5 Ways to Tackle Risk in Emerging Equities

Post on: 1 Апрель, 2015 No Comment

X

You must be a Registered User to print articles.

Register today for inside access to our thought-provoking coverage of the global financial markets!

Already Registered?

Page 1 of 2

Emerging-markets equities are far more turbulent than their peers in the developed world. Yet there are several steps investors can take to capture the attractive return potential while reducing volatility. Among them is the linchpin for success: keeping an active portfolio.

Economic progress and structural reforms over the past 20 years have reduced volatility in many emerging markets, but stock markets in developing economies remain more volatile than their developed-market counterparts. Furthermore, single-stock emerging-markets volatility tends to spike more sharply during times of crisis. AllianceBernstein research shows that since 1996 the chance of losing more than 30 percent of an investment in a single stock has been far more common in an emerging market than in a developed market. Plus, when a stock has lost 30 percent or more of its value, the average loss was also higher for emerging markets than for developed markets.

Buying the index might seem like a low-risk approach. At the beginning of 2014, however, the four riskiest emerging-market countries over the past 20 years — Russia. Indonesia. South Korea and Brazil (see chart 1) — represented more than 35 percent of the MSCI Emerging Markets index’s market capitalization. By being concentrated in the most volatile set of countries, a passive index will take on substantial excess risk. We believe investors can pro-actively mitigate the risks with the following five active principles in mind.

Don’t be too quick to reload into losers. In emerging markets, price momentum is very powerful. Winning stocks typically stay winners for longer than in developed markets. Losers keep on losing for longer too. So when a money-losing stock faces significant headwinds, we think investors should think twice before reloading — and should be quicker to consider selling a position.

Invest in less volatile companies. Companies with stable cash flows, good capital stewardship and/or lower sensitivity to the business cycle are good targets in emerging markets. Our research shows that compared with the EM market as a whole, the lowest-beta quintile of emerging-markets stocks was 3 percent less likely to see a 30 percent drop in price. Focusing on this segment can provide a meaningful pickup in long-term returns. Stocks of such companies might not do as well when markets are exuberant. They have, however, tended to outperform the market over full market cycles. We call this gaining more by losing less.

Hedge currency risk for times of stress. Currency is an important component of equity returns for nondomestic investors. Our research finds that since 1997, during typical market conditions, the relationship between emerging markets with the best-performing equity markets and the performance of those countries’ currencies has been negligible. But during periods of extreme market volatility, the linkage between a country’s currency, as measured by the real effective exchange rate and its equity returns, tends to increase significantly (see chart 2). So managing the risk of sharp swings in currency should always be considered by emerging-markets equity managers.

Diversification matters more in emerging markets. Unexpected — and often unpredictable — events happen far more frequently in the developing world. In developed markets, we generally believe you need at least 40 stocks to diversify away 95 percent of individual stocks’ risk. Because of the higher levels of single-stock volatility and higher correlations between stocks in emerging markets, however, we need nearly twice as many to provide the same level of risk reduction.

Following the largest names in the index can lead to unintended concentrations in specific countries, sectors or styles. For example, if we bought only the 75 largest stocks in emerging markets, more than 65 percent of the portfolio would be allocated to just four countries, with nearly 70 percent to financials, technology and energy. Don’t shy away from taking high active risk — but do combine it with prudent diversification.

Holistically combine stocks and bonds. Think beyond equities when considering diversification. When managed in an active, unconstrained and integrated strategy, a portfolio of emerging-markets stocks, bonds and currencies can generate returns that are similar to those of a stock-only strategy but with much less volatility. It also provides more flexibility than a stand-alone equity or debt portfolio in seeking higher risk-adjusted returns.

Risk control is a critical component in managing an equity portfolio. Because of the higher possibility of loss, we believe that emerging-markets investors should deploy a systematic approach, which could also enable them to compound more of their gains over the long term.

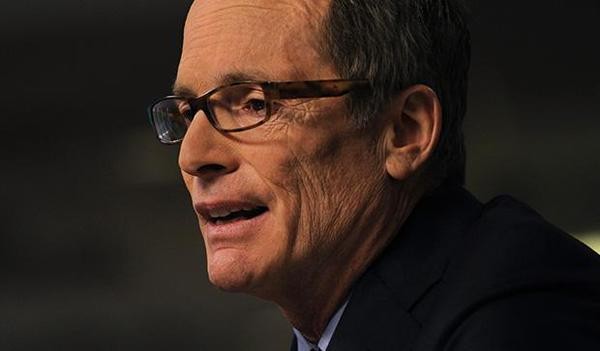

Morgan Harting is an emerging-markets portfolio manager, and Nelson Yu is co-head of equity quantitative research and portfolio manager, both at AllianceBernstein in New York.