Advantages and Disadvantages of Municipal Bonds

Post on: 21 Июль, 2015 No Comment

Advantages and Disadvantages of Municipal Bonds

The greatest advantage of municipal bonds can be summed up in two words: tax free. The interest rates on municipal bonds may seem low compared to similar long-term securities like Treasury bills and CDs, but tax advantages may level the playing field. Let’s look at some examples.

If you’re in the 25 percent bracket for 2008 federal income taxes, you’d have to find a taxable security with an interest rate of 4 percent to equal the yield of a tax-free municipal bond with an interest rate of 3 percent [source: David Lerner ]. In other words, if you have $5,000 to invest in a bond. you’d earn the same with a 3-percent tax-free bond as a 4-percent taxable bond.

The difference between taxable and tax-free bonds becomes even more exaggerated as you climb to higher income tax brackets. If you find yourself in the 35 percent federal income tax bracket, you’d have to find a 4.62 percent taxable interest rate to yield the same amount as a humble 3 percent municipal bond [source: David Lerner ]. Some taxpayers also have to pay state and local income taxes, depending on where they reside. In this case, a triple tax-free municipal bond — exempt from federal, state and local taxes — is highly attractive.

The second major advantage of municipal bonds is that they’re incredibly safe. Between 1970 and 2000, the 10-year cumulative default rate for municipal bonds was 0.04 percent [source: Fahim ]. In other words, during those 30 years, less than half of one percent of municipal bonds failed to pay back the promised interest and principle. Compare that to corporate bonds — bonds issued by private companies and investment firms to finance business operations — which carried a default rate of 9.83 percent over that same period [source: Fahim ]. Insured municipal bonds are practically risk-free, since the insurance company will pay up even if the bond issuer defaults.

You can find a tax-free bond that fits your investment strategy. Put bonds allow you to cash in earlier than the maturity rate with no penalties. Floating-rate municipal bonds allow riskier investors to adjust for fluctuating markets, and zero coupon bonds are ideal for risk-free long-term investments.

Since municipal bonds pay interest twice a year, they can also supply a predictable, tax-free income stream for retirees. Even if you sell a municipal bond before its maturity date, you’ll receive the current market price of the bond — which may be more or less than the original price — without any additional penalties.

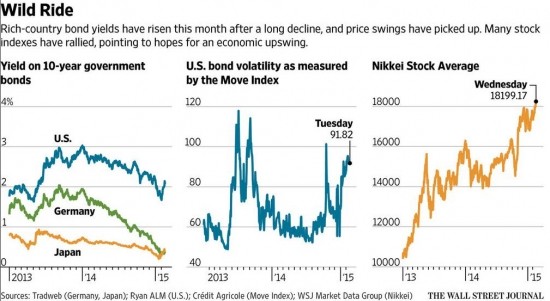

The only real disadvantage of municipal bonds is that they carry relatively low interest rates compared to other types of securities. This is particularly true when the economy is strong and interest rates for Treasury bills and CDs rise. Even after adjusting for taxes, it’s often hard for municipal bonds to keep up with the competition. But in economic downturns, all bond rates are low, so the tax-free status makes a bigger difference.

Another less common complaint about municipal bonds is that they can be difficult to cash in if the issuer is a smaller municipality like a rural county government.

Let’s learn how to buy municipal bonds and how much room they should take up in an investment portfolio.