A Beginner s Guide To Precious Metals

Post on: 3 Апрель, 2015 No Comment

Since the dawn of time, gold and silver have been recognized as valuable. And even today, precious metals have their place in a savvy investor’s portfolio. But which precious metal is best for investment purposes? And why are they so volatile? If you’re just getting started in precious metals, read on to learn more about how they work and how you can invest in them. There are many ways to buy into precious metals like gold, silver and platinum and a host of good reasons why you should give in to the treasure hunt.

All That Glitters IS Gold

We’ll start with the grand-daddy of them all: gold. Gold is unique for its durability (it doesn’t rust or otherwise corrode), malleability and its ability to conduct both heat and electricity. It has some industrial applications in dentistry and electronics, but we know it principally as a base for jewelry and as a form of currency .

The value of gold is determined by the market 24 hours a day, nearly seven days a week. Gold trades predominantly as a function of sentiment; its price is less affected by the laws of supply and demand. This is because new mine supply is vastly outweighed by the sheer size of above-ground, hoarded gold. To put it simply, when the hoarders feel like selling, the price drops. When they want to buy, new supply is quickly absorbed and the gold prices are driven higher. (Learn more in Does It Still Pay To Invest In Gold? )

Several factors account for an increased desire to hoard the yellow metal:

- Systemic Financial Concerns

When banks and money are perceived as unstable and/or political stability is questionable, gold has often been sought as a safe store of value. (To learn more, read 8 Reasons To Own Gold .)

The Silver Bullet

Unlike gold, the price of silver swings between its perceived role as a store of value and its very tangible role as an industrial metal. For this reason, price fluctuations in the silver market are more volatile than gold.

So, while silver will trade roughly in line with gold as an item to be hoarded (investment demand), the industrial supply/demand equation for the metal exerts an equally strong influence on price. That equation has always fluctuated with new innovations, including:

- Silver’s once predominant role in the photography industry (silver-based photographic film), which was been eclipsed by the advent of the digital camera.

- The rise of a vast middle class in the emerging market economies of the East, which created an explosive demand for electrical appliances, medical products and other industrial items that require silver inputs. From bearings to electrical connections, silver’s properties made it a desired commodity .

- Silver’s use in batteries, superconductor applications and microcircuit markets.

It’s unclear whether (or to what extent) these developments will affect overall noninvestment demand for silver. One fact remains; silver’s price is affected by its applications and is not just used in fashion or as a store of value. (Find out how everyday items you use can affect your investments in Commodities That Move The Markets .)

Platinum Bombshell

Like gold and silver, platinum is traded around the clock on global commodities markets. It tends to fetch a higher price than gold during routine periods of market and political stability, simply because it’s much rarer; far less of the metal is actually pulled from the ground annually. Other factors that determine platinum’s price include:

- Like silver, platinum is considered an industrial metal. The greatest demand for platinum comes from automotive catalysts, which are used to reduce the harmfulness of emissions. After this, jewelry accounts for the majority of demand. Petroleum and chemical refining catalysts and the computer industry use up the rest.

- Because of the auto industry’s heavy reliance on the metal, platinum prices are determined in large part by auto sales and production numbers. Clean air legislation could require automakers to install more catalytic converters, increasing demand, but in 2009, American and Japanese car makers were turning to recycled auto catalysts, or using more of platinum’s reliable (and usually less expensive) sister group metal, palladium.

- Platinum mines are heavily concentrated in only two countries: South Africa and Russia. This creates greater potential for cartel -like action that would support, or even artificially raise, platinum prices.

Investors should consider that all of the above factors serve to make platinum the most volatile of the precious metals. (For more on this entire industry, check out The Industry Handbook: Precious Metals .)

Filling Up Your Treasure Chest

Let’s take a look at the options available to those who want to invest in precious metals.

- Commodity ETFs. Exchange traded funds exist for all three precious metals, but as of 2009, you’ll have to be able to trade the London Stock Exchange (LSE) to access one for platinum. ETFs are a convenient and liquid means of purchasing and selling gold, silver or platinum. (For more insight, see Gold Showdown: ETFs Vs. Futures .)

- Common Stocks and Mutual Funds. Shares of precious metals miners are leveraged to price movements in the precious metals. Unless you’re aware of how mining stocks are valued, it may be wiser to stick to funds with managers with solid performance records. (For related reading, see Strike Gold With Junior Mining .)

- Futures and Options. The futures and options markets offers liquidity and leverage to investors who want to make big bets on metals. The greatest potential profits — and losses — can be had with derivative products. (For more on these agreements for delivery, check out Trading Gold and Silver Futures Contracts .)

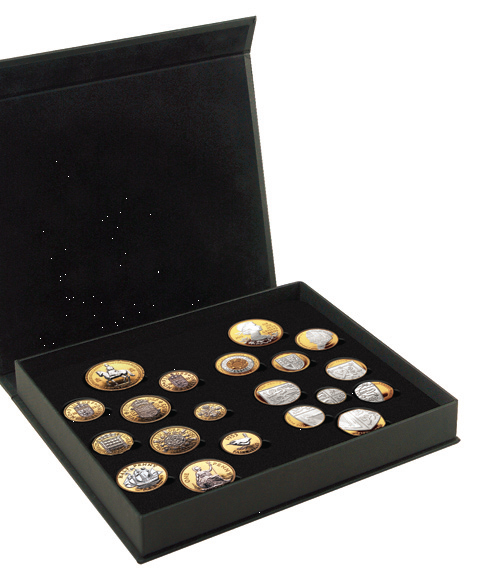

- Bullion. Coins and bars are strictly for those who have a place to put them. Certainly, for those who are expecting the worst, bullion is the only option, but for investors with a time horizon, bullion is illiquid and downright bothersome to hold.

- Certificates. Certificates offer investors all the benefits of physical gold ownership minus the hassle of transportation and storage. That said, if you’re looking for insurance in a real disaster, certificates are just paper. Don’t expect anyone to take them in exchange for anything of value.

Will Precious Metals Shine for You?

Precious metals offer unique inflationary protection — they have intrinsic value, they carry no credit risk and they themselves cannot be inflated (you can’t print more of them). They also offer genuine upheaval insurance, against financial or political/military upheavals.

From an investment theory standpoint, precious metals also provide low or negative correlation to other asset classes like stocks and bonds. This means that even a small percentage of precious metals in a portfolio will reduce both volatility and risk.

Conclusion

Precious metals provide a useful and effective means of diversifying a portfolio. The trick to achieving success with them is to know your goals and risk profile before jumping in. The volatility of the precious metals can be harnessed to accumulate wealth, but left unchecked, it can also lead to ruin. (Still want more information? Read Contemplating Collectible Investments and What Is Wrong With Gold? )