401K Asset Allocation Are You Investing the Right Way

Post on: 16 Март, 2015 No Comment

Is your 401k asset allocation set correctly? Failing to check could cost you $10,000 or more! Here are two easy methods for ensuring proper allocation.

Want to do one thing to ensure the money you’re saving today in your 401k or IRA will be around tomorrow?

Diversify.

Too many Americans have watched their retirement dreams disappear because they invested solely in the company stock of their employer.

It’s never a good idea to put all your eggs in one basket. No matter how big, stable, or fast-growing a company you work for, it can fail. And if it does, not only will you be out of a job, but that company stock (and your 401k) will be worthless.

So if you don’t read any further and your 401k provides the option to invest in your employer’s stock, make sure thats not the only investment you hold. Can you buy some? Sure! And if you can buy shares at a discount, all the better. Just make sure it doesn’t represent more than 10 percent of your total investment holdings.

Today’s post is a lesson in 401k asset allocation (or, simply put: diversification). We’ll move from simple to slightly more advanced.

The Easy Way To Diversify

If you want nothing to do with managing your investments, no problem: Choose a target-date mutual fund.

Most 401ks are beginning to offer these from a variety of companies. You simply figure out the date you will begin to withdraw money (for example, if you’re 25 in 2012 and want to retire when you’re 65in 2052you would choose a 2050 target-date fund).

The upside to these funds is that they continually rebalance as you get older. They start out aggressive (and more risky) and become less risky with time.

The downside to these funds is some have higher-than-average expense ratios and, obviously, they take control away from the investor.

Full Control Diversification

If you want more control over your asset allocation or your 401k does not offer target-date funds, choose:

- One stock mutual fund

- One bond mutual fund

- One domestic stock mutual fund

- One international stock mutual fund

- One bond mutual fund

Mike Piper provides good examples of simple portfolios that use low-cost Vanguard index funds. (This, by the way, is how Ive invested most of my own retirement fundsin just four Vanguard index funds.)

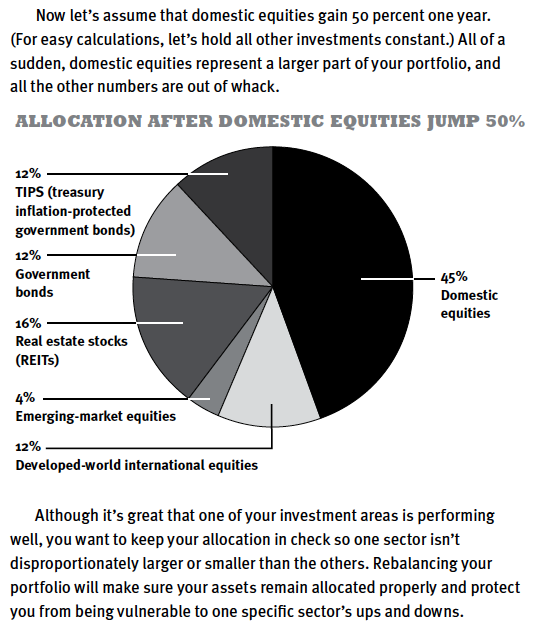

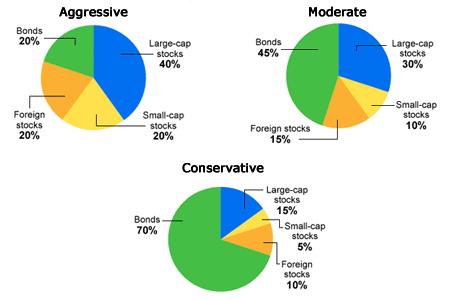

So how do you choose the right allocation? As you can see, the guidelines recommend buying more bonds and fewer stocks as you get older. This is because bonds are less volatile and less likely to lose large amounts of money in a year or two. They’re also less likely to deliver huge returns.

The old rule was to subtract your age from 100 to get the target allocation of stocks. So if youre 25, 100-25 is 75 and you would have 75% stocks in your portfolio. As were living longer, however, we need to earn bigger returns to make our money last in a longer retirement, so that rule could be subtract your age from 110 or even 120.

Here are very rough guidelines for 401k asset allocation: