A National Debt FAQ

Post on: 5 Апрель, 2015 No Comment

To go to the topic page on the United States’ national debt, click here.

2) What’s the difference between the national debt and the deficit?

3) What’s the difference between the publicly-held national debt and the total national debt?

4) Why does the debt the government borrows from itself matter? Doesn’t it come out of the same pool of tax revenues?

9) Would I really get a bill for $51,521?

1) What is the national debt?

The national debt is the measure of the United States’ federal government’s accumulated debt.

2) What’s the difference between the national debt and the deficit?

The deficit is the measure of how much the United States’ federal government borrows in one year. The national debt is the amount of all of the deficits (subtracting any surplus years) added together.

3) What’s the difference between the publicly-held national debt and the total national debt?

There are two ways of looking at the national debt: 1) Publicly-held debt and 2) total debt. The publicly-held debt is debt that the federal government owes to individuals, corporations, and foreign entities (including foreign countries). The total national debt, or gross national debt, is the publicly-held debt plus the debt the federal government owes itself (i.e. intragovernmental holdings). As of October 31, 2012, the government owed the public $11.4 trillion and owed itself nearly $4.85 trillion for a total of $16.3 trillion. (Source: TreasuryDirect.gov )

4) Why does the debt the government borrows from itself matter? Doesn’t it come out of the same pool of tax revenues?

When the government borrows from itself, it is labeled “intragovernmental holdings.” The United States Treasury Department defines intragovernmental holdings as “Government Account Series securities held by Government trust funds, revolving funds, and special funds; and Federal Financing Bank securities. A small amount of marketable securities are held by government accounts.” (TreasuryDirect.gov ) The total amount that the government borrowed from itself is $4.8 trillion which is roughly 30% of the debt.

In plain English, the federal government borrowed money from various government trust funds and retirement accounts such as the Department of Defense Military Retirement Fund ($376 billion), Civil Service Retirement and Disability Fund Office of Personnel Management ($819 billion), Federal Hospital Insurance Trust Fund ($228 billion), Federal Old-Age and Survivors Insurance Trust Fund ($2.6 trillion), and over one hundred other accounts. (Numbers are from September 2012: TreasuryDirect.gov )

The last one, the Federal Old-Age and Survivors Insurance Trust Fund, is what is commonly known as Social Security. (Social Security Administration ) You see, while many individuals thought that their Social Security contributions were tucked away in a lock box, the reality is that the government looted $2.5 trillion from the account to pay for current spending. At this point in time Social Security is a redistribution system wherein contributions are taken from current workers and immediately given to eligible retirees and beneficiaries.

So why does it matter that the government borrowed from itself? Simply put, the government ran a deficit of $1.1 trillion in 2012 (Financial Management Service ) and is expected to be between $641 billion and $1 trillion in 2013 (Congressional Budget Office ). Worse yet, programs like Social Security are currently running deficits and are projected to do so off and on for many, many years. In 2011, Social Security ran an estimated $45 billion deficit. (Social Security Administration ) The deficit for 2012 is expected to increase to an estimated $53 billion. In the graph below from the Mercatus Center of George Mason University. you can see the Congressional Budget Office’s projections from 2010 didn’t foresee a deficit in Social Security even for 2011:

After looking at the graph above and considering that the United States can’t pay for its current spending obligations, do you think that it will also be able to pay back the money that it has borrowed from Social Security and other retirement accounts? Furthermore, shouldn’t such debts also be included when considering the national debt?

5) How big is the national debt?

As of October 25, 2012, the official debt of the United States government is nearly $16.2 trillion. (Source: TreasuryDirect.gov )

Below is the up to the second amount of the official national debt (Source: UWSA ):

It’s worth noting that the official debt published by the United States’ government does not include unfunded liabilities like Medicare, Medicaid, and Social Security. Unfunded liabilities are promises that the government has made in the past about future spending. On November 8, 2010, the Chief of the Dallas Federal Reserve estimated that the total unfunded liabilities of the United States federal government could be more than $100 trillion:

According to our calculations at the Dallas Fed, that unfunded debt of Social Security and Medicare combined has now reached $104 trillion—trillion with a ‘T’—in discounted present value. – Richard Fisher, February 10, 2010

$104 trillion is over seven times the United States’ GDP, which is an annual measurement of all of the wealth of the United States.

