A Primer on Corporate Bonds II (Credit Risk)

Post on: 25 Апрель, 2015 No Comment

T his is a column by regular contributor Clark.

Credit rating agencies such as those mentioned in Part I of the series consider several parameters before issuing their ratings. But, an astute investor may want to look at a few metrics on his own to assess credit risk and boost his knowledge at the same time.

Credit Risk Analysis – Interest Coverage Ratio

Interest coverage ratio refers to the number of times a corporation would be able to make the annual interest payments on its debt based on current annual earnings before interest and taxes (EBIT), i.e.,

Interest Coverage Ratio = Earnings before Interest and Taxes (EBIT) / Annual Interest Payments

From an investor’s perspective, the interest coverage ratio should be as high as possible. A low interest coverage ratio indicates that the company has high debt (or earnings not living up to leveraged expectations), which could translate to potential bankruptcy or default. Ideally, the company should have enough earnings to cover its debt payments. i.e. the ratio should at least exceed 1.0.

It is worth noting that though interest coverage ratio is calculated as above, it is questionable whether earnings before taxes should be used. After all, it is known that all corporations pay taxes. So, if a certain amount is going to go to taxes, then we are left with a skewed metric. The ratio may have looked good when using EBIT but in reality, could be distorted. So, a conservative investor may want to use earnings before interest payments (and not EBIT) to compute interest coverage ratio and get a better picture.

Credit Risk Analysis – Capitalization Ratio

Capitalization ratio is a measure of the long-term debt of a corporation to its total capital (assets). Total assets include long-term debt and shareholder’s equity.

Capitalization Ratio = Long-term Debt / (Long-term Debt + Shareholder’s Equity)

This metric evaluates the amount of debt that the company carries in relation to its total capital, i.e. financial leverage. A ratio of 1.0 would show that there is no shareholder equity in the company and the entire assets are based on debt. Such a business may not be a good candidate for the bond investor. Hence, the capitalization ratio should be as low as possible and definitely less than 1.0 to indicate that there is at least some shareholder’s equity in the business.

Credit Spread

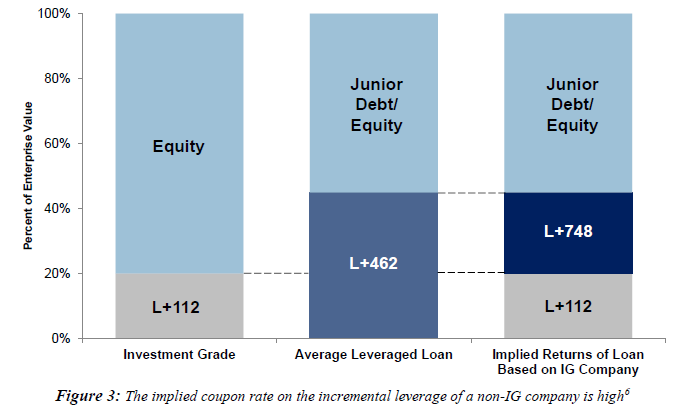

As you would have realized, corporate bonds carry additional risks when compared to government bonds. Companies compensate the investor who bears these extra risks by offering a better yield than government bonds. The difference between the corporate bond yield and government bond yield is known as credit or yield spread.

Credit spread or yield spread = Corporate bond yield – Government bond yield.

The return for accepting additional risk should show in the spread. The higher the credit and/or call risk (will be addressed in another article) of a bond, the greater the credit spread.

Company Factor

Let us assume that a bond investor has done his due diligence by checking credit ratings and analyzing various risks to buy an individual corporate bond. What would happen to the bond due to market or specific company changes? For example, if the financial leverage of the company gets minimized over time, then the credit rating agencies may upgrade the credit rating. This would indicate that the risk of default is reduced, pushing the corporate bond toward government bonds on the “risk of default” scale and, in turn, reducing the credit spread.

Market Factor

If the interest rates go down, then the bondholder stands to gain, since the yield of newly issued bonds would be lower. The bondholder would have a bond that offers a higher yield than the new bonds and hence, the price of his bond will go up to reflect the higher worth. As would be evident, an increase in interest rates would leave the bond investor holding a bond that is worth less (through lower yield and dropping price) than the new issues.

In the next part of the series, we’ll look at the other risks involved in buying corporate bonds.

About the Author. Clark is a twenty-something Saskatchewan resident employed in the manufacturing sector. He repaid around $20,000 in student loans and has been working to build his investment portfolio as a DIY investor (not trader) while nurturing plans to retire early. He loves reading (and using the lessons learned) about personal finance, technology and minimalism.