A Brief History of Bond ETFs

Post on: 4 Апрель, 2015 No Comment

With the volume of headlines that bond ETFs capture these days, it’s easy to take for granted the fact that these innovative products haven’t been around that long. In fact, it was ten years ago this month that iShares launched the first bond ETF (the iBoxx Investment Grade Corporate Bond ETF – LQD), along with three others.

At the time, there was certainly a business case for developing a new way to access fixed income. The over-the-counter (OTC) market where traditional fixed income instruments trade can be opaque, hard to navigate, and prone to unnecessarily high expenses (I’ve talked about this at length here on the blog ). Putting bonds into an ETF vehicle would give investors the best of both worlds: targeted bond exposure with exchange liquidity and transparency.

Although the idea clearly had merit, there were still some questions about how it would all work. Was it possible to put the OTC fixed income market on the exchange? How would liquidity be created for these products? What would a hybrid bond-equity product look like? Bonds had been listed on the NYSE and other exchanges for years, but had never garnered much interest from traders or investors. Would an ETF suffer the same fate?

Over 500 funds and $290 billion in assets later, the global fixed income ETF market’s success speaks for itself. So what were some of the key developments that brought us from those first four funds launched in 2002 to the plethora of bond ETFs available today? As I see it, there were three main stages that accounted for the market’s exponential growth:

- Creating a new market (2002-2006). In the first few years of fixed income ETFs, there were still only a handful of funds available, with slow and steady growth and usage by investors. Since the building and launching of these funds required a re-thinking of the ETF structure itself, only one other provider outside of iShares was willing to take the bet. By the end of 2006, there were still only six fixed income ETFs available with about $20 billion in assets. However, we knew it was only a matter of time before the concept would catch on.

- Additional providers enter the market (2007-2008). By 2007, there was a growing understanding that the “experiment” had in fact worked. The steady growth and acceptance of the fixed income iShares line-up had proven that there was investor appetite for buying bonds on an exchange. More importantly, investors were hungry for more. When the SEC standardized the fund structure and listing process for FI ETFs, a flood of new funds entered the market. By the end of 2008, the size of the market had almost tripled to $56 billion in assets, spread across 61 FI ETFs from eight providers.

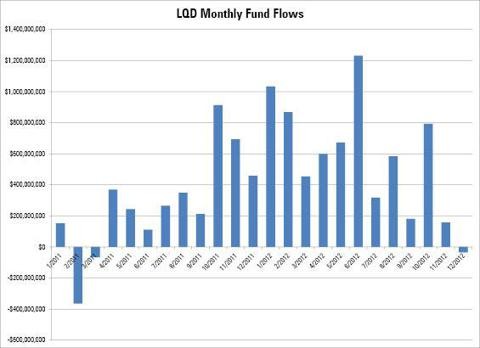

- The hunt for liquidity accelerates usage (2009-2012). During the financial market implosion at the end of 2008, trading volume in markets like corporate bonds fell by as much as 50%. Why? Liquidity in the bond market is supplied by broker/dealers, and since many of these firms were struggling to stay afloat, they pulled back from making markets in bonds. Because of this, many investors discovered an alternative way to access bonds – through fixed income ETFs. FI ETF trading volumes spiked, increasing 800 to 1000% for some funds. And with increased volumes came increased asset flows and even broader investor usage.

Where does the fixed income ETF industry go from here? We believe the market should continue to grow for several reasons. First, changing demographics in the US and abroad are going to result in more and more investors seeking income-producing investments, and since ETFs provide an efficient way to access fixed income, they should benefit significantly. Second, as global bond markets continue to evolve, increasing the investment opportunity set for investors, vehicles like ETFs that allow them to access challenging markets are likely going to be a vehicle of choice. And finally, ETFs are still being discovered by many investors. Despite all the growth of the past ten years, the ETF market is still tiny compared to the individual bond and mutual fund markets.

Given that ETFs are not just another way to buy fixed income, but are transforming the fixed income markets themselves, the sky is the limit for these game changing products.