Ackman Icahn Defend Activism as Munger Sees Harm to Business

Post on: 21 Апрель, 2015 No Comment

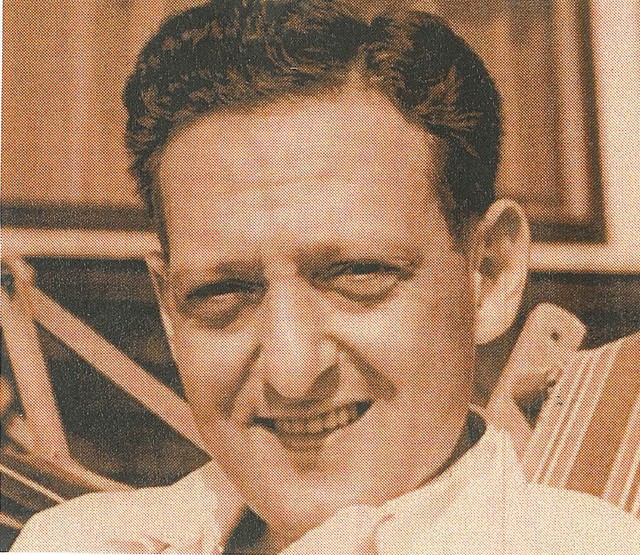

Charles Munger, vice chairman of Berkshire Hathaway Inc. Photographer: Jonathan Alcorn/Bloomberg

May 5 (Bloomberg) — Warren Buffett’s longtime business partner Charles Munger said activist investing is bad for the U.S. Two of the biggest practitioners, Bill Ackman and Carl Icahn, said not when they’re doing it.

Buffett and Munger, renowned for their success with long-term value investing at Berkshire Hathaway Inc. both predicted at the firm’s annual meeting that activist funds will draw more money. Munger questioned whether the strategy actually improves targeted companies.

The tactic is causing a bigger stir “than anything has in years,” Munger said. “I don’t think it’s good for America.”

Ackman and Icahn said in phone interviews after the May 3 meeting that they don’t want their practices lumped in with the type Buffett and Munger discussed. Ackman, who attended the event, and Icahn are among money managers who take stakes and then push corporate leaders for changes that reward shareholders.

“I 100 percent agree with them,” said Ackman, 47, who runs hedge fund Pershing Square Capital Management LP, of Buffett and Munger. Seeking short-term gains without creating better businesses is “bad for markets, and it’s bad for shareholders.”

Pershing Square typically holds stakes “four, five, six years or more,” Ackman said. He pointed to investments in Canadian Pacific Railway Ltd. and General Growth Properties Inc. as examples where value rose for shareholders. Almost every company he bought into had a higher market value after he exited, he said.

‘Short-Term Pop’

“I understand and somewhat agree with their criticisms that some activists are going for a short-term pop,” Icahn, 78 and chairman of Icahn Enterprises LP, said of Buffett and Munger’s remarks. “That doesn’t mean you throw the baby out with the bath water. One of the most important things we need in this country is to keep companies accountable.”

Buffett and Munger aired their thoughts in a back-and-forth that is typical of the meeting near Berkshire’s headquarters in Omaha, Nebraska, where the pair take questions for five hours. Buffett, the 83-year-old chairman and chief executive officer, asked Munger, the 90-year-old vice chairman, what he thought activist investing would be like in three years.

“Big,” Munger said. “What’s stopping it?”

“They are certainly attracting more and more money,” Buffett said. Wall Street sees activism as a form of success and is plowing funds into it, he said. “I don’t think it will go away, and I think it scares the hell out of a lot of managers.”

Conflating Strategies

Investors put about $30 billion into event-driven funds, the category of hedge funds that includes activists, last year, according to Hedge Fund Research Inc. That was almost half of the $63.7 billion in total inflows into hedge funds in 2013.

Ackman said people are conflating activism with investing for short periods. “Short-termism is a bad trend for American companies,” he said.

