Active ETF Market Share Update & Weekly Market Review

Post on: 6 Апрель, 2015 No Comment

of AdvisorShares

AdvisorShares Active ETF Market Share Update Week Ending 9/13/13

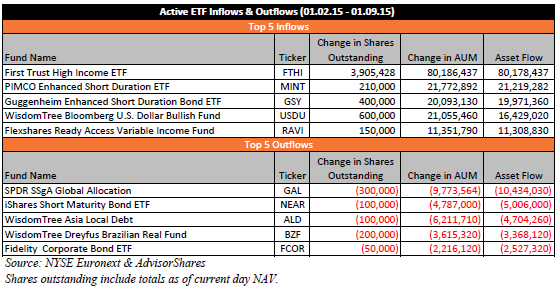

Last week, total AUM in all active ETFs increased by over $68.76 million. Assets in Short Term Bond active ETFs increased by nearly $140 million. The second largest increase in AUM came in the High Yield ETF category, which rose by about $20.366 million, largely due to creation units. US Equity active ETFs also saw a significant increase in AUM of over $8.68 million. The biggest decreases in AUM came in the Global Bond and Foreign Bond categories, which fell by $58.85 million and $44.3 million respectively. Assets in the Alternative Income category increased again but by less than in previous weeks; AUM increased by nearly $1.286 million. AUM for the Alternative active ETF category fell by almost $6.35 million. The Currency active ETF category saw an increase in value of about $2.56 million for the week, nearly as much as it added the week before. The smallest active ETF category, Sustainable ETFs, saw an AUM increase of nearly $1.185 million bringing the total AUM in that category to around $20.6 million.

Highlights of the Prior week

For the week of September 9 September 13

Stock Markets

The major stock market indexes rose for the second week in a row. The Dow Jones Industrial Average was the best performing index last week (up 3.09%), while the Nasdaq was the worst performer (up only 1.72%). The largest component of the Nasdaq, Apple, fell significantly after releasing two new versions of the iPhone 5, which failed to impress investors. Most of the gains came early in the week, after the Obama administration seemed to have found a diplomatic solution to the chemical weapons problem in Syria. Oil prices fell after reaching a two-year high, as the US appears to have avoided another military confrontation in the Middle East. US wholesale prices rose by a greater than expected 0.3% in August. The price increases seem to be mostly due to rising food and fuel costs, not wage pressures. However, retail sales for August increased by less than expected (0.2%) and the preliminary estimate for consumer sentiment dropped to 76.8.

Yields for US Treasuries fell a little bit after reaching two-year highs the previous week. While there wasnt much change in prices for US investment-grade corporate debt, there was a lot activity in the space last week. Verizon Communication issued $49 billion in debt to pay Vodafone for its stake in Verizon Wireless. This was by far the largest corporate bond offering in history, with the previous record of $17 billion set by Apple not too long ago. High yield bonds generally rose in price and many new issues of high yield debt were oversubscribed. While municipal bonds funds and still seeing outflows, the market seems to be stabilizing as many investors are now finding the higher yields attractive. Puerto Rico is the biggest cause for concern among municipal investors and some of its bonds yields have climbed above 8%. Hope for a peaceful solution to the Syrian crisis caused emerging market debt to trade up for the week. However, as emerging market currencies weaken versus a stronger dollar, returns for US investors have been unimpressive. Turkeys debt got a big boost after second quarter GDP growth numbers came in at 4.4%. Not only was this higher than expected, it was the highest growth rate since 2011 for an economy many thought was headed for troubles. Argentina also made the news, but in a negative sense, as S&P downgraded its debt from B- to CCC+.