Albert Edwards Turning More Bullish Investment Postcards from Cape Town

Post on: 14 Апрель, 2015 No Comment

One of the most popular reports ever published on my blog site was that of Albert Edwards and James Montier of Société Générale, entitled “ Market Fundamentals are Appalling (July 5, 2008). At the time they said: “The recession, which has barely begun, is more likely to be deep than shallow, market valuations are hideously expensive and the flation policymakers should be worried about starts with de-, not in-.”

Their distinctive bearish voices have been on the money. It was therefore with more than cursory interest that I read Edwards’ latest report (also with reference to Montier’s views), arguing that they were increasing their equity exposure significantly for both tactical and strategic reasons. However, longer term they are still expecting the S&P 500 Index to decline to 500 next year “as deep recession bites hard and the market is weighed down by a tsunami of analyst downgrades”.

The full report is republished in the paragraphs below.

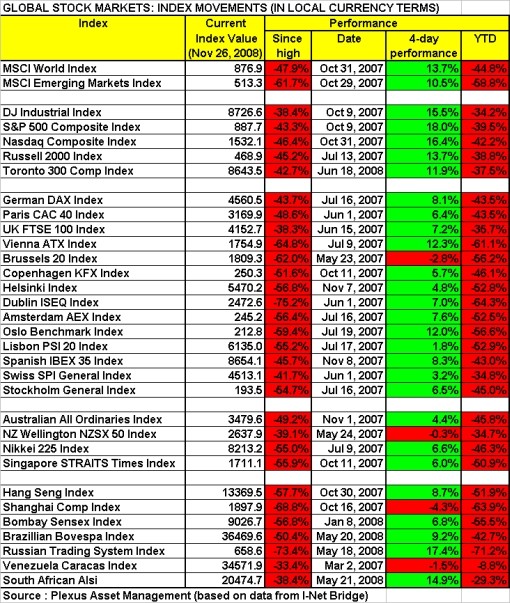

The recent plunge in equities has brought valuations to levels that even trenchant bears such as us might say that equities are cheap in Europe. But unfortunately they are still not in the US (see chart). Cheap valuations will indeed get much cheaper next year. But notwithstanding hedge fund liquidations, we now have the technical conditions for a decent bear market rally.

• So much has gone on in my few weeks away. The final bubbles of optimism and leverage are now bursting. While commentators focus on the spectacular bursting of the carry trade into emerging market equities, currencies and commodities, something else caught my eye. With Lucian Freud’s unfinished painting of Francis Bacon selling for £1.6m less than expected. the art bubble has finally burst! Things must be getting really bad.

• Strategists are bewildered. Weren’t equities supposed to be dirt cheap in the summer with a recession fully discounted? They just didn’t get it. This is a structural Ice Age derating that has, as we wrote on October 2, a long way to play out yet.

• When I have been asked by investors what would make me turn more bullish, invariably the answer would be a sharply lower equity market (as well as a cyclical recovery). We have the former now the S&P has plunged 30% since our September 4 meltdown ***Alert*** link. And at least we are now seeing Reuters reporting steep daily declines as the markets now fear a deep global recession. The market even seems to have got the message that emerging markets will suffer major growth disappointments.

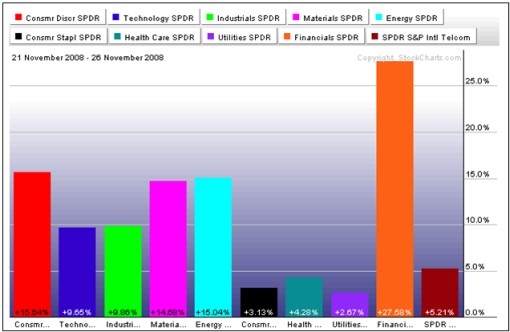

• But cheap(er) markets will not alone generate a rally. The technicals need to be aligned for that to happen. Notwithstanding the forced liquidations now taking place amidst the wreckage of catastrophic Q3 hedge fund performance link. we see the conditions as ripening for a decent bear market rally.

