Alternatives To Pimco s Total Return Fund

Post on: 8 Апрель, 2015 No Comment

The bond market is many ordinarily famous for stability, reserve and income. In general, its not a shred of a marketplace where we would design to find a same form of market-moving play ordinarily found in equities. In stocks, it seems like each month or so that a obvious CEO or house member changes companies or reduces his or her purpose on a moment’s notice. Just in a past few months, but going into too most detail, companies like Microsoft Corp. (MSFT ) and Oracle Corp. (ORCL ) have both found themselves in a headlines for accurately these reasons.

On Sept. 26, 2014, news that Bill Gross was resigning as CEO of Pacific Investment Management Co. a bond-market hulk that he co-founded, sent shockwaves by a bound income markets. This is a second vital proclamation of changes in a C-suite during Pimco this year after Mohamed El-Erian motionless to leave a association behind in January. (For compared reading, check out: The Greatest Investors: William H. Gross .)

According to a Wall Street Journal article. “About 14 cents of each dollar invested in taxable binds is in Pimco Funds.” The essay continues to contend that “28,000 401(k) skeleton have $88 billion invested in a Total Return fund.” For those unfamiliar, a Pimco Total Return account was managed by Bill Gross for 27 years and binds approximately $200 billion in assets. (For more, check out: Investing Bonds and Fixed Income .)

As Warren Buffett pronounced on CNBC’s Squawk Box. a news of Bill Gross’ abdication was “huge news…a large story.” Since many investors and portfolio managers deposit in resources since of a specific manager such as Bill Gross or Warren Buffett, its healthy that these same investors are now looking to possibly follow Gross into his subsequent portfolio during Janus Capital Group, Inc. (JNS ) or that they competence even repel supports and demeanour to other matching opportunities elsewhere. Below we’ll take a demeanour during a few pivotal players that are expected to advantage from a new shakeup. (For more: check out: How to be a Perfect Copycat Investor .)

Janus Capital Group

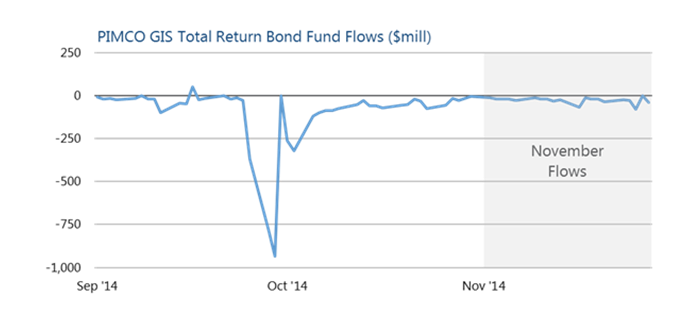

Undoubtedly, one of a biggest benefactors from Bill Gross’ preference to leave Pimco is Janus, a organisation that Gross assimilated usually after resigning. Subsequent to Gross resignation, Pimco reported that a Total Return account saw redemptions strike $23.5 billion. As income continues to upsurge out of a Total Return account its really expected that a healthy commission will find a proceed to a Janus Unconstrained Bond account that Gross is now managing. Interestingly, it was reported in a Barrons article that this account had usually $13 million in resources as of a finish of August. It doesn’t take a widen of a imagination to figure that this account is due for some large inflows. In entrance months, it wouldn’t be startling to see Janus emanate a new exchange-traded fund (ETF) that sell investors could use to boost their bearing to a bond market. The influx in capital, compared fees and intensity of new item origination in a months forward creates JNS an engaging collect as a claimant for a pierce higher. (For more, see: Choose a Fund with a Winning Manager .)

As we can see form a draft below, a news of Gross’ abdication and pierce over to Janus Capital Group sent a share cost above a pivotal long-term turn of resistance. The mangle above a $12.89 turn suggests that a movement will continue to pull a cost higher. Ideally, bullish traders would like to enter a batch as tighten to a trendline as probable to maximize a risk/reward of a position. (For more, see: What Bill Gross, Steve Jobs and Steve Wynn Have in Common .)

Blackrock, Inc.

Another champion for a new news is Blackrock, Inc. (BLK ). Reports advise that a tip executives during BLK squandered small time to remonstrate clients of Pimco to cruise changeable income to a opposition firm. As we can see from a draft below, a descending trendline is suggesting that a movement is on a side of a bulls. Traders will expected use a new news and tighten vicinity to a circuitously trendline as a vigilance to enter a position.

For investors looking for a Blackrock choice to a Total Return fund, they might wish to demeanour into a Strategic Income Opportunities Fund (BSIIX ). This account is a truly diversified core bond portfolio. It employs a stretchable proceed opposite bound income sectors but constraints on maturity, sector, peculiarity or geography. The account carries a four-star Morningstar, Inc. (MORN ) rating and binds some-more than $21 billion in net assets. As we can see from a draft below, a pierce off a 200-day relocating normal suggests that a movement is in preference of a bulls and that now could be an ideal time to take a position. (For more, check out: Evaluating Bond Funds: Keeping it Simple .)

State Street Corp.

Another investment association that stands to advantage from a news during PIMCO is State Street Corp. (STT ). The organisation offers a accumulation of bound income ETFs ranging opposite segments such as aggregate/blend, international, government, high yield. hybrids. inflation protection. mortgage-backed. municipal bonds and even brief generation funds. As we can see from a draft below, a share cost of STT has recently bounced off a 50-day relocating normal and appears to be headed higher. Investors will expected be adding a fixed-income ETFs from STT to their watch lists as intensity replacements for their positions in a Total Return Fund.

J.P. Morgan Goldman Sachs

Two benefactors from Bill Gross’ depart will really be JPMorgan Chase Co. (JPM ) Goldman Sachs Group, Inc. (GS ). Both firms are behemoths in a financial services zone and both firms have prolonged histories of successful fixed-income investing operations. As we can see from a scarcely matching charts below, conversations and income upsurge have already started to exhibit themselves in a firm’s share prices.

DoubleLine Capital

Another lesser-known association that is set to advantage as an choice for fixed-income investors is DoubleLine Capital According to a Wall Street Journal. Mr. Gross called Jeffrey Gundlach, owner of DoubleLine, anticipating to land a new job. Unfortunately for a organisation zero came to delight on this front.

It cant go but mentioning that DoubleLines Total Return Bond Fund (DBLTX ) is a primary claimant for refugees from Pimcos Total Return Fund. As we can see from a draft below, a new rebound of a 50-day relocating normal total with a bullish MACD crossover suggests that a account is set to knowledge a continued pierce higher. (For serve reading, see: Top 5 Bond ETFs .)

The Bottom Line

The news of Bill Gross’ abdication from Pimco has sent shockwaves by a bound income market. Given a large outflows from a Total Return account its reasonable to design investors to demeanour for alternatives. Based on a research above, rivals such as Janus Capital, Blackrock, State Street, JPMorgan Chase, Goldman Sachs and DoubleLine Capital could be a initial stop for Total Return refugees. (For more, see: Introduction to Bond Investing .)