Accessing alternative mutual funds

Post on: 29 Март, 2015 No Comment

Accessing alternative mutual funds

The Week-end News: Featuring talking points on the most recent financial news – November 28, 2014

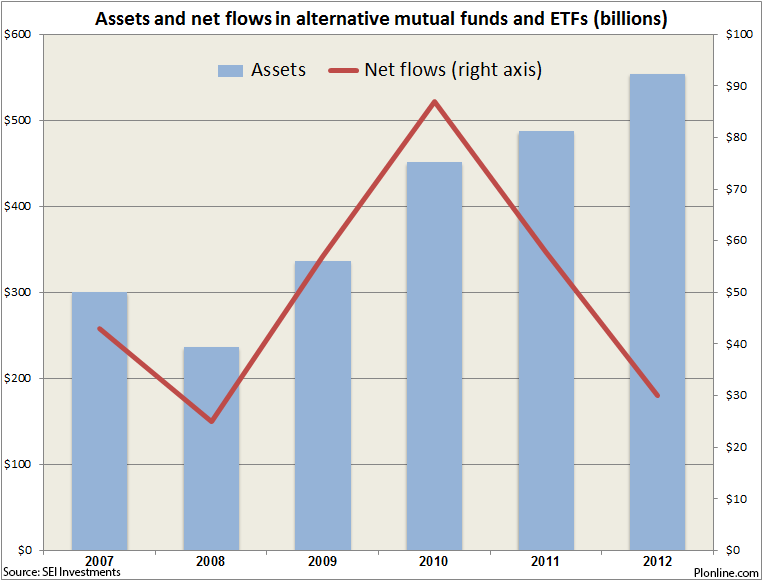

In the 10 years ended 2013, the Yale Endowment Fund outperformed U.S. stocks by nearly 3 percentage points and U.S. bonds by more than 6, as shown in the bar chart on the left. How did they do it? The pie chart on the right shows that half of the Yale fund is invested in alternatives. Alternative investments encompass a broad spectrum of non-traditional investments (including managed futures, master limited partnerships, and real estate investment trusts) that seek to provide risk and return sources that differ from stocks and bonds. Previously, alternative investments were accessible only to institutional (pension funds or university endowments) and ultra-high-net-worth investors. Today, many of these non-traditional investments can be accessed in a liquid, transparent, and cost-effective way through liquid alternative (“liquid alts”) mutual funds. The main benefits of liquid alts funds: they can be used to diversify holdings, dampen downside risk, and boost overall performance. The old standard of traditional stock and bond allocation models may not be the most robust strategy to succeed in today’s financial markets. Adding an appropriate exposure to alternative investments – the final building block of portfolio construction – can help investors achieve their objectives more effectively.

Oil at a 4.5 year low

It was a short week on Wall Street with U.S. stock and bond markets closed Thursday for Thanksgiving and open for a half-session on Friday. The S&P 500 and Dow still reached fresh all-time closing highs as investors gobbled up stocks. Oil prices continued to tumble, hitting a new four-and-a-half-year low after OPEC ministers agreed to keep production levels unchanged, despite a steep slide in prices due to weaker demand and oversupply. Gasoline prices also hit their lowest levels at the pump in 4 years, which some figure gives consumers more money to spend this holiday season. As measured by gross domestic product (GDP), the U.S. economy appears to be strong, contrary to what many think. Uncle Sam reported that GDP grew by a better-than-expected 3.9% during the summer months, thanks to more consumer and business spending. For the first time in more than a decade, Barbie toys are not the first choice for little girls this Christmas. Instead, toys featuring Elsa from Disney’s Frozen top this year’s list.

Cyber Monday sales

Sources: Labor Department, CNBC, Reuters, Barron’s, Automotive News, Wall Street Journal, Bloomberg, National Retail Federation, Bureau of Economic Analysis.

Mercer Global Advisors Inc. is registered with the Securities and Exchange Commission and delivers all investment-related services. Mercer Advisors Inc. is the parent company of Mercer Global Advisors Inc. and is not involved with investment services. ©2014 Mercer Advisors Inc. All rights reserved.