Alternatives ETFs Can an ETF replicate a hedge fund

Post on: 20 Май, 2015 No Comment

Hedge funds and ETFs have little in common on their face. Hedge funds are typically accessed only by wealthy individuals or institutions, are illiquid in the short run and charge very high fees. In contrast, ETFs can be accessed by anyone, are highly liquid in the short run and charge low fees, typically.

So how can an ETF possibly look like a hedge fund?

The simplest approach would be for the ETF to simply hold hedge funds in its basket. But it can’t—hedge funds are subject to lock up periods while ETF assets need to be traded daily.

The Direct Approach

While ETFs can’t hold hedge funds, they can act like one. In short, ETFs can deliver many popular hedge fund strategies such as long short, market neutral, currency carry, merger arbitrage etc. Where the strategy permits, some funds opt for the direct approach, taking direct positions in the underlying securities needed to deliver the strategy as dictated by an index or by active management.

A currency carry ETF can take long and short positions in currency forward contracts, which are likely the exact tools a hedge fund might use. Similarly, a long-short equity ETF can offset its long exposure by directly shorting stocks, shorting an equity ETF, holding an inverse equity ETF or entering a swap agreement with a large bank. Again, these are tools that a hedge find might use too.

Hedge Fund Replication

Hedge funds lock up investor capital for a reason. Sometimes the investments they make require the capital to stay put to have any chance of success. For this reason and for others, the direct approach described above doesn’t work for all strategies.

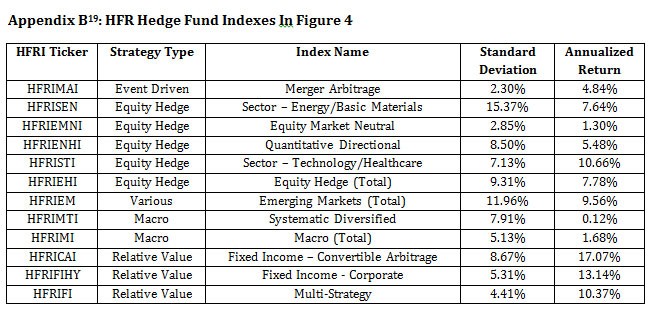

Instead, hedge fund replication ETFs rely on indexes to get the job done. It works like this: Hedge funds agree to report their returns to a hedge fund indexing firm. The hedge fund indexing firm than creates indexes to reflect hedge fund performance, either broadly or by a specific strategy. Hedge fund replication ETFs aim to match these hedge fund indexes as best they can using liquid assets. These liquid assets can be thought of as stocks and bonds but more typically are other ETFs with broad equity or bond exposure. In other words, hedge fund replication ETFs aim to map the returns of actual hedge funds onto liquid assets (which the ETF can actually hold) using regressions and other statistical processes. These ETFs might aim for broad multi-strategy hedge fund returns, or the returns of a specific strategy, like merger arbitrage. Naturally, the strategy they aim form informs the underlying assets they hold.

Copycat

There’s a third way to get at hedge fund returns in an ETF, namely by trying to mimic their actual holdings. Hedge funds have a reputation for secrecy, and certainly don’t publish their portfolios daily like many ETFs do. By law however, hedge funds publicly disclose their holdings on a quarterly, lagged basis. Copycat ETFs glean this public information, then apply screens (for sticky assets, manager record etc.) to come with a list of assets that they can hold directly. This process is confined to liquid underlying securities, typically stocks.

Do any of these approaches actually work? Yes and no. Some ETFs have proved able to deliver all-weather performance—low correlation to other asset classes and positive returns in down market cycles—at least in the short run. Still, the track record for most ETFs is quite short. Note too that hedge funds which aim for this kind of performance don’t deliver necessarily deliver it.

Find hedge fund ETFs in the ETF.com finder- Asset Class: Alternatives; Category: Absolute Returns.