In 2012, another economist, Laurence Kotlikoff of Boston University, calculated the fiscal gap which he describes as a measurement of the present value difference between all projected future federal expenditures (including servicing official debt) and all projected future taxes. (Source: Yahoo News ) This measurement captures all government liabilities, whether they are official obligations to service Treasury bonds or unofficial commitments, such as paying for food stamps or buying drones. (Source: Bloomberg ) Using the CBO’s alternative fiscal scenario, Mr. Kotlikoff calculated the U.S. fiscal gap to be $222 trillion.

Obviously, this number did not grow by $118 trillion in two years, but this demonstrates that the reported debt is dwarfed by the liabilities the government has taken on and that it is not entirely certain what the government’s future financial responsibilities are.

6) How fast is the national debt going up?

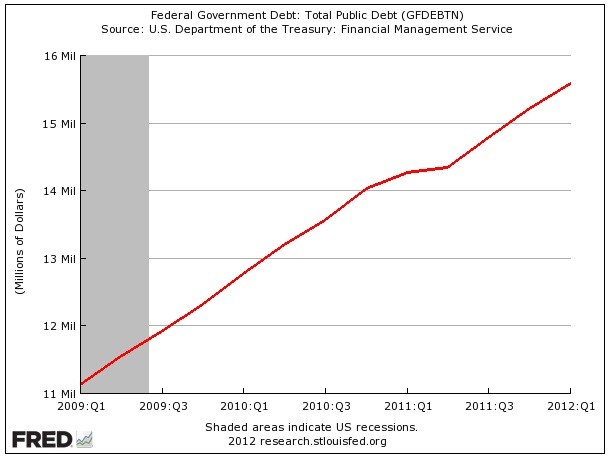

Between fiscal years 2003 and 2012, the national debt more than doubled from $6.8 trillion on October 1, 2003 to $16.1 trillion on September 30, 2012 (Source: TreasuryDirect.gov ). The rate of growth has been worse. For instance, on January 1, 1980, the national debt was roughly $863 billion. By the end of the decade, December 31, 1989, the national debt was over $2.9 trillion. That means that during the 1980s, the national debt more than tripled. You can see the growth of the national debt in the chart below (Source: St. Louis Federal Reserve ):

Using the Congressional Budget Office’s numbers, the Mercatus Center of George Mason University calculates that the national debt will nearly double again between 2011 and 2021 (Source: Mercatus Center ):

20Held%20by%20the%20Public_0.jpeg /%

Besides simply looking at the nominal amount of the national debt on a per year basis, it’s important to consider the ratio of the total national debt to the gross domestic product (GDP) of the United States. For 1970, the debt was roughly 35% of the United States’ GDP. In 1980, it was down to 32% of GDP. By 1990, the debt was over 55% of the GDP and in 2000 the debt was 57% of the GDP. What should give anyone pause is the fact that by the end of fiscal year 2012, the national debt has topped 100% of the United States GDP! You can see the acceleration of the debt in the graph below (Source: USGovernmentSpending.com ):

7) In 2012, are we still adding to the national debt?

Unfortunately, yes. According to the Congressional Budget Office on August 22, 2012, “ For fiscal year 2012 (which ends on September 30), the federal budget deficit will total $1.1 trillion, CBO estimates, marking the fourth year in a row with a deficit of more than $1 trillion. That projection is down slightly from the $1.2 trillion deficit that CBO projected in March. At 7.3 percent of gross domestic product (GDP), this year’s deficit will be three-quarters as large as the deficit in 2009 when measured relative to the size of the economy. Federal debt held by the public will reach 73 percent of GDP by the end of this fiscal year—the highest level since 1950 and about twice the share that it measured at the end of 2007, before the financial crisis and recent recession. ” (Source: CBO )

On February 13 2012, President Obama released his proposed budget for fiscal year 2013. Under this budget, the CBO anticipates the deficit for 2013 to be $977 billion. This budget will also increase the debt by nearly $6.4 trillion in the following 10 years. (Source: CBO ) The analysis of Michael Tanner of the Cato Institute can be viewed below. (Source: Cato Institute )

8) What does a $16,200,000,000,000 national debt mean to me?

