A Safer Alternative To Annaly Capital Management

Post on: 29 Март, 2015 No Comment

Annaly Capital Management Inc (NYSE:NLY ) has had the attention of income investors for a long time. Under the income tax code it is classed as a Real Estate Investment Trust (REIT), which means that it is not taxed on its profits as long as it distributes at least 90% of them to shareholders, so almost all its earnings go to investors instead of being used for the expansion, diversification, and acquisitions so beloved by ambitious management teams. The dividend is very good, too: based on the current price ($11.20) and recent dividends ($0.30/quarter, equivalent to $1.20 per year) it’s over 10%. You don’t get yields like that from US Treasuries; in fact, if Ben Bernanke knows what he’s talking about — and if he doesn’t, who does? — you won’t get even 4% from US Treasuries in his lifetime (Reuters report ).

Of course, there’s no free lunch; Annaly Capital Management stock isn’t in any way comparable with bonds issued by the US Treasury. It has paid a dividend every year since 1998 but that dividend has fluctuated in line with its profits, as by law it must for Annaly to retain its favorable tax treatment as a REIT. What the current yield is really telling you is this: the market believes that the large dividend is likely to be cut. To get an idea of how much the dividend has fluctuated, we have a 17-year history to look back on:

The low point was $0.57, in 2006, a nasty shock for those who had bought it the previous year expecting more like $1 and with recent memories of nearly $2. That’s the biggest risk for the NLY investor: wildly fluctuating dividend amounts. Naturally, the stock price fluctuates with the expected dividend. NLY’s prospects are discussed in more detail on Seeking Alpha here and here. b ut in this article I want to focus on a lower-risk alternative.

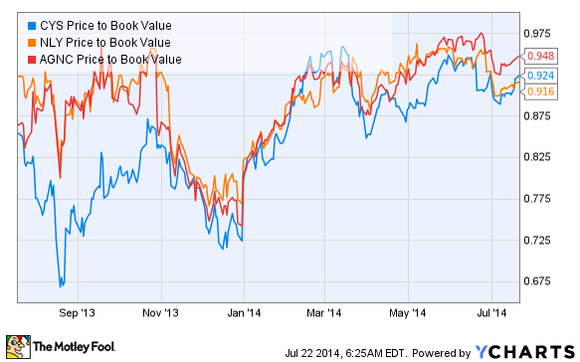

What seems not to be widely known is that you can almost eliminate this risk by giving up just a little of the generous yield. Alongside its common stock, Annaly has issued preference shares, on which it pays a fixed dividend — and this dividend is paid before calculating the dividend applicable to the common stock. Moreover, the dividend on the preference stock is “cumulative,” which means that if Annaly can’t pay it because it hasn’t enough earnings, it must pay all missed dividends on the preference shares before it may pay any further dividends on the common stock. There are actually three series of preference shares, all trading on the NYSE and all paying around 7.8%:

(If you use Yahoo Finance, the symbols there are NLY-PA, NLY-PC and NLY-PD.)

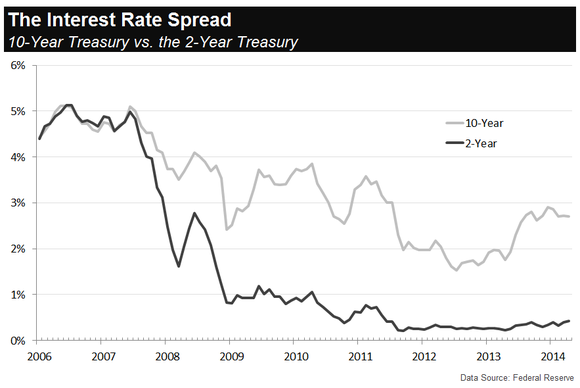

Like all fixed-income investments, NLY preference shares expose the holder to the risk that the investment will decline in value if market interest rates increase, or if inflation takes off. Interest rates are controlled by the Fed, and in my opinion there is almost no risk that rates will return to 4% or higher in the next few years. Most economists also dismiss the chances of a major increase in inflation any time soon.

Finally, there is still the risk that Annaly could become unprofitable; the risks of their Business are enumerated in their SEC filings. Annaly’s risk management successfully brought it safely through the financial storm of the Great Recession, which is reassuring, but you still should not put all of your eggs in this basket.

All these preference shares are callable at $25, which means that Annaly can buy them back for $25 any time it wants to. For this reason, you should never pay more than $25 for any of them; use a limit order to ensure you do not. I would suggest a limit somewhere in the range of $24.00 to $24.50; you might have to wait a few days until it is filled, but the next ex-dividend date will be around December 2 (check Annaly’s press releases in the next couple of weeks for the announcement of the exact date) so you shouldn’t be in a hurry. Trading volume is not high, which is another reason you should use limit orders. The high yield ensures that the price does not drop much below the ceiling of $25.

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no Business relationship with any company whose stock is mentioned in this article. (More…)

Additional disclosure: The author is long NLYPRC