Advantages of mutual funds in india

Post on: 21 Июль, 2015 No Comment

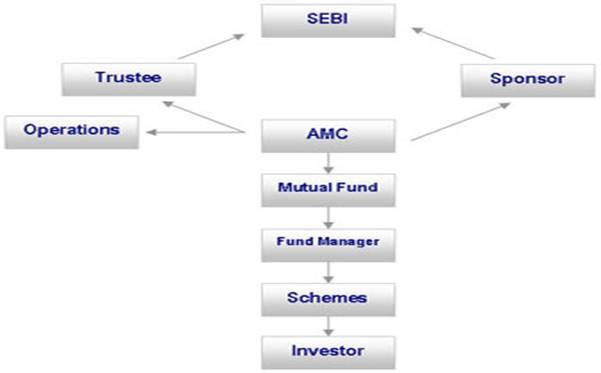

In an earlier article. we have seen what mutual funds are. Today, we see what the advantages of mutual funds in India are.

Mutual Funds offer a great deal of flexibility and ease to investors, both big and small.

Ranging from professional management to a plethora of diversification options, to ease of liquidity and low costs on the investors wallet, mutual funds offer perhaps the widest array of advantages which are readily not available with other investment products.

Lets have a look.

Diversification

Since mutual funds invest in different types of securities across different market capitalizations and sectors, they offer a great deal of diversification. They spread out your risk by owning, for eg, both shares and bonds.

They can buy into shares that are from different industries, eg oil and petroleum to banking and financials. They invest in a mix of small, large and mid caps. When your mutual fund has spread your money across such varied baskets, it has essentially spread your risk and so a huge loss in one security will not cause a major loss to the entire mutual fund and hence your investment.

If an investor would have to do this on his own, it would no doubt be a very tedious task.

Expertise Management

Mutual Funds are run by professional fund managers who know the business of money management and are skilled professionals. They manage investor’s money professionally as they have large tools at their disposal.

They are usually backed by an investment research team. The same cannot be achieved by an investor.

Easy to understand

Mutual Funds are simple to understand for an investor. Any product that is hard to comprehend should be avoided. In that sense, a mutual fund is very simple to follow.

Low costs

The transaction costs of a mutual fund are very small as compared to say the costs involved in direct trading on the stock market through your broker or when buying ULIPs.

They do not hurt the overall investments for the investor.

Flexible

Mutual Funds require very less amount of money for investment. You could start to invest with as little as Rs 500/-. In that sense, they can provide opportunities to even the smallest of the investors.

Liquidity

You could sell a mutual fund with great ease. They are highly liquid and one could convert his holdings into cash pretty quickly.