As citizens of the United States, arguably we are each responsible for the national debt. In monetary terms, that means as of October 3, 2012 (Source: JustFacts.com ):

- Every American owes $51,521 .

- Every household in America owes $136,158 .

9) Would I really get a bill for $51,521?

Sort of. Governments have a tendency to solve their debt problems in a number of different ways.

10) How do governments usually solve debt problems?

There are four ways that governments usually solve debt problems (Source: Mercatus Center, George Mason University )

- Cut government programs enough to close the budget gap.

- Raise taxes by the amount of the budget gap.

- Print money to pay off the debt, thereby generating inflation.

- Default.

11) We’ve had large national debts in the past, how is this one any different?

It is true that the United States has had large deficits in the past, but those were a result of borrowing during times of war (Revolutionary War, Civil War, World War I, and, especially, World War II). Additionally, after each period, the United States government substantially reduced the national debt.

The debt that America is rapidly running up now is not the result of war, but a result of runaway spending by the United States government. You can see this fact clearly in the graph below which was published by the Congressional Budget Office in June of 2012 (Source: CBO ):

20Debt%20held%20by%20public%201912_2037.png /%

The extended baseline scenario generally adheres closely to current law, following CBO’s 10-year baseline budget projections through 2022 and then extending the baseline concept for the rest of the long-term projection period. The extended alternative fiscal scenario incorporates the assumptions that certain policies that have been in place for a number of years will be continued and that some provisions of law that might be difficult to sustain for a long period will be modified.

12) How did America reduce its debts in the past?

The deficits that were run up in the past followed wars, namely the Revolutionary War, Civil War, World War I, and World War II. Some deficit spending did take place during the Great Depression. The common theme after each war though was the reduction of government spending, namely military spending.

Government spending was also different prior to the Great Depression. The United States Government did not have entitlement spending programs such as Medicare and Social Security, nor was it spending money on various departments such as the Department of Education, Environmental Protection Agency, Department of Energy, or the Department of Housing and Urban Development.

Because the United States government didn’t spend money on a lot of programs it was able to dramatically increase spending (and borrowing) during times of war. Conversely, once the war was over, the government greatly reduced its spending on the military.

You can see how this played out in this graph produced by the Mercatus Center of George Mason University using Federal Reserve Bank data (Source: The U.S. Postwar Miracle ):

20Spending%20before%20and%20after%20world%20war_II.jpeg /%

13) So, can’t we just reduce military spending to stop deficit spending and start reducing the national debt?

As of October 2012, total spending for fiscal year 2012 (ending on September 30, 2012) was estimated to be $3.54 trillion, while the deficit was approximately $1.09 trillion. (Source: CBO ) In March of 2012, the CBO released an analysis of President Obama’s proposed 2013 budget. They concluded that the proposed budget would increase government spending to $3.7 trillion, but would decrease the deficit to an estimated $977 billion as a result of a $350 billion increase in revenue. The next section will discuss tax increases as a means of balancing the budget. (Source: CBO )

It is estimated that military spending will have consumed $651 billion in 2012 (Source: CBO ) and $640 billion under President Obama’s proposed 2013 budget. (Source: CBO ) As you can see, in both cases this amount is well below the deficit.

To look at it another way, you can see from the chart below (produced by The Cato Institute ) that we could completely eliminate the military (19% of the budget) and we would still be running a deficit. Alternatively, we could eliminate Social Security (20% of the budget), Medicare (12% of the budget), and Medicaid (7% of the budget) and still be running a deficit. There is no easy solution to our problems.

