Active Indexing Being PassiveAggressive With ETFs

Post on: 4 Август, 2015 No Comment

Summary

- The wide use of ETFs doesn’t necessarily mean a commitment to indexing.

- Some investors use ETFs to try to outperform the market.

- Vanguard shares the research and explains the risks.

By James J. Rowley Jr. CFA; Donald G. Bennyhoff, CFA; Samantha S. Choa

- Dramatic growth in recent years in the number of exchange-traded funds (ETFs) and their total assets may suggest that investors have become more committed to indexing. Its important to recognize, however, that not all index-oriented investments, such as most ETFs, are used simply to capture the returns of the broad market. Although many index strategies are market-capitalization-weighted, in that the index components are represented according to their assets in the market, other index-based strategies are non-market-cap-weighted, including those that try to outperform the market on the basis of systematic exposures. Investors who use such strategies face uncertainty relative to the broad market as well as to their targeted exposures.

- For investors who have consciously decided to implement such a non-market-cap-weighted strategy, we suggest that a combination of market-cap-weighted index ETFs (hereafter, MC ETFs) may be preferable to alternatively weighted index ETFs (hereafter, Alt ETFs), because they may allow investors to more consistently capture their targeted exposures and may do so with lower implementation costs.

- Although ETFs generally represent rules-based products, we believe the portfolio construction methods of these tilt strategies 1 inherently choose not to be market-cap-weighted, and thus reflect active management.

- As a result of this active choice, the source of active management is transferred to the investor.

The widespread availability of ETFs has contributed to the simultaneous rise in the popularity of index-oriented, or passive, portfolio construction. However, this does not necessarily suggest that all investors are content to participate in the returns of the index averagessuch as those of the Standard & Poors 500 or Barclays U.S. Float Adjusted Aggregate Bond indexes. Investors may intentionally construct portfolios that attempt to outperform these readily available market-cap weighted indexes.

To perform differently from these asset-class proxies, the portfolios must be structured differently. Rather than basing their portfolios on individual security selection, many of these investors have decided to deviate on the basis of systematic market exposures (e.g. smaller-cap or value segments).

Although investors can fulfill their desired portfolio structures with market-cap-weighted ETFs, a growing number of ETF choices have been designed to cater to investors favoring non-market-cap weightedor alternatively weightedportfolios. Ultimately, the efficacy of such a strategy depends heavily upon how consistently and cost-effectively the systematic exposures are captured. As a result, investors seeking to harness these exposures might be best served using combinations of market-cap-weighted index ETFs, rather than alternatively weighted index ETFs. This paper discusses a number of new investment considerations related to tilt strategies. One of these considerations is often overlooked, since index-oriented or passive products are typically used: By creating portfolios whose characteristics differ from those of the broad market, we believe investors have implemented an active strategy and have effectively transferred the source of active management to themselves.

Evolution of active choice with ETFs

Since 2000, the rise in the availability and popularity of ETFs has been a global phenomenon (see Figure 1). For investors interested in indexed, low-cost investment opportunities, ETFs are now readily accessible to anyone with a brokerage account. ETFs also now cover a full range of asset and sub-asset classes, permitting investorswhether individuals or institutions, strategic asset allocators or tactical investors 2 to gain exposure to multiple areas of the market.

Notes on risk: Investments are subject to market risk, including the possible loss of the money you invest. Past performance is no guarantee of future returns. Funds that concentrate on a relatively narrow market sector face the risk of higher share-price volatility. Prices of mid- and small-cap stocks often fluctuate more than those of large-company stocks. Diversification does not ensure a profit or protect against a loss.

In fact, Cerulli (2014) found that although 52% of financial advisors often use ETFs as a cost-efficient core holding, 36% often use them to implement a thematic investment approach (for instance, investing in infrastructure), and 32% often use them for sector-specific exposures. Given the plethora of index ETFs, this papers analysis may be especially helpful for investors who (1) view systematic exposures to subsets of an asset class rather than security selectionas the source of potential outperformance, (2) have decided upon a predetermined allocation to such exposures, and (3) intend to maintain the exposures in a strategic, long-term manner, rather than in a tactical, short-term manner. 3

In lieu of using combinations of MC ETFs, investors may still consider implementing strategies with Alt ETFs in an attempt to outperform. Considering that such ETFs have been marketed as index strategies that outperform, it may seem obvious that they would provide the best of both worlds. However, Chow et al. (2011) and Philips et al. (2011) have shown that once exposures to size and style are taken into account, the alpha exhibited by many alternatively weighted index strategies is statistically indistinguishable from zero. In other words, any outperformance can be explained by systematic exposures, which todays MC ETFs can provide. The questions are: Which ETFs to invest in and why?