Both James Montier and I are agreed on one thing. In the short term, fundamentals often have very little bearing on market movements. Trending markets move in waves. In bear markets huge lurches down are often followed by significant rallies. After the recent market slump, currently investor sentiment is pretty washed out. Bears currently outnumber bulls by some 30%. The ratio has now hit support in a bear-market downtrend. An array of other technical indicators calls for a bear market bounce. At these times it often pays to be brave and disciplined even if one can’t see any catalyst for a bounce.

Yet one thing has definitely changed in the bulls favour while I have been away. There is much more acceptance of how bad things are getting in the global economy. I see talk of deep recession cropping up more regularly. Recent dreadful data such as the US consumption data can scarcely get much worse. The US Chicago National Activity Index has collapsed to -2.6 in September – a level consistent with GDP contracting some 3% yoy (see chart below).

In addition, I have seen increasing acceptance that emerging economies, and even China, could be headed into recession. And although this news has yet to be fully discounted by markets, at least the stench of the rotting global economic carcass now fills the nostrils of investors.

But it is in the area of valuation where the recent market slump allows us to be strategically somewhat less bearish (but let’s face it, we were maximum bearish!). With equities down some 30% since the start of September, valuation levels have radically changed. Forward PEs have slumped into single digits in recent weeks, and even our preferred measures of valuation using cyclically adjusted eps look a lot cheaper too (see front cover chart).

Value investors are finding a lot more stocks worth buying. James Montier published an update of his regular deep value screen on October 13 link. and found a far larger number of stocks now pass the test. James even confessed to incipient bullishness!

In addition, one of the most respected investors in the industry, Jeremy Grantham of GMO, has written recently that he can now find decent value opportunities and would become steady (not rapid) buyer at these levels. (I urge you to read his Q3 newsletter, link ).

We are increasing our equity exposure to 50% today above the 45% level we took it to in January when we similarly expected a bear market rally. We are more bullish now because of our reduced concern on the valuation situation compared to then. This should therefore be seen as a strategic as well as a tactical move.

Nevertheless we still remain underweight equities (50% versus 60% neutral) and expect to reduce our weighting once again from current levels. We still expect the S&P 500 to decline to 500 (what a coincidence) next year as deep recession bites hard and the market is weighed down by a tsunami of analyst downgrades in the non-financial stocks, where profits remain close to cyclical peaks (see chart below).

Despite being able to describe European equities as reasonably cheap now, a plunge in US cyclically adjusted valuations to revulsion levels of 8x from the current 13x will drive global equity prices substantially lower next year. The old quip comes to mind – what is the difference between a stock that has fallen 80% and one that has fallen 90%? The answer is 50%. Even with the S&P below 900, a move down to 500 will crush fund performance.

At a market level we continue to be reluctant to move overweight equities on valuation grounds alone. History suggests cheap equities can get a lot cheaper. Hence we remain strategically underweight equities. One key 1990s Ice Age lesson from Japan was that as equities de-rated, decoupling from bonds, the rules of the game changed and it did not pay to try and call a strategic rally too early. Huge rallies in the Nikkei occurred but they were wholly coincident with the economic cycle. We will be following the leading indicators for sight of any cyclical upturn. It will probably be awhile yet though.

A final word comes from David Fuller (Fullermoney ): Albert Edwards is forecasting 500 for the S&P 500 Index at some point next year. That is an extreme view, implying uncontrollable deleveraging and presumably massive bankruptcies. Consequently, I do not think it could be achieved without considerable policy errors. Fortunately, global monetary policy is now more conducive to a medium-term bottoming out and base building period for global stock markets. The biggest bull are usually too optimistic and the biggest bears are usually too pessimistic.

Source: Albert Edwards, Global Strategy Weekly, Société Générale. October 23, 2008.