5 Alternative Investments to Bonds

Post on: 11 Май, 2015 No Comment

With interest rates flat lined near zero, investors of all types are competing with each other to chase yields ever lower in desperation of cash flow. Although bond buyers may think they are conservative they are really speculators because buying an asset far above its intrinsic value with the idea that someone else will pay even more is the basic definition of speculating. Even if yields don’t fall from here, there isn’t much to be made waiting 10 years for a 2 percent yield or less — ignoring that inflation is higher than that.

This aberration has extended into the corporate bond market where large cap companies are now financing by using debt that pays less than their dividends. The end result is that millions of people who lost money over the past decade in stocks and housing are now buying bonds, annuities, and other fixed deposit credit based investments that are guaranteed to disappoint.

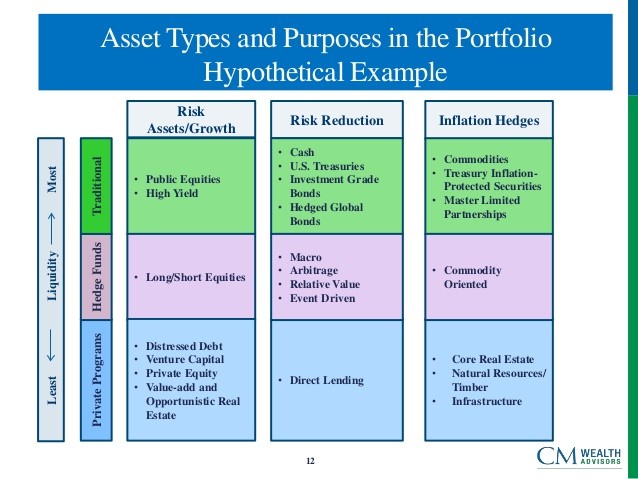

Traditional investment managers will continue to give you losing advice until your capital under management falls below the level at which they say it isn’t worth their time to service you anymore. This is because their goal is to charge a commission for selling securities, rather than preserve and increase your wealth. While there isn’t enough room for everyone to exit the bond and equity markets, there remains opportunities in alternative investments that should be the core of a portfolio. If managed correctly, they will offer sustainable cash flow much higher than what banks or governments are willing to provide. This is especially important for people who are entering or already in retirement and need some stable income to live off of, as well as capital preservation.

Gold and Silver — Ironically the biggest argument Wall Street and the mainstream media will use against precious metals is that they don’t pay a yield and can’t provide cash flow like bonds can. Now that yields are zero for all practical purposes, that reasoning vanishes. There is no longer an opportunity cost of owning precious metals over bonds or cash. Most importantly, real interest rates are negative, and as long as they are, gold and silver will have a powerful wind at their backs. Precious metals can be included in the cash and insurance portion of an allocation, and miners can be included in the equity portion. In addition to rising every single year, gold has appreciated at an annual rate of 18 percent over the last decade.

Farmland — Farmland, particularly in the Midwestern U.S. has increased as an investment over recent years. However there are still opportunities to purchase properties which provide stable income and protection from inflation. A successful investor can expect to lease the land to a farmer for a 4-6 percent annual yield. Historically land values have also appreciated by about 4-6 percent. Effectively, the investor could earn an inflation-adjusted 5-8 percent with little risk if it isn’t leveraged by debt. Over the last decade, farmland prices appreciated at a rate of 7 percent while the S&P 500 had a negative return. Farmland performed even better when factoring rental or operating income.

Lumber/Timber — Money does grow on trees when evaluating timber. Investors in forestry have the potential to earn a steady return from the growth of lumber as trees are always growing. Timber is also historically known for being a great inflation hedge. The land itself also appreciates in addition to the lumber. From 1990 to 2007, the National Council of Real Estate Investment Fiduciaries ((NCREIF)) Timberland Index had an annual return of 12.88 percent — higher than the S&P 500’s annual return of 10.54 percent and with less volatility. Investors could buy stock in timber companies such as Plum Creek (NYSE:PCL ) and Rayonier (NYSE:RYN ) that have dividend yields of more that 4 percent. Or they could invest directly in land and lumber projects.

Arbitrage — Although much more lucrative in the 1970’s and 1980’s, there remain several arbitrage strategies that provide cash flow consistent better than a treasury with less inflation risk. Merger arbitrage funds ARBFX and MERFX have appreciated by an average rate of 4 percent over the last 5 years and investors aren’t dependent on interest rates falling to make a profit.

Foreign real estate and businesses — While the U.S. Europe, Japan, and other developed countries are expected to see stagnating economies for the foreseeable future, there remains investment opportunities in developing economies. Real estate and other businesses in developing nations were much less affected by the credit crisis of 2008 because they didn’t use the same degree of leverage as the U.S. Europe, and Japan. For this reason they will recover faster and offer higher returns.

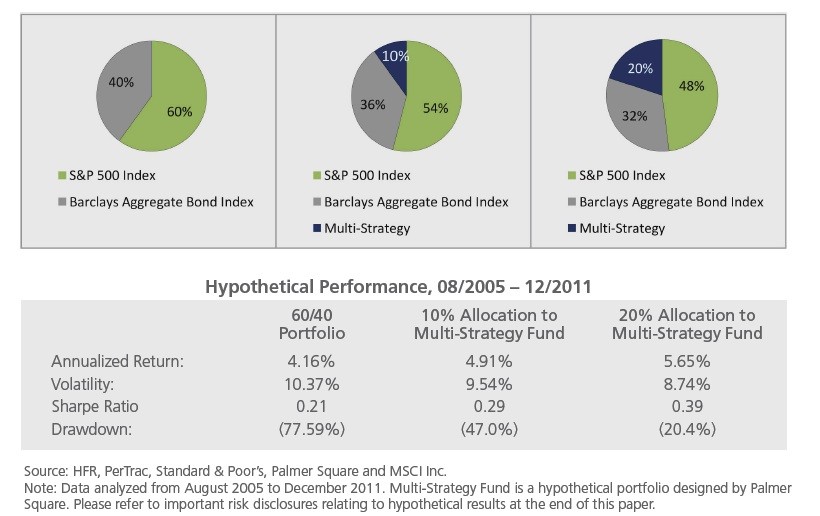

Click to enlarge:

By focusing on alternative investments, it is still possible for investors to achieve cash flow and annual returns between 4 to 10 percent. The key is to avoid overvalued stocks and bonds, and accumulate investments backed by tangible assets and special opportunities.

Disclosure: No positions