Figure 2 lists three different implementation tactics for ETF investing, with sample family indexes for each tactic. The first comparison in the figure looks at the alternatively weighted FTSE RAFI 1000 Index (FTSE and Research Affiliates) versus the broad-market Russell 3000 Index and combinations of Russell indexes. Although the FTSE RAFI is not part of the Russell family of indexes, inclusion of Russell here as a well-known index provider allows for analysis across multiple index providers. The second comparison places the alternatively weighted Standard & Poors 500 Equal Weight Index alongside the broad market S&P 1500 Index and combinations of S&P indexes. The third comparison features the Dow Jones U.S. Select Dividend Index relative to the broad Dow Jones U.S. Total Stock Market Index and combinations of Dow Jones U.S. Total Stock Market indexes. There are other alternatively weighted and market-cap-weighted strategy combinations, but we believe that these three comparisons fairly illustrate the concept. We believe the conclusions would hold if any of these three alternatively weighted indexes were analyzed across any of the broad market representations.

Construction methodologies for well-known broad index families are generally objective, rules-based, and transparent. 4 Differences remain at the margins, however, with respect to index-provider cutoffs for market size (large-, mid-, and small-cap) and the providers specific definitions for style (growth and value). None of this suggests that any specific index providers size cutoffs or style definitions are best; investors must determine for themselves which providers definitions align best with their own investment philosophy.

Market-cap index combinations tend to exhibit consistency

For investors who want to implement a tilt strategy, consistency would seem to be of paramount concern. After all, the whole point of deviating from a market-cap index is to wrest control of exposure weights that are traditionally determined by market participants in aggregate. As stated previously, to perform differently from a broad-market index, the portfolio needs to be constructed differently. Reweighting the systematic risk exposures is one means to accomplish this goal. Market-cap-weighted indexes (and their subcomponent indexes) are developed in a top-down manner, meaning they are constructed by grouping securities based upon shared systematic exposures such as market capitalization or style. The exposure is thus an input to the construction process. Alternatively, weighted indexes, on the other hand, tend to be built from a bottom-up (or company specific) perspective, and the fact that their constituent securities are non-market-cap weighted introduces an aspect of active management. For instance, fundamental indexes such as the FTSE RAFI start the process with security selection based on metrics such as sales, revenue, and dividends (see Arnott, Hsu, and Moore, 2005). Equal-weighted strategies, such as the S&P Equal Weight Index, start with a predetermined weighting scheme. And the selection process for the Dow Jones U.S. Select Dividend Index begins by focusing on the dividend-paying characteristics of stocks. In each of these cases, the systematic exposure is the by-product, because while the exposure exists, the amount of the exposure is inconsistent. It is much easier for investors to identify the intended exposure in advance with MC ETFs. 5 Figure 3ac uses returns-based style analysis to illustrate the greater consistency with which market-cap-weighted index combinations attain targeted degrees of size and/or style exposures relative to an alternatively weighted index. 6 This can be seen in two ways. First, with respect to any one market-cap-weighted combination, the data pointsalso known as style windowsappear very clustered, lying right on top of each other.

Second, the market-cap-weighted combinations appear to be evenly spaced from each other. In contrast, although the alternatively weighted index contributes to a general value bias, 7 the style windows exhibit significant drift, meaning they move around the style box with each different time period, rather than locating themselves around the same spot. This offers evidence of a less consistent adherence to specific size and style exposure.

Investors who seek outperformance on the basis of systematic exposures may find the more consistent capture of such exposures exhibited by these MC ETFs to be appealing. At the same time, investors who hope to use these Alt ETFs as a potential source of outperformance should understand their less specific exposure to value stocks and their greater variation (drift) of exposure to large-cap and mid-cap stocks over time. Such tendencies are likely similar to those exhibited by a traditional, large-to-mid-cap value active manager.

