A Record Stock Market with Record Federal Debt Does This Make Sense

Post on: 20 Июнь, 2015 No Comment

Follow Comments Following Comments Unfollow Comments

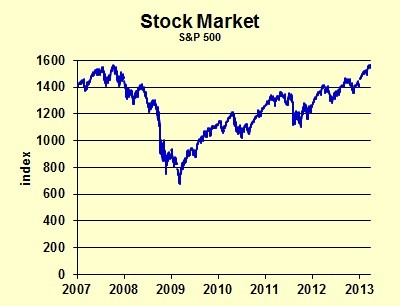

The stock market has hit record highs, causing surprise among many people. My friend Arthur noted two reasons why he could hardly believe the stock market is up. Here are comparisons between now and when the stock market was at its previous peak in October 2007:

- the federal deficit is over one trillion dollars, six times higher than in 2007

- federal debt is twice as high

How, he asked, can the stock market be reaching new highs in this environment?

Begin, I told him, with a simple model in which future cash flows are discounted to a present value. The analyst is concerned with the growth rate of cash flow (the numerator) and the interest rate by which those cash flows are discounted (the denominator).

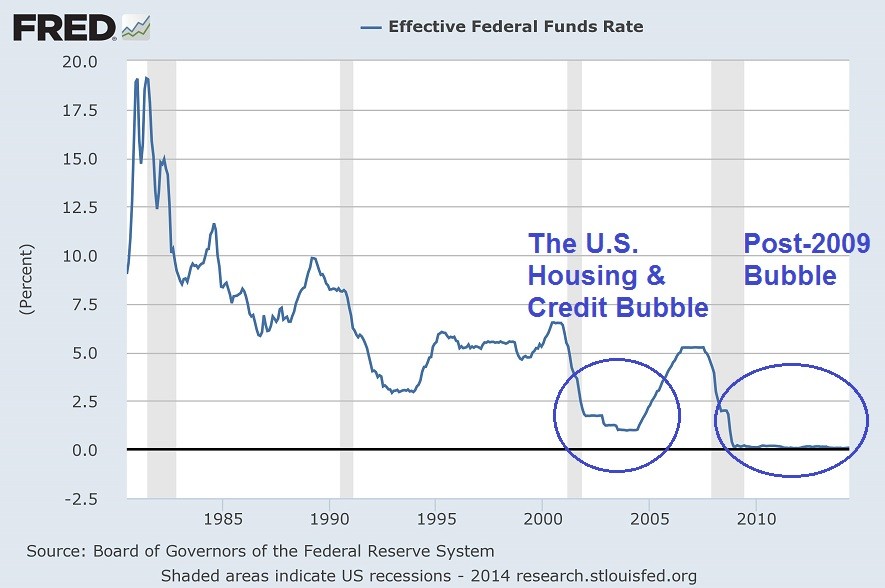

What about cash flow? For a simple approximation, let’s look at after-tax corporate earnings. They are 49 percent higher than at the previous stock market peak. What about the discount rate? One popular benchmark is the yield on 10-year Treasury bonds, which is 2.7 percentage points lower now than when the stock market was at its peak. A larger numerator, a smaller denominator, it’s a wonder that the stock market hasn’t been soaring for several years. Corporations as a group regained their peak profits back at the end of 2009; at that time the 10-year bond was about one percentage point below its level from the stock market peak. That might have justified the stock market getting back to its peak three years ago.

What about all of that bad news? First let’s talk about the federal deficit and debt and ask if that might influence future dividends and interest rates. Before beginning that discussion, note that the stock market is not a referendum on whether Congress and the President are doing a good job. The stock market is not a judgment about whether a sane person can be found in Washington DC. The stock market is simply the result of many smart people trying to make money on their investments. It’s kind of shallow in that it ignores so much, but kind of deep in its focus.

The nation’s federal budget leads easily to a forecast of higher tax rates in the future. (That’s a forecast, not a recommendation.) With higher tax rates, especially higher tax rates on capital, economic growth is likely to drop, as will the growth rate of profits. Note that we are talking about the growth rate of profits, not the level of profits. It’s quite reasonable to expect profits to rise, but at a slower rate, once taxes are increased. It’s not a sure thing, but it’s likely.

Second, what about interest rates? Nearly everyone expects long-term interest rates to be higher in the future. Many of us have been proved wrong about the timing of the increase, but everyone I know is sure that long-term rates will eventually be higher.

What does this mean for the stock market? We expect profits to rise at a slow rate, but the discount rate to also rise. Stocks could rise or fall, depending on the relative growth rate of profits compared to the increase in interest rates. This concern for the future is why the stock market did not regain its previous peak sooner. If not for our worries about future profit growth rates and future interest rates, we would have seen a booming stock market three years ago.

The stock market balances upside and downside risks. At the current price, the good news of rising profits and low interest rates is balanced by the bad news of higher taxes and higher interest rates to come. I’ll not forecast where the market will be a year from now, but I’m very confident that 20 years from now the market will be significantly higher, despite higher tax rates and higher interest rates.

* * *

To stay up to date on business and the economy, subscribe to my free monthly newsletter. View a sample .