An Evaluation Of Emerging Markets

Post on: 8 Апрель, 2015 No Comment

Emerging Markets Corporate Bond Strategy

Article Main Body

What is PIMCO’s Emerging Markets Corporate Bond Investment Approach?

Investment opportunities in emerging markets (EM) corporate bonds have expanded dramatically in recent years. Governments across the developing world have sought to shift their economies to a higher growth plane by facilitating increased investment in key sectors, allowing private investments in formerly state-owned companies and supporting the growth of privately held companies. As a result, the EM corporates market has deepened in size and attracted more investor interest, and is now offering investment opportunities in many sectors like energy, metals and mining, transportation, telecommunications, social housing and banking, among others. The PIMCO Emerging Markets Corporate Bond Strategy aims to benefit from this development.

PIMCO’s process for investing in emerging markets corporate bonds takes place within the context of our robust emerging market investment framework. Sovereign research forms the foundation for this framework and, consistent with the firm’s overall investment philosophy, our approach begins with a secular analysis of the global economy. We then employ a multi-step process for analyzing sovereigns. First, we identify countries with strong, underlying credit fundamentals (including strong fiscal positions, stable/improving political situations, comfortable reserve levels, and debt profiles that can withstand financial shocks, among others). Second, we consider the impact of our global outlook on these countries, including prospects for demand from advanced economies, commodity prices, interest rate trends and other components of the external environment. Finally, we evaluate the technical conditions of the market to identify both the upside and the imbalances that could potentially lead to market dislocations in a given country.

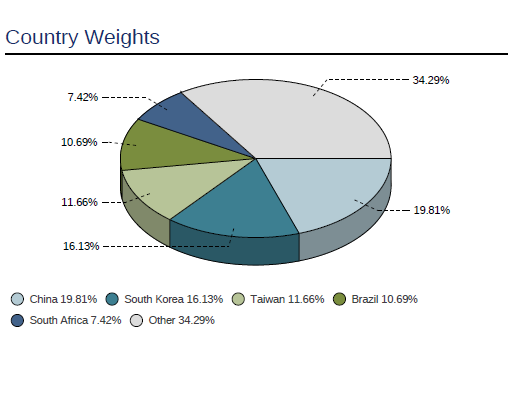

This disciplined multifaceted framework provides the basis for our country, industry, and issuers’ weightings, duration, curve, currency and instrument selection decisions, as well as relative value assessments. By emphasizing high quality countries and sectors strongly positioned for growth, often of systemic importance for the government, it helps us in our effort to optimize the set of strategies for a given investment environment while seeking to limit downside risk.

PIMCO’s Emerging Markets Experience