A StepbyStep Guide to Painlessly Plan and Vet Your Retirement

Post on: 26 Апрель, 2015 No Comment

Planning your retirement seems boring. But whether your retirement is five years away or fifty, it’s never too early to start planning for your golden years, and it doesn’t have to be a tedious, painstaking process. Numerous financial tools can help you do everything from calculating how much money you’ll need when you retire to finding the best investment mix and making sure you’re saving enough now. Follow these steps and wizards to get your comprehensive plan started (the sooner the better, so your money can grow exponentially !).

Albert Einstein is credited with saying that the most powerful force in the universe is compound… Read more Read more

What You Need to Get Started: Retirement Plan Basics

There are four basic things you’ll need to gather to create a plan for retirement: the target date or age at which you’d like to retire, how long your money should last, what your expected living expenses will be in retirement, and what assets you already have. Here’s how to figure it all out:

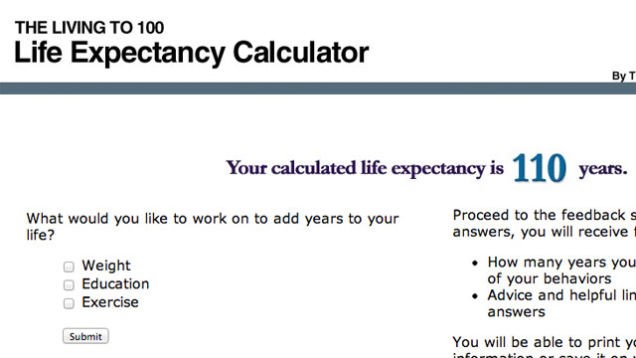

- Step 1. Determine when to retire. While typically we think of 65 as the common retirement age, today’s longer average lifespans make it less feasible to retire so soon. Many people may have to—and will be able to—work many more years past the age of 65. As the Simple Dollar says in The Truth About Retiring at 65, 65 is the new 45. Whatever your retirement age goal is, be sure to plan for all the years you may need to be covered financially. Step 2. Find out how many years to include in your plan (i.e. how long you are likely to live). This is a critical part because the whole point of retirement planning is to not outlive your savings. Often, your parents’ and grandparents’ lifespans can clue you in to your own longevity. This calculator from Vanguard can also help you determine your probability of living to a specific age. Step 3. Estimate what your expenses will be in retirement. Most people will have fewer living expenses by the time they’ve retired—a mortgage finally paid off, for example, and kids out of school. As a rule of thumb, financial advisers have recommended needing 75%-80% of your current income in retirement. For a more detailed number, check US average household spending in different categories and use that as a template to estimate your retirement living expenses more precisely. Step 4. Make an inventory of your current assets and savings. Gather your investment and savings account statements so you can get a clear picture of what you have to work with right now (if you use previously recommended money management site Mint. you can get your investment info gathered in one place very easily).

Once you have those basics figured out, you’re ready to roll with a few financial calculators and wizards. To create a basic or starter plan, try AARP’s Retirement Calculator . which is straightforward and easy to use while also being customizable. The calculator asks you a few questions about your household and retirement expectations, then makes a few assumptions (e.g. lifespan based on gender), which you can override. In the end, you’ll be presented with a retirement graph showing how much you’ll need to retire and how much you’ll have saved by that retirement age. If you’re not saving enough, the tool offers specific suggestions for reaching your retirement goal, like how much you’ll need to increase your annual savings or how many years to postpone retirement.

Vet Your Plan Against Several Retirement Calculators

There may not be one perfect retirement calculator; each has different assumptions for life expectancy rates, expenses you’ll have in retirement, etc. The best thing to do is try a few of them, taking each with a grain of salt and checking the calculators’ definitions so you can see how they fit your needs. These are some of the most useful tools, though, so you can just go through them in checklist fashion.

How much you should be putting away each month

Morningstar Target Savings Rate . This simple calculator from investment site Morningstar takes your age, annual income, and current savings to determine what percent of your salary you should be socking away for retirement. It assumes you’ll need about 80% of your current income when you retire.

