5 Lending Club Risks Why Peer to Peer May Lend Itself to Problems

Post on: 16 Март, 2015 No Comment

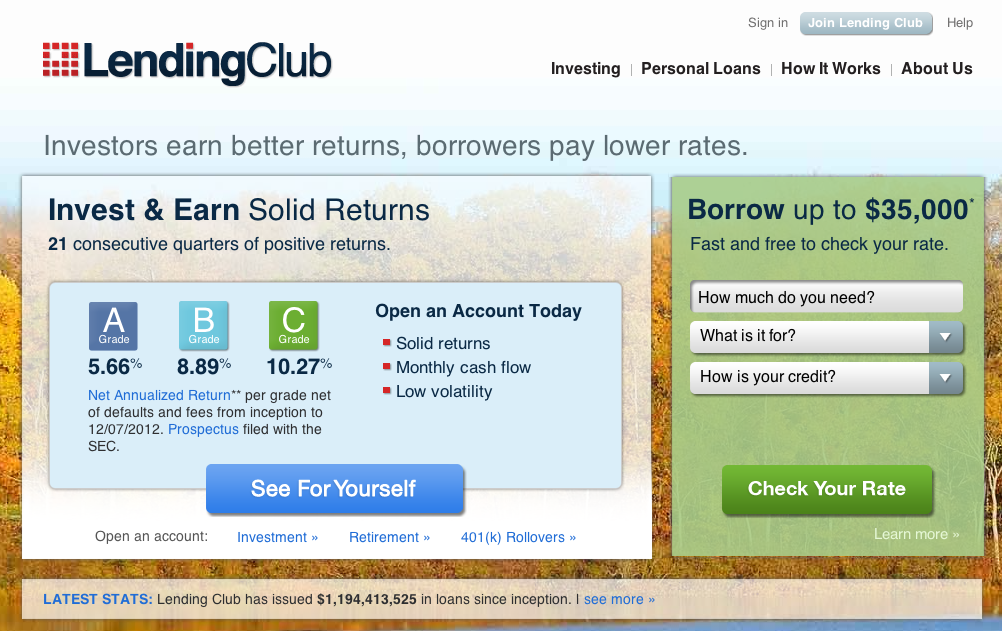

The internet is full of positively glowing reviews of peer-to-peer lending programs like Lending Club or Prosper just a few months into their experience.* The problem is: this coverage frequently lacks a well-rounded look at all of the risks and complications of P2P investing (or speculating) over the long haul. Beyond tax headaches and default risk, there are also issues of institutional, concentration, liquidity and call risk.

Taxes. Before we even get into the five major kinds of P2P risks, there is the obvious issue of taxation. For anyone using a taxable account, payments will generally be taxed at their normal income level (as opposed to municipal or federal bonds which can be entirely or partially tax exempt. But beyond the tax payments, there is tax paperwork. You may receive and have to deal with a number of different forms depending on the amounts you invest or have to figure out taxes yourself on smaller amounts.

Default Risk. The most obvious form of risk is that borrowers will default. This risk may be reduced through diversification but, of course, cannot be eliminated or fully estimated. Notably, initial results will look particularly promising. Investors see their rate of return to date right on the main page of their profile, but without the caveat that this rate will almost certainly be reduced going into their second and third years as people default.

Call Risk. Also known as prepayment risk, this leaves you open to people paying ahead of schedule and thus depriving you of your interest stream. While there are many reasons this is frustrating (including having to spend more time finding more notes), a major concern here is that interest rates go down and you find that the rates you locked into as a lender are ones you no longer have access to. In short: you may lose your existing high-interest payments and have to reinvest in lower-yielding notes, while the borrower happily borrows more money at a lower rate to pay you off early.

Institutional Risk. In years past, P2P websites have been shut down or put on hold by entities like the SEC while legal issues were sorted out. There is always the risk that a change in laws or some kind of internal corruption will put your entire investment portfolio of notes at risk. Unlike CDs, there is no FDIC-style insurance here. Unlike many mutual fund companies, your claim to underlying notes may become muddled, or at least need to be mediated should the P2P service fail. It is the unknowns, regardless, that should worry you here the institutional risks that may not even be obvious at this moment.

Liquidity Risk. With a bond index fund or ETF, you can generally sell your shares at least during active trading hours and on active market days. With P2P sites, you may not have access to a trading platform at all, and, regardless, are at risk that buyers will dry up at just the wrong moment (also a theoretical risk for ETFs, particularly low-volume ones). A lack of liquidity can be problematic for many reasons, including the opportunity cost of being unable to sell notes in emergencies, or to reinvest or rebalance your holdings. Standard durations at places like Lending Club are 36 to 72 months a long time to wait. Even bank CDs generally offer savers and investors a way out (sometimes with a small penalty) if need be.

Concentration Risk. Diversify as much as you can and you are still lending money to a relatively small and specific group and type of borrower. Compared to a bond index, your portfolio of notes on a P2P site is likely to be small and subject to parallel economic forces and with a dangerous history, in many cases, of defaulting on past loans. It will always depend on your point of comparison and how much you have invested, but a few dozen or so notes is, for instance, a lot more concentrated than hundreds or thousands of issues within a bond index funds.

None of this is meant to suggest you should not try P2P lending if you deem it suitable to your purposes. It is simply intended as a reminder that the number at the top of your login screen may not be representative of your long-term returns, and that even if your returns are good, they come at the cost of various specific and systematic risks.

*For the record: this author happily uses Lending Club, but does so with a relatively small sum, mainly for entertainment purposes (fun money) and with no illusions about the safety of what is at stake. It was an educational decision, not a financial one.