401K PP integration Page 1

Post on: 19 Июль, 2015 No Comment

Author Topic: 401k PP integration (Read 3422 times)

Need some help. Looking to implement PP across a 401k and several Roth IRA/IRA accounts. Problem is choices in GW 401k are limited and a brokerage window would cost $2500/year.

Here are the amounts:

GW 401k: $175,000

Other accounts total: $300,000

Good news is GW 401k has a SP500 option (I included other relevant plan options at the bottom), so I was thinking:

Option 1:

Allocate the other accounts into 3 parts of about $100k each Gold/Cash/30 year bond, then allocate $100k of the $175k GW into the SP500 option while splitting the remaining $75k into $25k PIMCO Total Return, $25k SP500, $25k Oakmark Equity & Income II.

The problem with that is there is no way to really rebalance the stocks portion if all of it is in the GW 401k. And handling monthly contributions would be a pain.

So option 2:

The GW 401k account has short term bond funds: Thompson Plumb Bond THOPX, Great-West Short Duration Bond Init MXSDX

There is also something that doesnt publicly trade and Im not sure I fully understand called the Key Guaranteed Portfolio Fund which I believe pays 1.45%/year (offered by the 401k plan provider, not sure I like this part This fixed fund is offered through a group fixed and variable deferred annuity contract issued by Great-West Life & Annuity Insurance Company. A ticker symbol is not available for this investment option. The Key Guaranteed Portfolio Fund is backed by the general assets of Great-West Life & Annuity Insurance Company.)

The problem is the short term bond options hold all kinds of paper (some junk bonds) and I am not sure if this is a valid replacement for cash. They seem risky. And this Key Gauranteed Portfolio Fund sounds like something I dont want to put my money in — what if the plan sponsor faces financial difficulties or some unexpected accounting error?

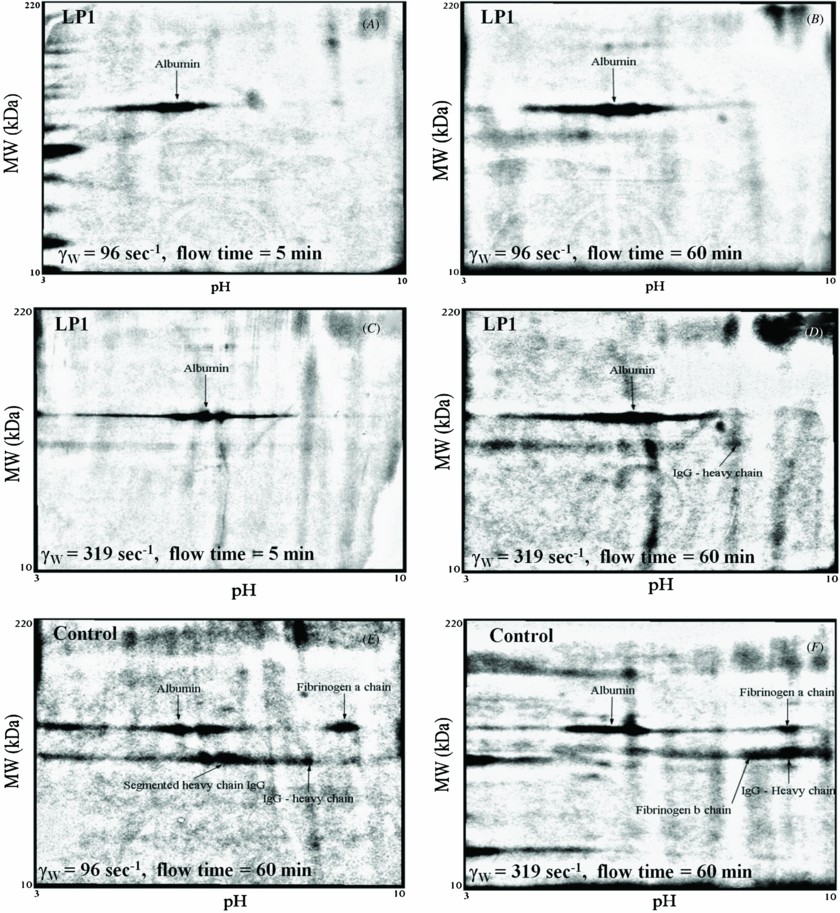

I graphed MXSDX vs. SHY vs. SHV vs. THOPX

Looks like THOPX is more risky/higher volatility than MXSDX and SHY and SHV (see below for descriptions of what each one holds)

What do you suggest?

Thank you!

More Information

Great-West Short Duration Bond Init MXSDX

Principal Investment Strategies

The Fund will, under normal circumstances, invest at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in investment grade bonds. The Fund will select securities based on relative value, maturity, quality and sector. The Fund will maintain an actively managed portfolio of bonds selected from several categories, including U.S. Treasuries and agency securities, commercial and residential mortgage-backed securities, asset-backed securities, and corporate bonds. The Fund will maintain an average duration between one and three years based on the portfolio manager’s forecast for interest rates. The Fund may invest up to 20% its net assets in securities of below investment grade quality (“high yield-high risk” or “junk”) bonds. For purposes of pursuing its investment goals, the Fund may, from time to time, enter into derivative contracts, including futures contracts on U.S. Treasury securities.

Thompson Plumb Bond THOPX

Principal Investment Strategies

Principal Investment Strategies of the Fund. The Bond Fund normally invests at least 80% of its net assets plus any borrowing for investment purposes in a diversified portfolio of bonds, including corporate bonds of domestic issuers and of foreign issuers payable in U.S. dollars, short-term debt instruments, mortgage- and asset-related securities, bonds of foreign government issuers (including its agencies and instrumentalities) payable in U.S. dollars, and U.S. Treasury securities and other debt securities issued or guaranteed by the U.S. Government (including its agencies and instrumentalities). Although the Bond Fund invests primarily in investment-grade debt securities (i.e. those rated in the four highest rating categories by S&P or Moody’s), it may invest up to 10% of its net assets in bonds rated below investment grade (commonly referred to as “junk” or “high-yield” bonds). In the aggregate, these below-investment-grade bonds, along with the other bonds in the Fund’s portfolio, will comprise at least 80% of the Fund’s net assets plus any borrowing for investment purposes. The Bond Fund may invest up to 20% of its net assets in other non-debt securities, which include convertible bonds, common stocks and variable-rate demand notes. The dollar-weighted average portfolio maturity of the Bond Fund will normally not exceed 10 years. The Bond Fund does not purchase securities with a view to rapid turnover.

Key Guaranteed Portfolio Fund

Investment Objective & Strategy

As a general account product, participant principal and interest are fully guaranteed by the entire general account assets of GWL&A, which as of December 31, 2011, were $26 billion and include $1.99 billion in shareholder equity and accumulated surplus. This means that GWL&A holds an additional 7.7% in reserves for every dollar of liability we have. These assets are primarily high-quality, fixed income bonds, with 99% rated investment grade and 33% rated AAA.

Other GW 401k options:

Maxim S&P 500 Index Portfolio — MXVIX

Moderate Allocation

Oakmark Equity & Income II — OARBX

Intermediate Bond

Metropolitan West Total Return Bond M — MWTRX

Wells Fargo Advantage Ttl Return Bond Ad — MNTRX

PIMCO Total Return Admin — PTRAX