Americans are not increasing savings

Post on: 16 Март, 2015 No Comment

by Edward Harrison / on 12 October 2009 at 13:12 /

You have probably heard a lot of chatter from the media about a newfound thrift amongst American consumers .

The general take is that Americans, faced with lost incomes and wealth and burdened by record levels of debt, have moved away from the asset-based consumption models of yore. Instead of using the 401(k) or the house to do one’s savings, Americans are now saving the old-fashioned way by cutting spending and stashing money away in bank accounts. The commonly-held belief is that we are witnessing a secular change away from excess consumption toward thrift in the household sector.

Not true.

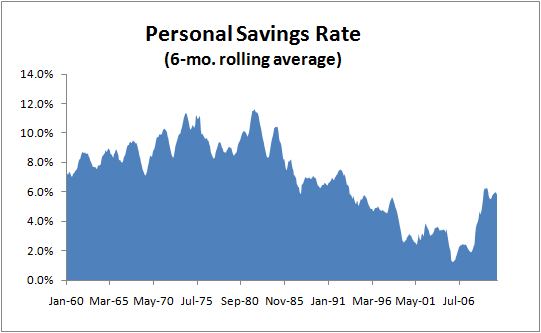

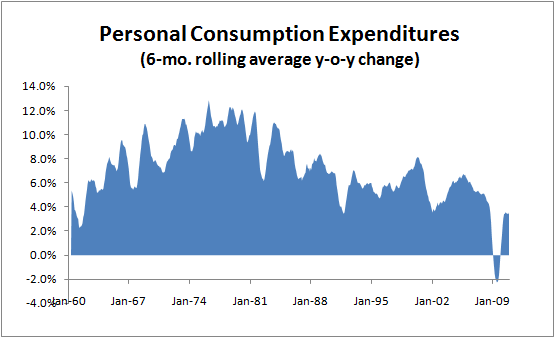

If you haven’t noticed, asset markets in the United States are all rising: stock prices. bond prices. house prices. even gold prices and commodity prices. This certainly is not lost on the mutual fund industry . And it is not lost on American households either. The savings rate has declined to 3.0% after briefly hitting an 11-year high of 5.9% in May. Welcome back to the asset-based economy .

(click on image to enlarge)

In the charts above, the left side shows how savings levels spiked up in response to the recession and credit crisis. The right side shows a fall off in the savings rate since May, just after the jobless claims numbers first began to recede.

A few factoids about the savings rate:

- Savings rates averaged 9% through 1982. They were consistently above 7% through 1992. Since then, savings rates have collapsed. From Jan 1969 to November 1997 (comprising all monthly data since record-keeping began), the 10-year average savings rate was higher in every single month than the 5.9% savings rate achieved in May 2009.

- Measuring the 12-month average savings rate, savings troughed in America at an all-time low of 1.4% in April 2008.

- Average savings has since increased monthly to the present 3.9%.

- The monthly savings rate peaked in May 2009 at 5.9%. It declined every month to August, hitting 3.0% in August.

What should be evident from the charts above is that the collapse in savings coincided with the secular bull markets in bonds and equities and with a secular build-up of debt (see “Household debt as an indicator of secular bull and bear markets ”).

My takeaway from the data during this past downturn is that American households are not necessarily saving more. As asset prices have risen, a return to the asset-based economic model seems to be taking hold. Let’s look to future personal income data from the BEA to confirm if this trend holds.

If so, the feedback between asset price increases, collateral for bank lending, increased consumption and economic growth could be more powerful than is commonly assumed. This is what could drive a multi-year recovery … that is until the next debt- and asset bubble-induced downturn ends this brief nirvana.

Edward Harrison is the founder of Credit Writedowns and a former career diplomat, investment banker and technology executive with over twenty years of business experience. He is also a regular economic and financial commentator on BBC World News, CNBC Television, Business News Network, CBC, Fox Television and RT Television. He speaks six languages and reads another five, skills he uses to provide a more global perspective. Edward holds an MBA in Finance from Columbia University and a BA in Economics from Dartmouth College. Edward also writes a premium financial newsletter. Sign up here for a free trial .