Monthly income you can expect with your current savings rate and investments

T. Rowe Price Retirement Income Calculator . The free retirement planner from T. Rowe Price only takes about ten minutes to fill out, but prompts you to enter in more details, such as the balances for different types of retirement accounts and how much your employer contributes to your retirement plan. It also considers asset allocation (more on that in a bit) in its calculations. In the end, you’ll get an estimate with how much monthly income you’re projected to have in retirement, and the likelihood of your savings lasting your entire retirement. You’ll know there’s a problem when you’ve got a 30% probability of meeting your monthly retirement needs.

Make sure your plan works if the economy goes to hell (again)

T. Rowe Price uses a Monte Carlo simulation strategy that models future uncertainty and probability. If you’d like to project the minimum you should be saving based on actual stock market history, take a look at FIRECalc . FIRECalc tests your retirement plan to see if it could have withstood the worst financial calamities in our history—and, if so, it’s a good bet your retirement is on track. You simply input your portfolio balance, annual spending, and how many years you want the plan to last. You’ll get an overwhelming line graph that you should look at as a whole to see when your plan may fall into the negative zone. It’s wise to assume there will be at least one other financial collapse before you retire.

Visualize almost all details of your retirement picture

Smart Money Retirement Planner . If you only want to try one tool, consider this one offered by Smart Money. Not only is it very visually appealing, it’s robust enough to include costs for different categories of spending in retirement, show you a year-by-year picture of your entire retirement period, and account for when specifically you’ll draw money out of your accounts.

Figure out where to actually put your retirement money

Asset allocation: There are an awful lot of asset allocation tools to help you decide on the right mix of investments. A balanced portfolio will mitigate your risks while giving you the best chance of increasing your wealth. TIAA-Cref uses a simple questionnaire to gauge your risk and investment preferences, then suggests a portfolio for you, though it only shows a few investment types.

Bankrate’s Asset Allocation Tool is also handy. You adjust the sliders for your information and the pie chart shows how much you should have in large cap stocks or funds, foreign stocks, bonds, and so on.

Lazy investing. For the simplest approach, if you don’t want to bother with rebalancing your portfolio every year or managing all those different types of securities, you could invest in a lifecycle (or target-date) fund, which varies its investment mix for you, gradually getting more conservative as you approach your retirement target date. Lifecycle funds are convenient, but may not perform as well as a portfolio you put together yourself, as The Motley Fool points out.

Tax-free or tax-deferred accounts. Remember, also, that your best bet is to max out your retirement contributions, if possible, in a tax-deferred account or a Roth IRA. (Charles Schwab’s Roth vs. Regular 401(k) Calculator can help you decide which type of account to use.) If your employer matches your contributions, you’ll definitely want to make at least the minimum contributions to get that matching bonus (otherwise, it’s like throwing away free money!).

Investment analysis. For evaluating your investment portfolio, Morningstar’s Instant X-Ray tool is excellent. In fact, all of Morningstar’s tools. including the mutual fund screener and portfolio allocator, are great for investors. You can find new investments and set up your portfolio on Morningstar for further analysis.

Get financial advice from a professional

Finally, don’t overlook your investment brokerage. Most of them have tools to help you better understand the investments you already own and may offer individual guidance as well. Fidelity Investments. for example, offers its account holders access to some of the best investment research available and you can get a consultation with one of their advisers.

Don’t be afraid to hire a financial adviser to set up and balance your retirement portfolio for you, either. Especially in the wake of the Madoff scandal, however, you’ll definitely need to vet any financial pros you consider. One resource you can check to make sure a broker is legit is the Financial Industry Regulatory Authority (FINRA)’s database. and there are a few other resources mentioned by Forbes for avoiding that sort of major financial disaster.

Review and Update Your Plan Regularly

Although the tools above can give you some guidance and a plan of action, a comfortable retirement really is a goal that’s hard to plan for decades in advance. Just as we now have longer lifespans that make retiring at age 65 less feasible, the market and other economic factors will continue to change. It’s important, then, to review your plan regularly (e.g. yearly) and make sure your assumptions—how much money you’ll be making and putting away, the returns on your investments, and the age at which you’ll stop working—still hold true. But, again, the earlier you get a start on your plan, the better.

If you have any retirement planning tips, tools you’d recommend, or other advice, share them with us in the comments.

You can follow or contact Melanie Pinola, the author of this post, on Twitter.