5B1%5D.png /%

14) Can’t we just raise taxes to balance the budget?

There are two problems with raising taxes:

- Raising taxes will take more money from the very businesses we depend on for jobs.

- It’s not realistic to balance the budget by just raising taxes.

- What Raising Taxes on All Working Americans Means:

As of October 5, 2012, the CBO estimates the deficit for fiscal year 2012 to be $1.09 trillion. (Source: Congressional Budget Office ) As of October 2012, there are 143 million Americans in the employed civilian labor force. (Source: Bureau of Labor Statistics ) If the taxes were spread equally across all of them, then each employed civilian (excluding military) would owe an extra $7,622.38 in taxes just to balance the budget in fiscal year 2012.

$1,090,000,000,000 = $7,622.38 in new taxes per working American

143,000,000

Can you afford an extra $7,622.38 in taxes this year?

- What Raising Taxes on Rich Americans Means:

Let’s say we just wanted to raise taxes on the top 10% of working civilians, which would be 14,300,000 Americans. Simple division tells us that each of those working Americans would owe roughly $76,223.78 in addition to the taxes they are already paying.

$1,090,000,000,000 = $76,223.78 in new taxes for the top 10% of wage earners

14,300,000

Since individuals making slightly over $100,000/year are included in that 10% working civilians, some individuals will literally have to pay out more in taxes than they actually make.

15) Can’t we just print more money to solve the debt problem?

In economic terms, printing money would be called “monetizing the debt.” When a country prints more money to get out of a debt problem, it hopes to pay back the debt with more money than it had before. Doing so is inflationary and debases the currency.

When money is created out of thin air, as happens with “monetizing the debt,” it loses value. There’s more money out there while there are still the same amount of resources available. That means everything goes up in cost.

While it works in the government’s favor in the short term to print money, in the long term it makes most Americans poorer as their hard-earned dollars purchase less. Additionally, inflating the money supply encourages reckless speculation in the stock market, destroys savings, causes prices to rise, and generally does great economic harm.

If the government prints its way out of the debt problem, you may avoid getting directly taxed for the costs of the debt, but you will pay for the debt whenever you buy groceries, gas, a house, or anything else. Life, and especially the necessities, become a bigger and bigger part of your monthly budget.

To learn about inflation, click here .

16) Are we running deficits because the U.S. government has a revenue problem?

Simply put, no. The government has a spending problem, not a revenue problem.

During 2011 and 2012, the revenues to the federal government were $2.3 and $2.45 trillion respectively. However, spending was still well above this amount at $3.6 trillion and $3.54 trillion respectively leaving us with greater than $1 trillion deficits each of those years. (Source: CBO )

Runaway government spending in 2011 and 2012 added nearly $2.4 trillion to the national debt. (Source: CBO ) That’s roughly $16,783.22 for every working American. In October of 2012, there were 143 million working Americans according to the Bureau of Labor Statistics .

The Federal Reserve provides the graph below (produced on October 30, 2012) to show the disparity between spending and revenue. The blue line, as you can see, shows that government revenue has been steadily climbing. The red line is government spending which has far outpaced revenues, particularly over the last three decades. (Source: Federal Reserve )

17) Does the US owe money to foreign countries? If so, which ones?

As of August 2012, the United States government owed $5.43 trillion to foreign countries. Of that amount, $1.15 trillion was owed to China. Japan is the second largest holder of US debt, holding nearly $1.12 trillion.

With $5.43 trillion owed to foreign countries, this means that every American’s share of that debt is over $17,292. (In August 2012, there were 314 million Americans according to the U.S. Census .)

You can see the amounts owed to various countries as of December 2010 in the chart below (Source: Department of the Treasury ):

20held%20debt.png /%

Numbers are in Billions (e.g. 1150 = $1.15 trillion)

18) Is the interest on the national debt a big deal?