Ackman helped Chicago-based General Growth avoid collapse by pushing the shopping-mall owner to file for bankruptcy in 2009. The effort “turned $60 million into $1.6 billion,” he told Bloomberg News in 2011, and contributed to his flagship fund’s net return of 29 percent in 2010.

Some more recent bets at Pershing Square have fared worse. In August, he sold out of a holding in J.C. Penney Co. for $504 million, about half of what he paid for it, after more than two years of efforts to revamp the Plano, Texas-based retailer. The stake wasn’t a short-term move, it just didn’t work, Ackman said.

“Not every shareholder activist strategy is going to be successful,” he said.

Icahn’s Investments

Icahn, who ranks 31st on the Bloomberg Billionaires list, has pressed for changes at online marketplace EBay Inc. this year, calling for a spinoff of its PayPal payments unit and for adding board members. Last month he backed off, and San Jose, California-based EBay agreed to add an independent director. The shares slipped 5.2 percent this year through last week.

Icahn also pushed for changes at Apple Inc. including through posts on Twitter Inc.’s messaging service. He has called on the technology company to return more of its cash to shareholders in payouts. Cupertino, California-based Apple said April 23 it will increase its share repurchase authorization by $30 billion and boost its dividend. The stock jumped 8.2 percent the next day, the most since April 2012.

“We own a lot of stocks long-term,” Icahn said. “I haven’t sold a share of Apple.”

Corporate View

Icahn and Ackman have sparred publicly over their bets on Herbalife Ltd. Icahn is the nutritional supplement company’s biggest shareholder while Ackman has bet against the stock.

Berkshire’s strategy has been to buy companies ranging from See’s Candies to the Burlington Northern Santa Fe railroad, keep their management and hold them forever. Buffett and Munger also have invested in stocks and control the largest stakes in companies including Wells Fargo & Co. and American Express Co.

“As iconoclastic and unusual as Berkshire Hathaway is, it represents big, corporate America” on this issue of activism, said Lawrence Cunningham, a professor at George Washington University. Munger perceives activist investing as making corporations more like commodities than complex, social institutions that over time can contribute value, said Cunningham, who is also author of the forthcoming book “Berkshire Beyond Buffett.”

Pushing Buffett

Icahn, who didn’t attend the Berkshire meeting, published an article that day in Barron’s in which he called on Buffett to take a more of an activist role as an investor in situations like a dispute over Coca-Cola Co.’s pay package.

Icahn wrote that if Buffett, a billionaire who drew thousands of people to Omaha to hear his thoughts on investing and the economy, doesn’t speak out for changes who will?

“Activism is extremely important for the future of our country because some of these companies are run badly,” Icahn said. “Some of these boards are a travesty.”

Berkshire is the largest shareholder in Atlanta-based Coca-Cola. Buffett abstained from voting against the soda maker’s pay proposal at Coca-Cola’s shareholder meeting on April 23, then criticized the plan after it passed. He said at the May 3 meeting that he discussed the issue privately with CEO Muhtar Kent, which was better than a public rebuke.

Buffett, speaking of activism, said at Berkshire’s meeting that “there are certain cases where corporate managers should be changed.”

‘Quick Fix’

Activist funds are drawing money as investors diversify from bonds, where returns can be eroded by rising interest rates, and from stocks, which have already climbed sharply, said Brad Alford, head of Alpha Capital Management LLC in Atlanta. Investors should be aware that the tactic is risky because it can be a lone person making one big call, said Alford, whose firm runs two mutual funds that invest in hedge-fund strategies.

“Certainly there are some boards that need to get their butts kicked, but they don’t necessarily need someone coming in who doesn’t know their business,” Alford said. “A lot of these activists have only ever worked on Wall Street. It’s a quick fix. It’s not the way Buffett and Munger invest.”

To contact the reporters on this story: Margaret Collins in New York at mcollins45@bloomberg.net ; Noah Buhayar in New York at nbuhayar@bloomberg.net

To contact the editors responsible for this story: Dan Kraut at dkraut2@bloomberg.net ; Christian Baumgaertel at cbaumgaertel@bloomberg.net David Scheer