A Currency War Forces the Federal Reserve to Keep Interest Rates Low

Post on: 16 Март, 2015 No Comment

At the end of 2014, it seemed all but certain that the Federal Reserve would raise interest rates in the first half of this year. But thanks in part to an escalating currency war and recent flair-up in Europe over Greek debt, those plans have been shelved.

The central bank said on Wednesday that it will keep short-term interest rates between 0% and 0.25% despite its opinion that economic activity has been expanding at a solid pace. Importantly, the Fed said that its assessment of when to raise them will take into account readings on financial and international developments.

While the bank didn’t offer details about what international developments it was referring to, there can be little doubt that the dollar’s strength plays a pivotal role. Since last July, the value of the dollar has soared by 15% versus the world’s major currencies, making U.S. exports less competitive in global markets.

The impact from this has become increasingly clear as American companies report earnings for the final three months of 2014. The rising dollar will not be good for U.S. manufacturing or the U.S. economy, Caterpillar ‘s CEO Doug Oberhelman told analysts and investors Tuesday. Procter & Gamble said its fourth-quarter sales struggled against a five percentage point headwind from foreign exchange. And even Apple ‘s shockingly strong quarter would have been even stronger, absent fierce foreign exchange volatility.

The dollar’s strength is being fueled by multiple factors. Lower oil prices have caused currencies in Russia, Mexico, and other energy-dependent economies to fall precipitously. Since the middle of last year, for instance, the Russian ruble has lost roughly half of its value versus the dollar.

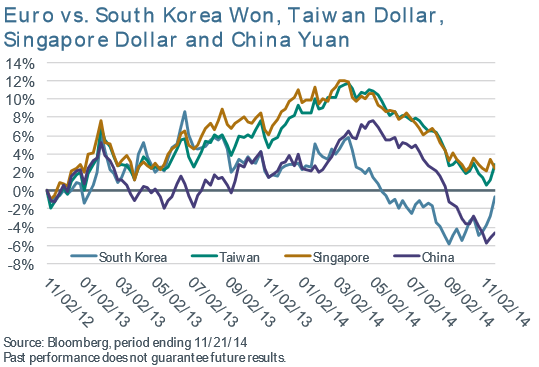

Monetary policy by the European Central Bank is also playing a role. In an effort to jump-start the continent’s ailing economies, the ECB announced earlier this week that it would follow in the Federal Reserve’s footsteps by buying 60 billion euros in government bonds each month over the next year and a half. Because this expands the number of euros in circulation, anticipation of the news pushed the euro’s value to its lowest point vis-a-vis the dollar in more than a decade.

Finally, actions by central banks in Canada, Singapore, Japan, and other countries suggest a deliberate attempt to manipulate exchange rates in a broadening currency war. Most recently, Canada cut its benchmark interest rate last week by a quarter of a point, and the Monetary Authority of Singapore said this week that it would take measures to slow the appreciation of the Singapore dollar.

The net result is that the Federal Reserve has little choice but to delay an increase in interest rates. Doing otherwise would only further drive up the value of the U.S. dollar given that higher rates would attract international capital, and thereby boost the demand (and thus price) for dollars.

Bank of America + Apple? This device makes it possible.

Apple recently recruited a secret-development dream team to guarantee its newest smart device was kept hidden from the public for as long as possible. But the secret is out. and some early viewers are claiming it’s destined to change everything from banking to health care. In fact, ABI Research predicts 485 million of this type of device will be sold per year. But one small company makes Apple’s gadget possible. And its stock price has nearly unlimited room to run for early, in-the-know investors. To be one of them, and see Apple’s newest smart gizmo, just click here !