A RiskFree Asset

Post on: 6 Сентябрь, 2015 No Comment

The US Treasury bond has earned the reputation of the safest asset by being the most liquid, and issued by the most politically stable country, with the largest economy and strongest military. When the wonks perform long term studies of asset class returns, they typically call the US Treasury the Risk-Free Asset. While this may be an academic term, this Risk-Free Asset is not risk free.

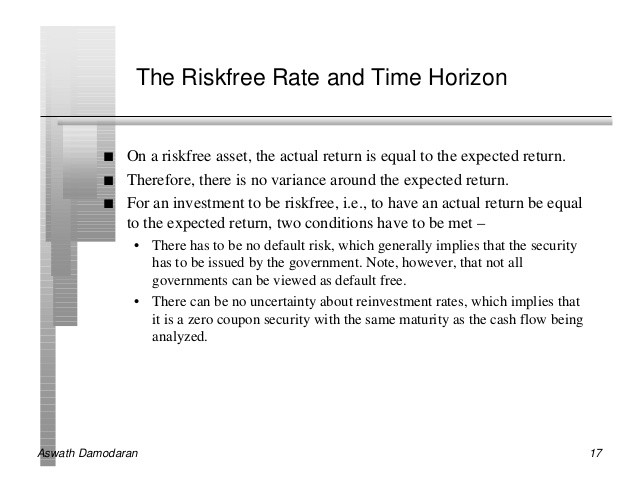

There is no such thing as a Risk-Free Asset. All bonds, whether sovereign or corporate have many risks: risk of default (issuer risk), liquidity risk, currency devaluation, inflation, call risk, term risk and rising interest rates. Sovereign Debt is issued by governments, therefore US Treasuries are considered Sovereign Debt.

- Default Risk: Within the same country, Sovereign Debt is generally less risky than corporate debt, especially in a period of high stress.

- Liquidity Risk: US Treasuries are the most liquid — and high liquidity means safer. US bonds are the most liquid because they are the bonds most often issued, because the US is the world’s largest debtor. It is ironic that the largest debtor becomes the safest debtor because of the liquidity of its bonds.

- Currency Devaluation: A US-based investor who spends only in dollars and holds dollar-denominated bonds; technically has no currency devaluation risk. On the other hand, if this same investor held bonds in foreign currencies ((NYSEARCA:WIP )) that depreciate against the dollar, the investor would receive fewer dollars when cashing in.

- Inflation: By far, inflation is the largest threat to bonds. Inflation-protected bonds protect you against inflation and to a lesser extent against devaluation (because devaluation stimulates inflation). Because of this, inflation-protected bonds are less risky than nominal bonds (same issuer). There are very few corporate inflation-protected bonds as most are issued by governments. The inflation-protection is only as good as the accuracy (honesty) of the CPI reported by the government. Many pundits (myself included) believe that the US is grossly under reporting their CPI. As for Foreign CPIs, Pimco’s Bill Gross believes they are for the most part, accurately calculated .

- Call Risk: When a company issues a callable bond at 10% and the prevailing interest rater later declines to 8%, the company may decide to call in its bonds. By buying back its bonds, the company can save money by issuing new bonds at a lower interest rate. US corporate bonds are generally subject to call risk. US Treasuries cannot be called.

- Term Risk: The longer the bond maturity, the riskier it is. This is because the longer a bonds maturity, the more likely the bond will be decimated by inflation and/or devaluation. As well, long bonds are more susceptible to being called.

- Rising Interest Rates: As rates rise, long bonds drop in value. Inflation and Rising Interest Rates are bond destroyers.

Rising Interest Rates

As the following chart shows, interest rates on 30 year bonds are the lowest they have been in the last 30+ years. The chart is hard to read, but it begins in 1977 and ends in 2008. Rates have ticked up somewhat since 2008. As rates rise, long bonds drop in value. Conversely, as rates fall, long bonds rise in value.

Bull Market in Bonds

The sustained fall in long term interest rates since 1982 has been the main driver behind the 27 year bull market for bonds. Any study that begins in 1982 comparing long bonds with the S&P500, will show that performance of 30 year and 20 year bonds has nearly equaled that of the stock market.

It is unwise to assume that bond yields will stay at or near their current multi-decade lows. Bond yields are sure to rise and bond prices are sure to fall, thus hurting bond portfolios.

Default

Sovereign nations do default, and sometimes unexpectedly. For example, Due to its oil wealth, Ecuador had plenty of money in the bank. Even though it was not forced to default, it chose to do so. When people talk of the risk of default of sovereign nation, they are usually referring to foreign (non-US) countries. Nowadays, no one knows who is next in line to default. Since the U.S. is a Sovereign nation, it is subject to default. The likelihood of this is very low, as I wrote in an earlier article .

How to Lower Risk

Stacking the risks above, the least risky bonds are Sovereign (less default and liquidity risk, no call risk) Inflation-Protected, shorter-term bonds. This boils down to: Inflation-Protected Sovereign (government-backed) bonds. You can buy a diversified pool of these two bonds in convenient ETF form with the symbols TIP (US Government) and WIP (Foreign Governments). Click here to read more about WIP. Click here to read more about TIPS.

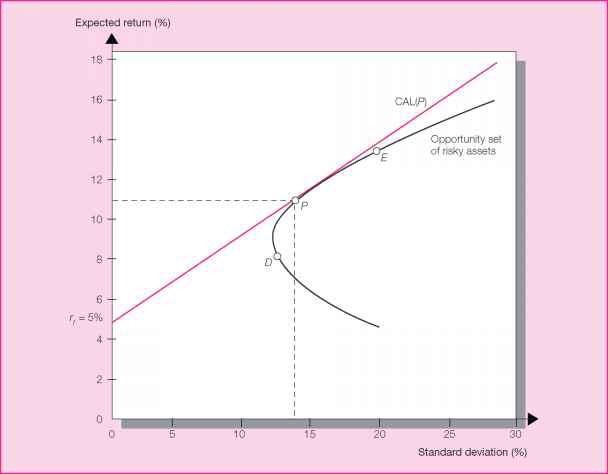

Diversification Lowers Risks

A diversified portfolio of sovereign bonds is far less risky than holding the bonds of a single foreign country (a single issuer). (This point is tempered by the fact that you are exposed to currency risk). A diversified portfolio of assets, some of which are risky (even including a sprinkling of risky Italian Sovereign bonds) become a lot risky when blended in a diversified portfolio this is the magic of diversification. It can be empirically proven that a portfolio of 100% US Treasury bonds is riskier than a portfolio of 80% US Treasury bonds and 20% Foreign bonds.

US Treasuries Are Not Risk-Free

US Treasuries have the same implicit risks of all bonds. They are certainly not risk-free. In two previous article s, I have argued that US Treasuries are riskier than other bonds. Take nothing for granted, don’t assume that even the mighty US Treasury bond is safe. Spread your bets

Disclosure: Author is long individual US TIPS and WIP. You should consult with a professional before investing.