Market-cap ETFs can provide a cost advantage

The analysis so far has considered MC ETF combinations and Alt ETFs purely from an investment strategy perspective, but when implementing the strategies, investors will incur costs. Previous Vanguard research has highlighted how costs increase the hurdle to outperformance for individual funds (e.g. Philips et al. 2014; Wallick et al. 2011); considering costs in an MC ETF combination versus an Alt ETF framework is just as important. Portfolio-tilting strategies attempt to capture as much of a systematic exposure as possible, but higher costs directly erode the amount captured. On average, we have found that MC ETF combinations have lower costs than do Alt ETFs.

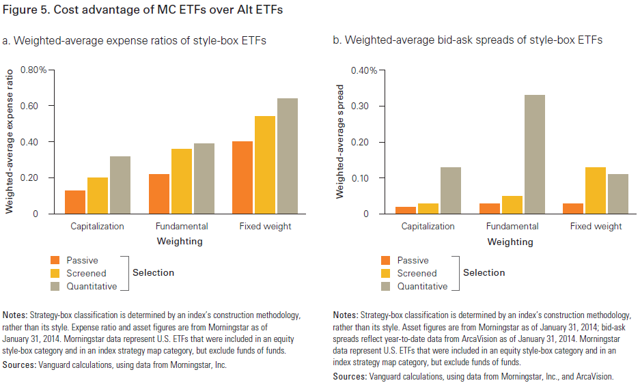

Exchange-traded fund investors face bid-ask spreads in addition to expense ratios, so each of these costs needs to be accounted for when constructing portfolios. 8 Using the Morningstar index strategy map, which places index funds into one of nine categories according to their security-selection process and their security-weighting methodology, Figure 5ab summarizes the cost advantage of MC ETFs over Alt ETFs with respect to both expense ratio and spreads, respectively. 9 ETFs that would be used for style-box-based MC ETF combinations are captured by the capitalization-weighting and passive-selection bar. Alt ETFs are located in the fundamental and fixed-weight weighting columns across any of the three security selection methodology rows. There is a general relationship in the graphs that costs increase as the categories move away from market-cap-weighted and passive.

In this framework, MC ETF combinations generally represent the most cost-effective manner to implement tilts as part of an overall portfolio strategy. As discussed in the previous section, when viewed in conjunction with issues of style drift and consistency, Alt ETFs could be considered a lower-cost alternative to a traditional actively managed fund.

Challenges of active management

Investors who implement tilt strategies with MC ETFs effectively in-source amounts of active management. The choice to tilt a portfolio away from the market-cap weighted index represents one layer of active risk. The choice to implement the tilt with sources of traditional active management (security selection, market timing, or actively managed funds) would be a second layer. However, by using MC ETFs to implement the tilt, investors eliminate that second layer.

The choice to construct a tilt strategy using MC ETFs still brings with it the consequence of potential underperformance versus a broad-market index. Although the small-cap and value exposures have been sources of outperformance over the very long term (see Fama and French, 1992; 1993), they have also been sources of cyclical underperformance. Figure 6 illustrates the cyclicality of relative performance for various combinations of the Russell 3000 Index and Russell 2000 Value Index. Not surprisingly, the magnitude of the peak-to-troughs is a function of how much a combination moves away from the broad market (as represented by the Russell 3000 Index) and toward the intended tilt exposure (the Russell 2000 Value Index). 10 In other words, the red line, representing a combination with 100% allocated to the Russell 2000 Value Index, has more extreme highs and lows than those of the dark-blue line, representing a combination with 20% allocated to the Russell 2000 Value. To mitigate the one layer of active risk and the magnitude of any cyclical underperformance, investors could consider relatively smaller allocations to the tilt exposure.

Another aspect of these challenges is that, in practice, it may be difficult to implement these strategies, for two main reasons. First, portfolio construction developed in theory does not always have an investable equivalent, because of issues such as taxes and frictional costs. Second, for large-scale portfolios, capacity constraints could come into play.

Conclusion

The growth of the ETF marketplace has made it possible for investors to access numerous types of index-based investment exposures. For investors who seek to outperform a broad-market asset class or index on the basis of a predetermined allocation to systematic risk exposures, MC ETFs now allow them to implement their tilt strategies.

