401(K) Fee Schedule

Post on: 23 Август, 2015 No Comment

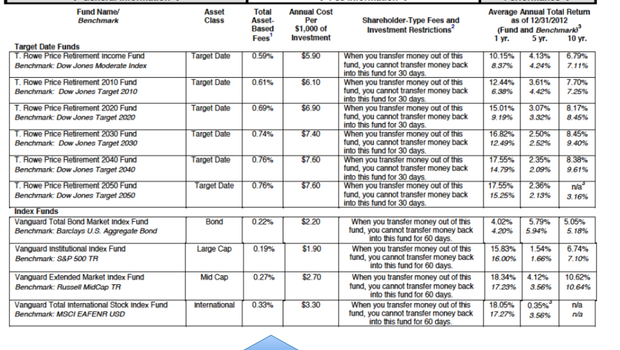

At Employer’s discretion, 0.25% of total year-end assets is charged to either the Employer or the Plan. If charged to the Plan, fees are allocated to individual Employee (Participant) accounts.

Self-Directed Brokerage Accounts

Trades in Self-Directed Brokerage Accounts are subject to the Saturna Brokerage Services commission schedule. All applicable commissions are paid to Saturna Brokerage Services. Depending on each employee’s investment choices, Saturna Brokerage Services may also receive sales charges (loads) and/or 12b-1 fees from non-affiliated mutual funds and Dreyfus money market funds.

Mutual Fund Expenses

Please consider an investment’s objectives, risks, charges, and expenses carefully before investing. To obtain this and other important information about Amana Mutual Funds. Sextant Mutual Funds. or Idaho Tax-Exempt Fund in a current prospectus or summary prospectus, please visit Documents & Forms or call toll free 1-800-728-8762. Please read the prospectus or summary prospectus carefully before investing.

Investing involves risk, including possible loss of principal. Generally, an investment that offers a higher potential return will have a higher risk of loss. Stock prices fluctuate, sometimes quickly and significantly, for a broad range of reasons that may affect individual companies, industries, or sectors. When interest rates rise, bond prices fall. When interest rates fall, bond prices go up. A bond fund’s price will typically follow the same pattern. Investments in high-yield securities can be speculative in nature. High-yield bonds may have low or no ratings, and may be considered junk bonds. Investing in foreign securities involves risks not typically associated directly with investing in US securities. These risks include currency and market fluctuations, and political or social instability. The risks of foreign investing are generally magnified in the smaller and more volatile securities markets of the developing world. For municipal tax-exempt funds, taxation may depend on your state of residence and the alternative minimum tax may apply. These and other risks pertaining to specific funds are discussed in each fund’s prospectus and summary prospectus. Clicking a fund’s name will take you to a more detailed page that includes objectives, strategies, and risks of that specific fund.

Amana Mutual Funds. Sextant Mutual Funds. and Idaho Tax-Exempt Fund are offered only by prospectus. Nothing on this website should be considered a solicitation to buy, an offer to sell, or a recommendation for any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful.