A Guide to Commodity ETFs and ETNs

Post on: 6 Май, 2015 No Comment

The Full List

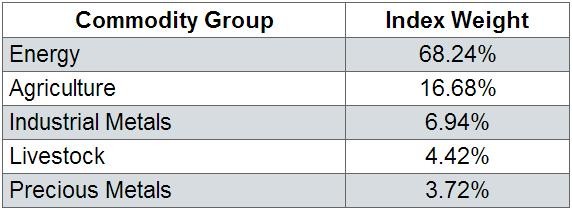

- Broad commodity indexes and baskets are available via ETFs (GCC. GSG. DBC ) and ETNs (UCI. GSC. DJP. GSP ). There’s also a leveraged broad commodity ETF (NYSEARCA:UCD ), a leveraged broad commodity ETN (NYSEARCA:DYY ), and a double-short broad commodity ETF (NYSEARCA:CMD ) and ETN (NYSEARCA:DEE ).

- Agricultural commodities include cocoa (NYSEARCA:NIB ), coffee (NYSEARCA:JO ), cotton (NYSEARCA:BAL ) and sugar (NYSEARCA:SGG ) — all ETNs. Agriculatural commodity baskets cover livestock (UBC. COW ), grains (JJG. GRU ), softs — ie. coffee, cotton and sugar — (NYSEARCA:JJS ), biofuels (NYSEARCA:FUE ) and food (NYSEARCA:FUD ). Broader agricultural indexes are also available via ETF (NYSEARCA:DBA ) or ETN (UAG. JJA. RJA ). Don’t confuse agricultural commodity ETFs/ETNs with ETFs which track the stocks of companies in the agricultural commodity business (CUT. MOO ).

- Industrial commodities include aluminum (NYSEARCA:JJU ), copper (NYSEARCA:JJC ), lead (NYSEARCA:LD ), nickel (NYSEARCA:JJN ) and tin (NYSEARCA:JJT ) — all ETNs. Industrial metals baskets are also available via ETF (NYSEARCA:DBB ) and ETF (UBM. JJM. RJZ ). As with agriculture, ETFs are available which track the stocks of companies in the industrial commodities business (PKOL. KOL. SLX. HAP ).

- Oil is available as a simple long (USO. USL. OIL. DBO. OLO ), leveraged long (NYSEARCA:UCO ), short (SZO. DNO ) and double short (DTO. SCO ). There are also simple long ETFs for heating oil (NYSEARCA:UHN ) and gasoline (NYSEARCA:UGA ). Natural gas is available as an ETF (UNL. UNG ) or ETN (NYSEARCA:GAZ ). Energy commodity baskets are available as an ETF (NYSEARCA:DBE ) or ETN (UBN. RJN. JJE ).

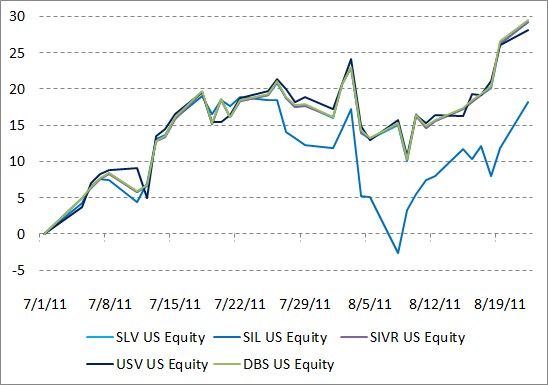

- Precious metals are available in a basket (NYSEARCA:DBP ) or as individual metals. Gold is available as a simple long (GLD. IAU. SGOL. DGL. UBG ), leveraged long (DGP. UGL ), short (NYSEARCA:DGZ ) and double short (DZZ. GLL ) position. Silver. too, is available as a simple long (SLV. SIVR. DBS. USFV), leveraged long (NYSEARCA:AGQ ) and double short (NYSEARCA:ZSL ) position. Platinum comes as a simple long (PPLT. PTM. PGM ) and short (NYSEARCA:PTD ). Palladium comes only as a simple long (NYSEARCA:PALL ). Like the other commodities, you can buy ETFs containing gold and silver related stocks — the major gold miners (NYSEARCA:GDX ), junior gold miners (NYSEARCA:GDXJ ), silver miners (NYSEARCA:SIL ) and mixed miners (NASDAQ:PSAU ).

What Are They?

- Commodity ETFs (exchange traded funds) attempt to track the price of a single commodity, such as gold or oil, or a basket of commodities by holding the actual commodity in storage, or by purchasing futures contracts. Because futures provide leverage (more exposure than the actual cash invested), ETFs that use futures contracts have uninvested cash, which they usually park in interest-bearing government bonds. The interest on the bonds is used to cover the expenses of the ETF and to pay dividends to the holders.

- Commodity ETNs (exchange traded notes) are non-interest paying debt instruments whose price fluctuates (by contractual commitment) with an underlying commodities index. Because they are debt obligations, ETNs are subject to the solvency of the issuer.

- Commodities-related ETFs generally track the producers of commodities, such as mining companies. While the financial performance of those companies — and thus their stocks — may be highly leveraged to the underlying commodity, other factors can impact the profitability of production. The ETFs, therefore, may not reflect the performance of the underlying commodity. For example, gold miners are highly leveraged to the discovery of gold deposits, exchange rates and their relationships with the countries where gold deposits are found.

Why & How To Use Them

More from this section