A Simple Profitable HeikinAshi Trading System

Post on: 16 Март, 2015 No Comment

If you’re new here, you may want to add me on YouTube. Twitter. Google+ or subscribe to my RSS feed. Thanks for visiting!

Heikin-Ashi candlesticks are a slightly different way of viewing the markets. In this article I will show how they can be used as part of a profitable trading strategy.

Heikin-Ashi Candlesticks

The image below shows the DJIA with normal candlesticks.

This next image below shows the DJIA over the same period using Heikin-Ashi candlesticks.

The two images are quite similar but note how the trends are clearer on the Heikin-Ashi chart. This is because the candles are calculated based partly on the average price and the price of the preceding candle. The effect of this is to smooth the candles and gloss over minor moves in the opposite direction to the main trend.

The advantage of Heikin-Ashi candlesticks is that they make the trend clearer and help nervous traders (which is all of us sometimes!) remain with the dominant trend. However, it is important to remember that when the market does change direction Heikin-Ashi candles react more slowly.

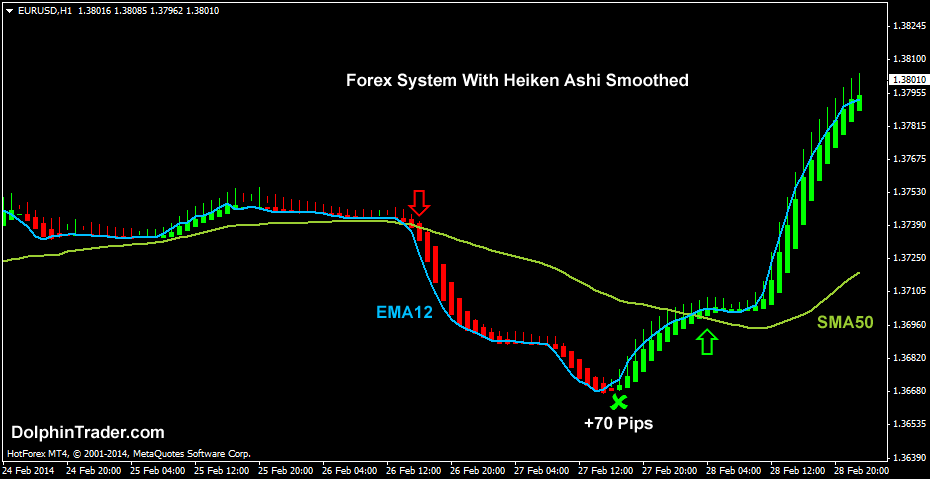

Heikin-Ashi Trading Strategy

The strategy I tested was based on the EUR/USD pair on the 4-hour timeframe. The historic data was from 2000 2014.

The strategy I backtested is:

- Trade Long when Heikin-Ashi turns positive and MACD is below 0

- Trade Short when Heikin-Ashi turns negative and MACD is above 0

- Close Long when Heikin-Ashi turns negative

- Close Short when Heikin-Ashi turns positive

I used a stop-loss and profit target of the ATR * 10.

I did a second backtest which included a trailing stop of the ATR * 1.

Additionally, I only took trades that occurred during the European trading session. This includes the US morning session.

Finally, I wanted to take account of the summer slowdown in the financial markets an so excluded the months of July and August from my analysis.

Backtest

Excel Backtest Model

I backtested the trading strategy using my Long-Short Excel Backtest Model. This is a spreadsheet that can be used to test all sorts of trading and investment strategies. Excel is a great tool to use for backtesting because it is very accessible and allows testing of quite complex strategies. On this site I have given a number of examples of different trading strategies that I have tested using this model. You can click on the link to the backtest model if you would like to purchase this.