In the long run, yes. Currently, the overall interest rate on the national debt is quite low with interest rates ranging from roughly 0% on a 3 month bond to 2.75% on a 30 year bond. You can see the rates as of early November 2012 in the chart below (Source: Bloomberg ):

20bond%20chart.png /%

Because portions of the national debt were purchased at different times for different terms (e.g. 3 month, 10 year, etc.), there is no one interest rate for it. Because some of the terms of US debt purchases are short-term (e.g. 3 months), the debt actually rolls over and must be resold. It is when the debt is resold that the interest rate can change. Therefore, while the overall interest rates on the national debt are low right now, they could become much higher in the future.

As Bloomberg reported in early 2011: Still, about $4.5 trillion, or 63 percent of the $7.2 trillion in public Treasury coupon debt, needs to be refinanced by 2016. That gives the government a narrowing window as growing interest expense will curtail its ability to spend.

To help understand the cost of the interest on the national debt, the Congressional Budget Office (CBO) estimates the cost of the interest as a percentage of GDP (the annual measurement of economy). The CBO estimates that the net interest payments as of December 2010 are roughly 1.5% of GDP. While low, as a percent of GDP, interest payments as a percent of GDP have been just over 3% of GDP in the past. You can see the historical data and future projections in the chart below (Source: CBO ):

20Debt%20Interest%20Payments%20as%20Percent%20of%20GDP.jpeg /%

Now, the chart above can be a bit misleading because the public national debt as a percentage of GDP is at its highest since roughly World War II. The interest rates on the debt, though, are at historic lows. This means that the interest paid on the debt today is quite small when considered as a percent of GDP.

If interest rates go up from today’s historic lows, then the United States would have significantly higher interest payments on the national debt as a portion of GDP. You can see the historical interest rates in the chart below (Source: CBO ):

20to%202020%20Interest%20Rates%20on%20Treasury%20Notes_0.jpeg /%

The amount paid in 2012 for interest on the national debt was $359,796,008,919.49. (Source: Department of the Treasury ) As an aside, this number is qualified with a note explaining that the accounting methods at the Department of Defense were adjusted resulting in a one-time decrease of $75 billion, but we will consider the reported number. $460 billion in interest payments amounts to roughly $1,143 for every man, woman, and child in America. You can see the historical interest payments on the national debt in the chart below:

20on%20debt.png /%

If interest rates were to rise to those seen in the 1970s or the 1980s, interest payments on the debt would rise significantly as well.

6% Interest Rate

In the early 1970s, the net interest rate was roughly 6% on the national debt. A 6% annual interest rate on today’s national debt ($16.3 trillion) would be $978 billion, which is more than 2.5 times the interest payment for 2012. This would consume around 40% of the estimated $2.45 trillion in revenues to the government in 2012. Based on a population of 314 million Americans, if divided equally each American’s share in taxes would be $3,114.65.

8% Interest Rate

In the early 1980s, the net interest rate was roughly 8% on the national debt. An 8% annual interest rate on today’s national debt ($16.3 trillion) would be $1.3 trillion, which is more than 3.5 times the interest payment for 2012. This would consume around 53% of the estimated $2.45 trillion in revenues to the government in 2012. Based on a population of 314 million Americans, if divided equally each American’s share in taxes would be $4,140.13.

10% Interest Rate

In the mid-1980s, the net interest rate was roughly 10% (for some bonds, it went as high as roughly 14% in the 1980s). A 10% annual interest rate on today’s national debt ($16.3 trillion) would be $1.6 trillion, which is nearly 4.5 times the interest payment for 2012. This would consume around 65% of the estimated $2.45 trillion in revenues to the government in 2012. Based on a population of 314 million Americans, if divided equally each American’s share in taxes would be $5,095.54.

Impact on Government

The federal government would be severely impacted by rising interest rates on the national debt. If the net interest rate on the national debt rises, even to just 6%, the interest payments alone would consume increasingly more of the national economy and would reduce the capacity of the federal government to fulfill its other obligations. You can see this danger in the chart below (Source: Mercatus Center ):

20of%20National%20Debt%20long-term%20spending%20explosion.jpeg /%