After the Beta Trade in Emerging Markets

Post on: 16 Май, 2015 No Comment

Sammy Suzuki (pictured) and Morgan Harting

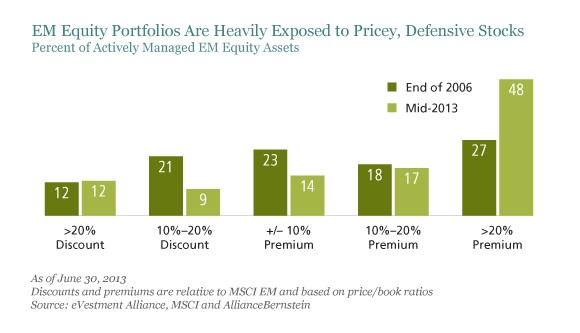

It’s getting harder to generate equity returns in emerging markets (EMs). Simply chasing the index—the so-called beta trade—won’t do the job anymore. But with a more discriminating, active approach, we believe investors can still capture opportunities in the next phase of the EM growth evolution.

Over the past decade, turbocharged EM economic growth has coincided with turbocharged investment returns (Display). For the 10 years ended December 31, 2013, EM equities and bonds delivered respective annualized gains of 11.2% and 11.8%, far outperforming developed-market (DM) equity returns of 7.0%.

New Challenges in Changing Environment

But the era of easy index-driven equity returns is probably over. Economic growth has slowed. The credit, commodity and investment cycles have peaked. Reform efforts in many EM countries have stagnated or regressed. China’s difficult economic transition and waning appetite for commodities is taking its toll. And the gradual normalization of ultra-accommodative US monetary policies—and its resulting influence on capital flows—further clouds the outlook.

EM equity valuations have fallen with the sell-off of the past couple of years, and are currently at some of the biggest discounts to their DM peers over the past decade. But, though EM companies are more profitable today, the disparity between EM and developed-world corporate profitability is far less pronounced than it was in 2003.

Finding Great Companies

Against this backdrop, EM returns are likely to be more muted than during the previous 10 years. So should investors steer clear? We don’t think so.

Great companies exist across the developing world, even in not-so-great economies. That’s the story for South African discount-apparel retailer Mr Price Group, which has posted earnings growth of 24% a year for the past decade, despite a sluggish domestic economy.

And emerging markets are no strangers to technological innovation. Such advances are producing new leaders across a variety of industries in Taiwan, including textiles, semiconductors and key industrial components (for tech giant Apple and carmaker Tesla Motors, for example). The rise of the EM middle class is creating new sources of demand for companies as diverse as Brazilian credit-card-processing company Cielo and Chinese appliance-maker Haier. And over the past two decades, we’ve seen the rise of world-class EM companies (think Tata Consultancy Services and Hyundai Motor), with good management, strong brands and differentiated technologies.

Still the Land of Alpha Opportunity

But is there fertile ground to generate alpha, or market-beating returns, in EMs? In fact, our research shows that these markets are still far more inefficient and far richer with alpha potential than their developed-world peers. Certain equity factors, such as valuation, price momentum and balance-sheet quality, have been far more reliable drivers of excess stock returns in EMs than in advanced markets (Display).

Other tools are less effective. For example, simply investing in companies with high sales growth hasn’t been a good investing strategy in most regions around the world, and EMs are no exception to this rule. Our research also shows that focusing on a country’s economic growth potential has had little or no predictive value in helping investors pick countries or stocks within developing markets. For example, Mexico has been one of the slowest-growing EM economies for more than two decades, yet it is also home to one of the best-performing equity markets over the same period.

Game Plan for EM Investing

Beyond the metrics, to succeed in EMs, investors will need to identify companies that can most deftly navigate the new environment. Finding tomorrow’s EM winners will take rigorous research, entailing local knowledge and global industry insights—and a discriminating eye.

How best to capture the potential in EM depends on individual return requirements and risk tolerance. But, as a guiding principle, we think that shifting away from the benchmark, while focusing on companies with strong capital management, high odds of positive earnings surprises and attractive valuations, should be a rewarding formula for investing in emerging markets—even after the beta trade.

This blog was originially published in Institutional Investor .

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.

Sammy Suzuki is Portfolio Manager for Emerging Markets Core Equities and the Director of Research for Emerging Markets Value Equities, and Morgan C. Harting is an Emerging Markets Portfolio Manager at AllianceBernstein ( NYSE:AB ).