Our consistency and cost analyses show that the use of MC ETF combinations would seem to be preferable to Alt ETFs when implementing a tilt strategy that seeks to rigorously capitalize on these theoretical, systematic risk exposures. In fact, it would appear that consistency would be a key concern to these investors, as the reason for deviating from market-cap indexes is to gain specific control of exposure weights that were determined by market participants in aggregate. However, to perform differently from a broad-market index, a portfolio needs to be constructed differently, and reweighting systematic risk exposures is one means to accomplish this goal. As this analysis has emphasized, these deviations involve active choices that, in actuality, transfer the source of active management to investors themselves.

1 This analysis is predicated on a portfolio-tilting strategy in which investors begin with a broad-market index ETF and add an overweighting with a specific size and/or style of index ETF. It does not attempt to replicate the exposures provided by an alternatively weighted index ETF. For an analysis of alternatively weighted equity indexing, see Philips et al. (2011).

2 Strategic allocations represent long-term portfolio allocations, and tactical allocations reflect short-term deviations in an attempt to add value to a portfolio.

3 See footnote 1, for an explanation of a portfolio-tilting strategy.

4 See Philips and Kinniry (2012), for a discussion of index-construction methodologies.

5 Standard & Poors (2013: 1) reached a similar conclusion, noting: In terms of risk factor exposure, a complex and dynamic combination of size and style risk factors has contributed to return differences. It may be difficult to replicate the equal weight index return outcomes through a simplistic combination of style and sector indices.

www.styleadvisor.com/resources/concepts/style_analysis.html (Zephyr Associates, 2011), for a basic discussion of style analysis.

7 The value bias is noted by Kaplan (2008) and Perold (2007). Although this is one of the reasons we use combinations of value and smaller-cap indexes to illustrate the consistency benefit of MC ETFs, the consistency benefit was also evident with combinations of growth and smaller-cap indexes.

8 Trading commissions may also exist, but since these are dependent on an investors brokerage platform, we focus here on expense ratios and bid-ask spreads because these costs are incurred regardless of trading venue.

9 The methodology behind the Morningstar index strategy map is based on work by Ferri (2009).

10 This relationship held true with respect to all the exposure tilts across each index provider in this analysis.

References

Arnott, Robert D. Jason Hsu, and Philip Moore, 2005. Fundamental Indexation. Financial Analysts Journal 61(2): 8399.

Cerulli Edge, 2014. U.S. Monthly Product Trends Edition. January; available at https://external.cerulli.com/file.sv?F0003AF.

Chow, Tzee-man, Jason Hsu, Vitali Kalesnik, and Bryce Little, 2011. A Survey of Alternative Equity Index Strategies. Financial Analysts Journal 67 (5, Sept./Oct.): 3757.

Fama, Eugene F. and Kenneth R. French, 1992. The Cross-Section of Expected Stock Returns. Journal of Finance 47(2): 42765.

Fama, Eugene F. and Kenneth R. French, 1993. Common Risk Factors in the Returns on Stocks and Bonds. Journal of Financial Economics 33(1): 356.

Ferri, Richard A. 2009. The ETF Book: All You Need to Know About Exchange-Traded Funds. Hoboken, N.J. John Wiley & Sons.

Kaplan, Paul D. 2008. Why Fundamental Indexation MightOr Might NotWork. Financial Analysts Journal 64(1): 3239.

Perold, Andr F. 2007. Fundamentally Flawed Indexing. Financial Analysts Journal 63(6): 3137.

Philips, Christopher B. Francis M. Kinniry Jr. David J. Walker, and Charles J. Thomas, 2011. A Review of Alternative Approaches to Equity Indexing. Valley Forge, Pa. The Vanguard Group.

Philips, Christopher B. and Francis M. Kinniry Jr. 2012. Determining the Appropriate Benchmark: A Review of Major Market Indexes. Valley Forge, Pa. The Vanguard Group.

Philips, Christopher B. Francis M. Kinniry Jr. Todd Schlanger, and Joshua M. Hirt, 2012. The Case for Index-Fund Investing. Valley Forge, Pa. The Vanguard Group.

us.spindices.com/documents/research/equal-weight-index-10-years.pdf.

www.styleadvisor.com/resources/concepts/style_analysis.html.

Wallick, Daniel W. Neeraj Bhatia, Andrew S. Clarke, and Raphael A. Stern, 2011. Shopping for Alpha: You Get What You Dont Pay For. Valley Forge, Pa. The Vanguard Group.