An introduction to active ETFs

Post on: 6 Июнь, 2015 No Comment

The definition of an actively managed exchange traded fund (ETF) varies between providers. But the term generally refers to an active ETF that tracks a passive index, and instead of replicating its performance exactly, the fund manager can change the weightings of the fund in relation to the index.

In last November’s asset management benchmarking survey, global consultancy McKinsey & Company estimated that by 2015, $600 billion (£377 billion) will be under management in actively managed ETFs, with the majority of these funds fixed-income and money market – otherwise known as overnight deposit rates – focused.

Actively managed ETFs currently make up around 1 per cent of all ETF assets under management, according to McKinsey. However, the consultancy believes they have the potential to ‘change the narrative in traditional asset management and initiate a growth curve for the industry as a whole’.

These vehicles are most common in the US, where active ETFs have been listed on US indices for several years, but they have yet to make a dent in the UK market. Over the pond, Wisdom Tree, AdvisorShares and Powershares are active in this space.

In the UK, Pimco Sterling Short Maturity ETF was one of the first actively managed ETFs to be listed in on the London Stock Exchange. Managed by Mike Amey, the ETF tracks the LIBID GBP 3 Month index, in the same way that any normal ETF would. But instead of hugging the index, Amey can change the weighting within the fund to wherever he may find value – investing in longer-dated bonds than the index includes, for example. Since launch last June, the ETF has attracted £36.2 million in assets. The annual management charge weighs in at a cheap 0.35 per cent.

Michael-John Lyle, managing director at Source, which acts as the distribution platform for the Pimco ETF, says the fund has built up ‘a loyal and diverse investor base that appreciates the combination of daily liquidity and higher yields available from short duration bond funds’.

Pimco also offers the Pimco US Dollar Short Maturity Source ETF and the Pimco Euro Short Maturity ETF, for investors wishing to hedge investments in another currency. Like the sterling-denominated ETF, it is managed by Pimco to add value over the index.

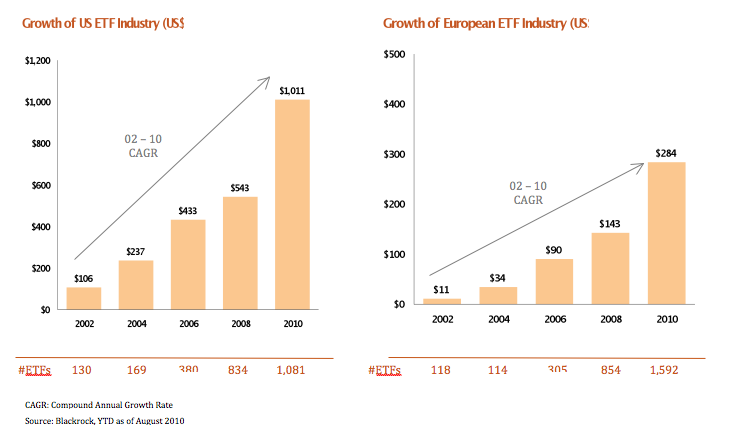

At present, Pimco is the only provider offering active ETFs in the UK. BlackRock’s ETF arm iShares currently has ‘no plans’ to launch any actively managed ETFs, while db-X trackers is in a similar situation, with just a few funds listed in Frankfurt. Lyxor, part of Société Générale, and behemoth ETF Securities also doesn’t offer any. Invesco Powershares, which has a big actively managed business in the US, doesn’t have any UK-listed active ETFs.

Jose Garcia-Zarate, ETF analyst at Morningstar, believes Pimco launched the active ETFs to ‘tap into a market fed up with rock bottom deposit rates’.

For active ETFs going forward, he adds: ‘We’re expecting more developments on the equity side, rather than just fixed income. But, actively-managed ETFs is a fairly recent phenomenon – they’ve only existed for the past two or three years in the US.

‘It’s an interesting area of development, but it hasn’t gained any traction. The whole idea of active ETFs defeats the original passive notion of them, and there isn’t a clear definition of what they are.’

Jason Witcombe, chartered financial planner at Evolve Financial Planning, believes that there will be ‘some confusion’ if active ETFs become widely used, as most people consider ETFs to be passive, tracking vehicles. ‘If an ETF structure offers consumers a lower-cost way to get active management, this should be welcomed,’ he says.