5 ETF Portfolio With Near Zero SPY Correlation

Post on: 13 Июнь, 2015 No Comment

When thinking about how I wanted to construct this portfolio I had a short qualifications list for each fund I picked as well as goals for the overall portfolio. The qualifications for picking my funds are as follows:

- The ETF should have at least 100 million in AUM.

- The ETF must be in existence for at least one year.

- The ETF must not be a leveraged ETF.

- The ETF must not track the same or similar index as another ETF in the portfolio.

- The bond fund ETFs chosen cannot be total bond market funds.

The goals that I wanted this portfolio to achieve are:

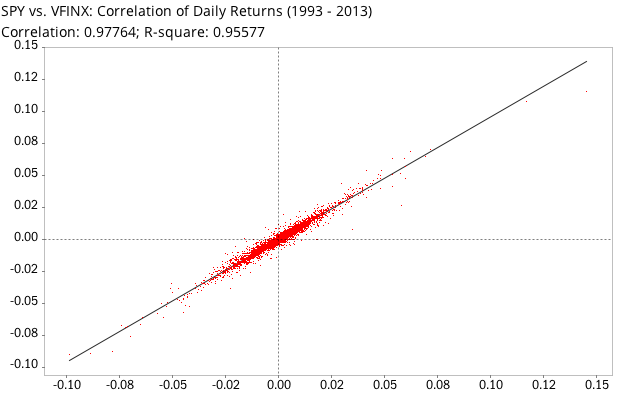

My main goal is to construct the portfolio with as near to zero correlation to the SPDR S&P 500 Trust ETF (NYSEARCA:SPY ) as possible.

- Have all five funds at an equal weight of the portfolio.

- Include one equity fund that is not a large cap fund.

- Include three bond funds.

- Include one precious metals or commodities fund.

Keeping to my main goal in mind I found a chart from ETFscreen.com that shows a large list of ETF correlations to the SPY. My selection process for each fund is as follows:

- Equity Fund: When looking for an equity fund to include in the portfolio I started at the top of the correlation chart where correlations to the SPY are 1.0, and worked my way down until I spotted the S&P MidCap 400 SPDRs (NYSEARCA:MDY ), and I included it in my portfolio because it fit my qualifications and the goal of an equity fund that was not a large cap fund.

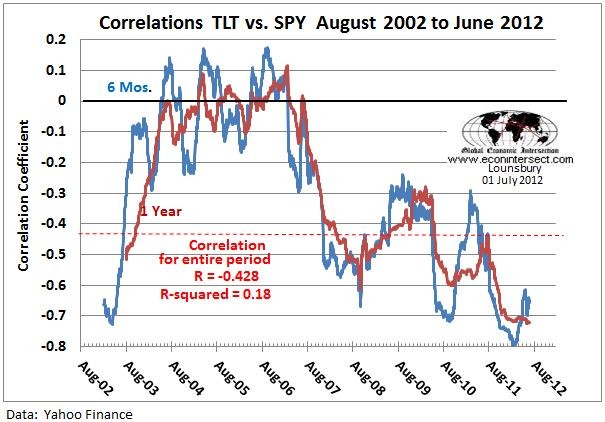

- Bond Fund No. 1: Since I picked an equity fund that has a high correlation to the SPY, I needed to pick a bond fund with a low correlation to the SPY. Scrolling to the bottom of the correlation chart, I found the Vanguard Extended Duration Treasury ETF (NYSEARCA:EDV ) which was the lowest correlated bond fund.

- Precious Metals/Commodity Fund: Since I had picked one fund with high and another fund with low correlation to the SPY, I thought it would be a good idea to pick a fund with a correlation near 0. So I went to the correlation chart and went to zero, and found the PowerShares DB Precious Metals (NYSEARCA:DBP ) as being the closest to zero correlation Precious metals or commodities ETF.

- Bond Fund No. 2: For this choice I wanted a bond fund that was not a U.S. Treasury Bond ETF, so that left my choices to corporate bonds, municipal bonds, foreign bonds or convertible bonds. So I started on the correlation chart near -1.0 and scrolled through until I found the lowest correlated bond ETF out of the remaining bond categories, and found the Vanguard Long-Term Corp Bond ETF (NASDAQ:VCLT ).

- Bond Fund No. 3: For the final fund in the portfolio I wanted the fund to have a shorter duration than EDV or VCLT. So I started looking through the correlation chart for bond funds with the lowest negative correlations that were not a long term treasury or corporate bond fund and found that the iShares Barclays 7-10 Year Treasury Bond Fund (NYSEARCA:IEF ).

Below are two tables, the first showing each fund and weight of the portfolio, and the second showing the correlations of each fund to the SPY and other funds in the portfolio to each other.

Portfolio Description and Weight