A Simple Retirement Portfolio Anyone Can Build (Equal Sector Weights) YearEnd Update

Post on: 17 Апрель, 2015 No Comment

This is an update to my first article on Seeking Alpha, and it can be found here. The basis of the article was building a retirement portfolio that just about anyone can put together and manage without spending a lot of time doing it. The portfolio uses an equal sector weight strategy, along with a bond/hedge allocation. The current mix is 80% stocks and 20% bonds/hedge. An amount equal to 10% of the portfolio is set aside as a cash reserve. Each quarter, the portfolio will gain 1.5%. If the portfolio over-performs, some shares will be sold, and the cash reserves will rise. If the portfolio loses money, shares will be purchased, and money will be taken out of the cash reserves to get back to the 1.5% quarterly gain. This way, you always know what the portfolio will be worth. Vanguard ETFs will be used for re-balancing to keep costs down.

I would like to thank all of people who took the time to read the first article and post comments on the portfolio. It is greatly appreciated. The market has had a nice run since the article was published. I have decided to re-balance the portfolio now to get it on a 3/6/9/12 quarterly update schedule. I have also taken some of the advice given in the comments to tweak certain aspects of the original portfolio.

Changes Made To The Original Portfolio:

1. The bond allocation received the most comments. Some suggested investing in foreign debt, gold, and preferred stocks to possibly avoid the worst of a potential bond bubble. After some research I agree and have invested in (NYSEARCA:PCY ) (Power Shares Emerging Market Sovereign Debt), (NYSEARCA:IAU ) (iShares Gold Trust), and (NYSEARCA:PSK ) (Wells Fargo Preferred Stock ETF).

2. I eliminated (NYSE:O ) (Realty Income) and bought more (NYSEARCA:VFH ) (Vanguard Financials ETF) to simplify and better diversify. There is actually a fairly large REIT allocation in VFH after looking into it.

3. I took a profit on (NYSE:BHP ) (BHP Billiton Limited) and replaced it with (NYSE:FCX ) (Freeport McMoran Copper and Gold). FCX lost around 20% suddenly, and it seemed to be a good time to make the switch.

The Current Portfolio:

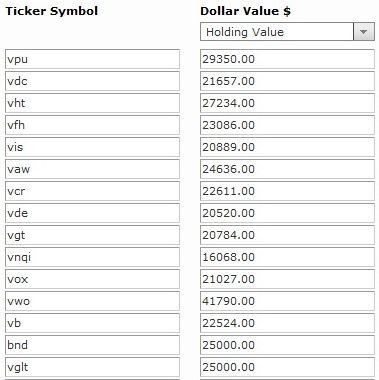

The following chart shows the current portfolio. It reflects one quarter’s worth of appreciation. The individual sectors are targeted at $3,045 ($3,000 * 1.5%) and the bond portion $8,120 ($8,000* 1.5%).

Equally Weighted Sector Portfolio