5 Fixes for Your Retirement Plan

Post on: 15 Апрель, 2015 No Comment

After decades of accumulating wealth, you probably know the basic rules: buy and hold, keep costs low, and diversify. But if you’re rounding the corner toward your late 50s with retirement in sight, the rules are about to change. “There’s a well-established playbook for saving and investment when retirement is far off,” says Rob Williams, managing director of income planning at the Schwab Center for Financial Research, “but as you near the distribution phase, it’s important to make a shift.” Failing to adjust your plan might reduce your chances of having a comfortable retirement. Here are five fixes to help you weather this crucial transition stage.

For many years, you’ve judged your portfolio’s performance based on market benchmarks like the S&P 500 ® Index or (occasionally) comparisons to your peers. But that changes as you near retirement. “We’re used to comparing ourselves to others,” says Rob, “but really the point is, Can I support my lifestyle? ”

The new benchmark, in other words, is you. Your focus needs to shift away from just growth or performance and toward a combination of growth and wealth preservation, says Rob.

Remember that the years immediately before and after retirement are critical for your portfolio, as anyone who retired just before the Great Recession will confirm. If you haven’t already, it’s time to tilt your portfolio toward less risky assets. The right mix is important.

After decades of driving toward your savings goal, you should now need to focus on how long your savings need to last. Wade Pfau, professor of retirement income at The American College of Financial Services, and others argue that while retirees often believe they can comfortably take 4% a year out of their nest egg (known as the 4% rule), it’s important to stay flexible and adjust your withdrawal amount annually depending on your needs, your life expectancy and how the market fares.

Near-retirees may also neglect to plan for when they’ll take Social Security, and to factor in taxes on withdrawals on their IRA. In a recent Bankers Life survey. over half of retirees did not realize that they would have to take required minimum distributions (RMDs) from their traditional IRA or 401(k) starting at age 70½—or face a tax penalty of 50% of the RMD amount. Talk to a financial advisor about the best strategies for managing your tax bill.

Yes, bonds are the classic income investment. But when you no longer have a salary, you can’t let all your income rest on a single asset class, Rob says. He suggests a total return approach that takes a broader view of income: “You want to think about investment income, as well as capital gains and principal.” That means classic income investments such as investment-grade bonds and dividend-paying stocks—and possibly moderate withdrawals from your principal or capital gains. “People sometimes assume their principal is untouchable, but it can be considered a source of cash flow,” he says.

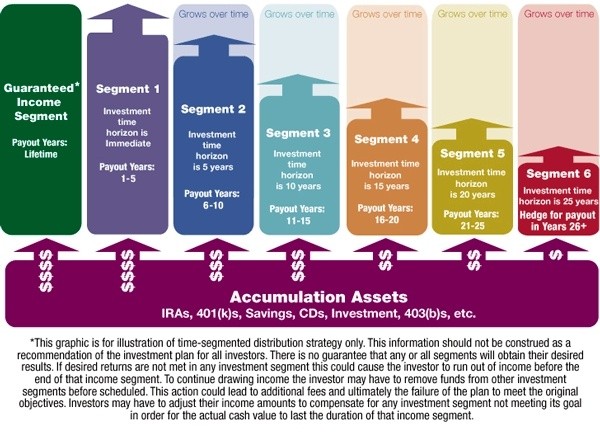

Another way to create a stable income stream is to layer several sources of income to cover your regular expenses. You might, for example, use some combination of an immediate fixed annuity, Social Security benefits and the required minimum distribution from your IRA. Then you can keep the rest of your portfolio in a diversified mix of stocks and bonds for some growth potential. And don’t forget real estate: if you have substantial equity in your home, you can draw on that for income by downsizing to a smaller place, says Wade Pfau of the American College.

Figuring out how long your money will last is tough if you don’t know how much you’ll be spending, notes Rob. Here are some important factors to consider:

- While studies show that some retirement expenses are likely to drop as you age, you know that medical costs can be a real wild card. According to the Employee Benefit Research Institute, a couple with even moderate medical and prescription drug expenses could need as much as $255,000 to cover lifetime health care costs.

- This is a good reason to assess your coverage now, for both medical and long-term care insurance.

- And as you read the next slide about getting in sync with your mate, you’ll want to consider the higher or lower costs associated with different lifestyle choices like travel, where you live, entertainment and so on.

Waiting until after retirement to figure out that he wants to tour Australia while she wants to hit the links every day can seriously jeopardize the chances of having a happy retirement. Yet the majority of couples do just that: Fewer than 40% of pre-retiree couples have similar ideas about their golden years, a survey by Hearts & Wallets found. Other studies have found that couples most often disagree on the timing of retirement, where they’ll live and what kind of lifestyle they can afford.

Don’t make the same mistake. About five years ahead of retirement, sit down with your partner and separately write down your ideas for what age you’ll both retire, whether you’ll downsize or move, and how much you have and think you’ll need in your retirement accounts. Then compare notes. If you’re not seeing eye-to-eye, talk with a financial planner who can help you figure out what quality of life will make both of you happy—as well as address any retirement planning blind spots—and make a concrete plan for your portfolio that’ll help get you there.