6 Major Risks of Bond Investing

Post on: 8 Июль, 2015 No Comment

Interest Rate Risk

Interest rates are constantly moving. When interest rates go up, the market value of bonds issued in the past with lower interest rates, will go down. (As their price goes down, the yield will rise, making them competitive with interest rates being offered on new bonds). If you need to sell a bond before its maturity date, you will lose money if interest rates are higher when you sell the bond, than they were when you bought it. This is what is known as interest rate risk.

Reinvestment Risk

When you hold a bond to maturity, or sell it prior to maturity, there is a risk that you will only be able to invest the proceeds at lower rate of return. When interest rates are falling, this is in an important risk to consider when buying short-term bonds. Reinvestment risk also applies to the coupon payments that you receive over the life of the bond and the fact that you may not be able to reinvest them at the same rate of return.

Inflation Risk

If inflation is higher than expected, the real rate of return (which is the bonds interest rate minus inflation) will be lower than anticipated. For example, if the interest rate of a bond is 3%, and inflation is 2%, the real rate of return is 1%. Most bonds are priced so that the yield is higher than inflation, resulting in a positive real rate of return. However, in this example if inflation was 4% instead of 2%, you would have a negative real rate of return of -2%.

Credit or Default Risk

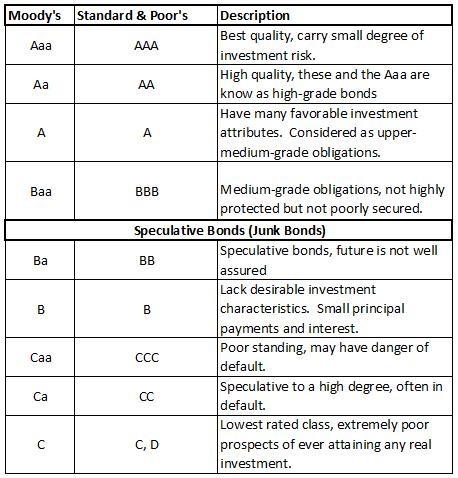

Default risk is risk that the issuer of the bond will not be able to pay the interest or principal payments and you will lose some, or all of the money you have invested. While this is possible with government bonds, generally this is the largest concern among corporate bondholders. You can learn more about measuring a bonds default risk here.

Ratings Downgrades

The risk that the company whose bond you have invested in receives a ratings downgrade. When a specific bond or bond issuer receives a ratings downgrade, generally the market price of the bond falls, as new buyers in those bonds require a higher yield, to compensate they for the increased perceived risk.

Liquidity Risk

With the exception of treasury and agency bonds, most US bonds are less liquid than stocks. Put simply, a liquid market means there are lots of buyers and sellers actively engaged in trading a security. Lack of liquidity means the opposite. If you need to sell a corporate or municipal bond in hurry, there may not be a lot of buyers competing to purchase the bonds, resulting in a price which does not reflect their underlying value.