve. Another possible solution is to make use of historical spreads between overnight rates and swap rates and attempt to model an OIS curve.

The Bottom Line

In order to determine a market value for an investment, a valuation must be performed, usually using the DCF method. For the value to be fair, the discount rate must be the same as the rate of return. Derivatives were considered to be free of counterparty risk, and being traded in the interbank market, were valued using interbank lending rates as discount rates. The 2007 crisis showed that these rates were not good proxies for the risk-free rate and that derivatives have counterparty risk. Uncollateralized derivative trades retain counterparty risk and can be valued using well-understood methods. Collateralized derivative trades reduce counterparty risk and therefore must be valued using a risk-free rate. Daily collateral calls suggest that OIS discounting is the logical choice for such types of valuation; however, this can prove to be a challenge in markets where the OIS market is insufficiently liquid.