A Strong Dollar A Strong Economy (Cause and Effect )

Post on: 16 Март, 2015 No Comment

Rich men smoke big cigars; so, Im going to buy myself a big cigar and be rich

Back in the olden days when I studied international economics, the exchange rate was determined by supply and demand in foreign exchange markets. The supply of dollars derived from our demand for foreign goods and services. The demand for dollars derived from foreign demand for U.S. goods and services. If the supply of dollars in the foreign exchange market rose relative to the demand for dollars, the dollar depreciated to restore equilibrium. If the demand for dollars in the foreign exchange market rose relative to the supply, the dollar appreciated to restore equilibrium.

Note that its the supply and demand for dollars in the foreign exchange market that determine the dollar exchange rate, not the amount of dollars supplied in the domestic economy. There may be some correlation between the two, but the relationship is not direct. Contemporary commentary generally misses that point and go directly to the creation of money by the Fed to a decline in the exchange rate for the dollar. The value of the dollar in terms of goods and services may be related to but is not the same as the value of the dollar in terms of foreign currencies.

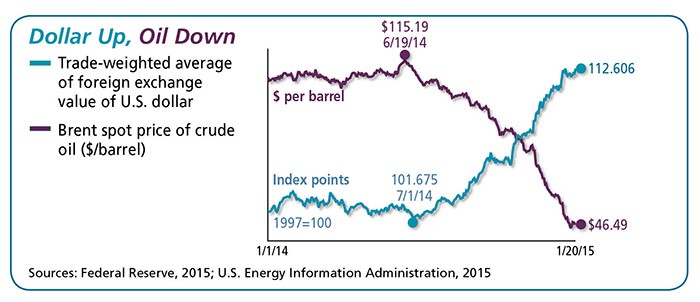

Back to international economics in the olden days: If the U.S. begins to grow faster than our trading partners, our demand for imported goods and services would rise relative to the foreign demand for our exports, and the dollar would weaken to restore balance in trade. If our growth lagged behind that of our trading partners, our import demand would decline relative to foreign demand for our exports, and the dollar would strengthen to restore balance in trade. In other words, other things equal, a stronger economy led to a weaker dollar and a weaker economy led to a stronger dollar. Today, we hear that a strong economy leads to a strong dollar, but the mechanism through which that happens is not spelled out.

Other things equal, if foreign demand for our goods and services increases, causing the foreign currency demand for dollars to increase, appreciation of the dollar would coincide with a stronger domestic economy. The dollar appreciation doesnt cause the economy to strengthen; instead, both result from a common cause the increased foreign demand. To repeat: If foreign demand for U.S. exports increases, the resulting improvement in our trade balance will strengthen the domestic economy.

If foreign demand for our exports declines, so would the foreign demand for dollars in the foreign exchange market, and, other things equal, the dollar would depreciate as the economy weakens due to its declining trade balance. Thus, if the impetus is from foreign demand, the dollar and the economy strengthen or weaken together, both reacting to the same external change.

Contemporary arguments that a stronger dollar would lead to a stronger economy is true only if the dollar strength results from greater external demand. Yet, foreign demand, or, indeed, foreign trade is rarely mentioned. Instead, it is assumed that dollar strength would result from having the dollar talked up or supported by the Secretary of the Treasury, the Chairman of the Federal Reserve Board or the President. I call that strength through levitation, which, were levitation possible, would have the opposite of the desired effect. The levitated dollar would weaken our exports, increase our imports, and reduce GDP growth.

Contemporary discussions of the dollar on financial TV include few references to trade. More emphasis is placed on monetary policy either too-low interest rates or too much monetary expansion. Leaving the interest-rate discussion for later, I will just point out again that there is no direct link between money creation by the Fed and the price of the dollar in foreign exchange markets. Not all newly created money finds its way to foreign exchange markets where exchange rates are determined. While there may be a loose correlation between too much money creation in general and too many dollars trying to buy foreign currencies, that second step is necessary but is never mentioned. But, I contend, that a levitated dollar unrelated to foreign export demand would weaken the economy rather than strengthen it.

What if the dollar strengthens because the Fed raises short-term domestic interest rates relative to foreign interest rates and attracts capital from abroad? While the net overall impact on the U.S. economy would depend in part on how the capital is used, the impact on the economy from foreign trade would be negative since the higher dollar would encourage imports relative to exports.

A frequently heard recent argument is that the Federal Reserve has created too many dollars (usually called liquidity) which has directly reduced the dollars value in foreign exchange markets. Ill examine the growth rates of money later, but for now let me just say that Im not convinced there has been too much money creation.

Most of the bank reserves created by the auctions have been offset or sterilized by open market operations Second, even if the best measure of money Im not sure which measure that is these days has grown more rapidly recently than before, the velocity of that money has obviously declined, offsetting its impact on real GDP. I say obviously because real GDP has increased at less than a one percent annual rate for the past six months. An effort by the Fed to slow money growth to boost the dollar would, in my opinion, tank an economy that is barely limping along. In terms of the equation of exchange, MV=PQ, a growth in M doesnt cause inflation. It takes growth in MV.

The reduction in velocity is rarely mentioned these days, but a freeze-up of credit markets is mentioned often. It appears inconsistent to me to say that financial institution are hoarding rather than lending money and, at the same time, to argue that the Fed is creating too much money. When velocity plummets, the Fed should step up money growth to offset it rather than slow money growth to reinforce its impact on the economy.

My comments above assume that the best measure of the stance of monetary policy is money growth. If the Federal Funds Rate is the better measure, we would get different results, since it is currently negative in real terms. I dont think it is the better measure, especially since the link between the Federal Funds rate and more relevant longer term rates seems to have broken down.

Since I drifted a bit, let me just restate my principal point: A stronger dollar resulting from a rising demand for our exports relative to our imports will lead to a stronger economy. A stronger dollar created by other means would likely weaken the economy. Conversely, a stronger economy made stronger by non-trade forces, would be more likely to weaken the dollar than strengthen it.