A bear market in bonds or just an adjustment

Post on: 23 Июль, 2015 No Comment

A bear market in bonds, or just an adjustment?

- The Treasury market is headed for what will probably be its worst monthly return since December 2010, mostly in response to comments from the Federal Reserve (Fed) suggesting that it might start reducing its bond purchase program as early as June 19.

- We believe that the market reaction was probably overdone; even before the Fed comments, Treasury yields were rising due to factors that often cause some backup in Treasury yields.

- It is important to remember that the markets we have been recommendingA and BBB credits in municipal bonds and high-yield corporatesare performing far better than Treasuries.

The bond marketmore precisely, the Treasury marketis having a volatile May. On May 1, the yield on the benchmark 10-year Treasury note was 1.63%. Yesterday, the same benchmark closed at 2.16%more than 50 basis points (100 basis points equals 1.00%) higher, a big move for any month. The total return for the 10-year Treasury note thus far in May is -3.4%. If sustained, the month would end with the worst monthly return since December 2010.

Almost one-half of the yield increase has occurred in the past week, mostly in response to comments from Fed officials and a few sentences in the Federal Open Market Committee (FOMC) minutes suggesting that the Fed might start reducing its bond purchase program as early as the June 19 FOMC meeting. The market reaction was probably overdone, as the minutes stated only that some participants would support an early reduction in bond purchases if the economic data released in June are strong and sustainable. That data may be moderately healthy but will almost certainly fall short of being strong.

Even before the Fed comments last week, Treasury yields were rising due to better-than-expected employment figures in early May and a continuation of the stock market rally. A strong stock market often causes some backup in Treasury yields, as has the absence of the flight-to-safety bid (usually sparked by a crisis overseas). Because there is no crisis in the global markets, we have seen weak demand for Treasuries from foreign investors.

We are now hearing that this is the onset of the dreaded bear market in bonds, but the truth is probably less exciting. The Treasury market, which was overbought, has adjusted to be more consistent with an economy that is growingalbeit slowlyand the absence of a crisis overseas. At the current higher yields, Treasuries have become more attractive versus German and Japanese government notes and bonds, so foreign demand might improve somewhat. I do not expect this market correction to push the 10-year yield beyond 2.25%.

Avoid Treasuries and TIPS

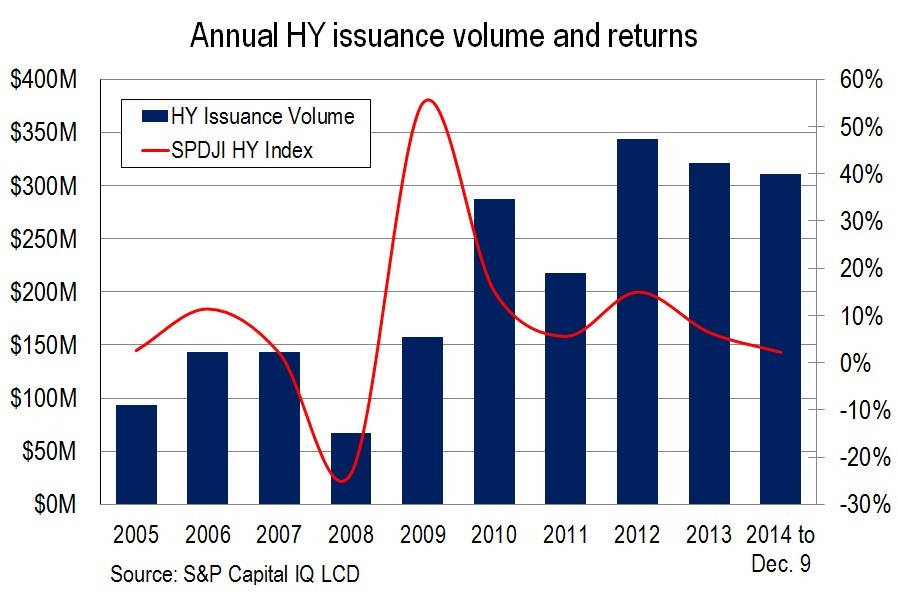

It is important to remember that the markets we have been recommending are performing far better than Treasuries. We have been recommending avoiding Treasuries and Treasury Inflation-Protected Securities (TIPS), and the returns of TIPS this month demonstrate why: year to date, they are returning -3.8%. Corporate high-yield bonds have a small positive return thus far in May but a 5% return thus far in 2013. The municipal market has a modest negative return thus far for May but a year-to-date return of 0.8%. The year-to-date returns for the municipal sectors we have been recommendingthe A and BBB creditsare 1.0% and 2.1%, respectively. Those are not bear market returns, and I do not expect bear market returns from those sectors for the rest of 2013.